The Stocks to Watch When Supreme Court Rules on Trump’s Tariffs

TL;DR

An upcoming Supreme Court ruling on Trump's tariffs could significantly impact stocks. A decision against tariffs would likely boost markets, especially benefiting consumer and industrial companies, while upholding them could have negative effects.

Key Takeaways

- •A Supreme Court ruling striking down Trump's tariffs would likely boost stock markets by eliminating business costs and potentially providing tariff refunds.

- •Consumer companies (especially apparel and toy makers) and industrial manufacturers would benefit most from tariff relief.

- •Financial stocks could gain from stronger consumer spending and potential Federal Reserve rate cuts if tariffs are removed.

- •The timing of the ruling remains uncertain, with no decision expected before January 2025 at the earliest.

- •Companies heavily dependent on imports stand to gain the most, while domestic producers that benefited from protectionism might lag.

Tags

An upcoming US Supreme Court ruling on the legality of the sweeping tariffs that President Donald Trump rolled out in April — briefly sending markets worldwide into a tailspin — could be the next test for stocks that have been flying high.

The S&P 500 Index has since rallied 39% from the lows hit that month. It closed at a record high Thursday, in part because tariffs have settled lower than Trump’s highest threats, while support has come from an artificial-intelligence investment boom and a US economy that has kept expanding fast enough to throw off record corporate profits.

If the nation’s top court says Trump exceeded his authority with the blanket tariffs on countries around the globe, there will still be significant uncertainty. The White House could use other laws to reimpose some new levies, for example. Bond traders could push up yields over worries about the deficit, and that concern could spread into the equity market.

However, companies eager for a relief will likely to have to wait until at least January. With the Supreme Court beginning a four-week holiday recess, the window has all but closed for a ruling this year on challenges to Trump’s sweeping import taxes.

But when a decision does come, market participants say the initial reaction, at least, would likely be positive for stocks should the court strike down the tariffs. A ruling upholding the tariffs would likely have the opposite effect.

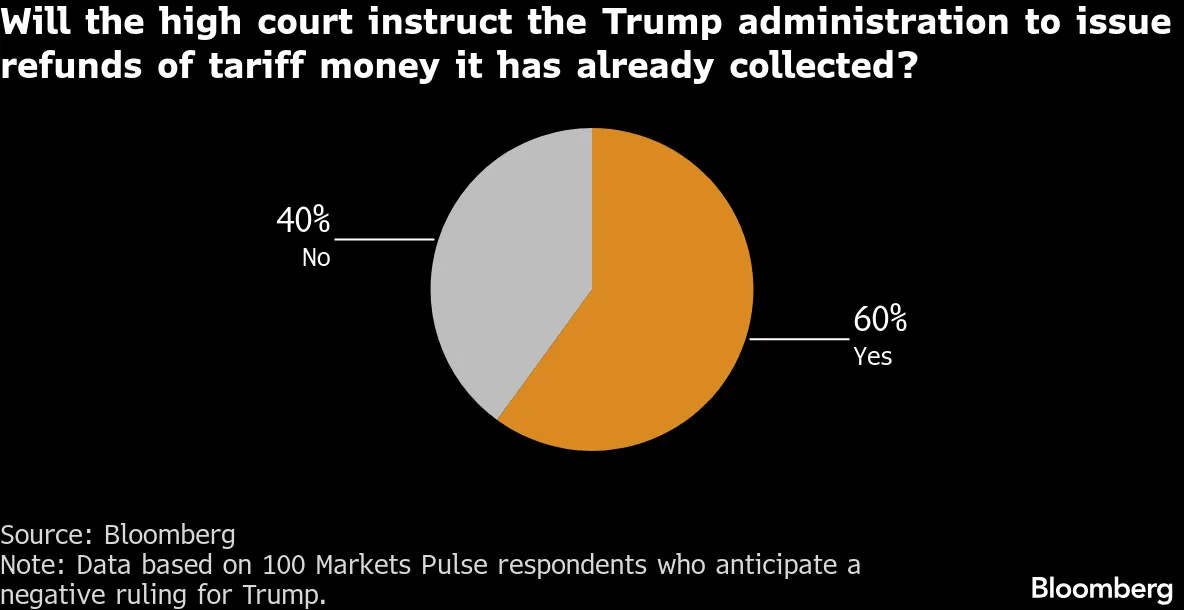

There are a few reasons why. Striking down the tariffs would eliminate a tax that many businesses haven’t completely passed along to customers, resulting in a drag on the bottom line. Refunds on what they’ve already paid could provide a windfall. And consumer spending may get a boost, too, given that Democrats in Congress estimate tariffs have cost the average American family some $1,200 over the past 10 months.

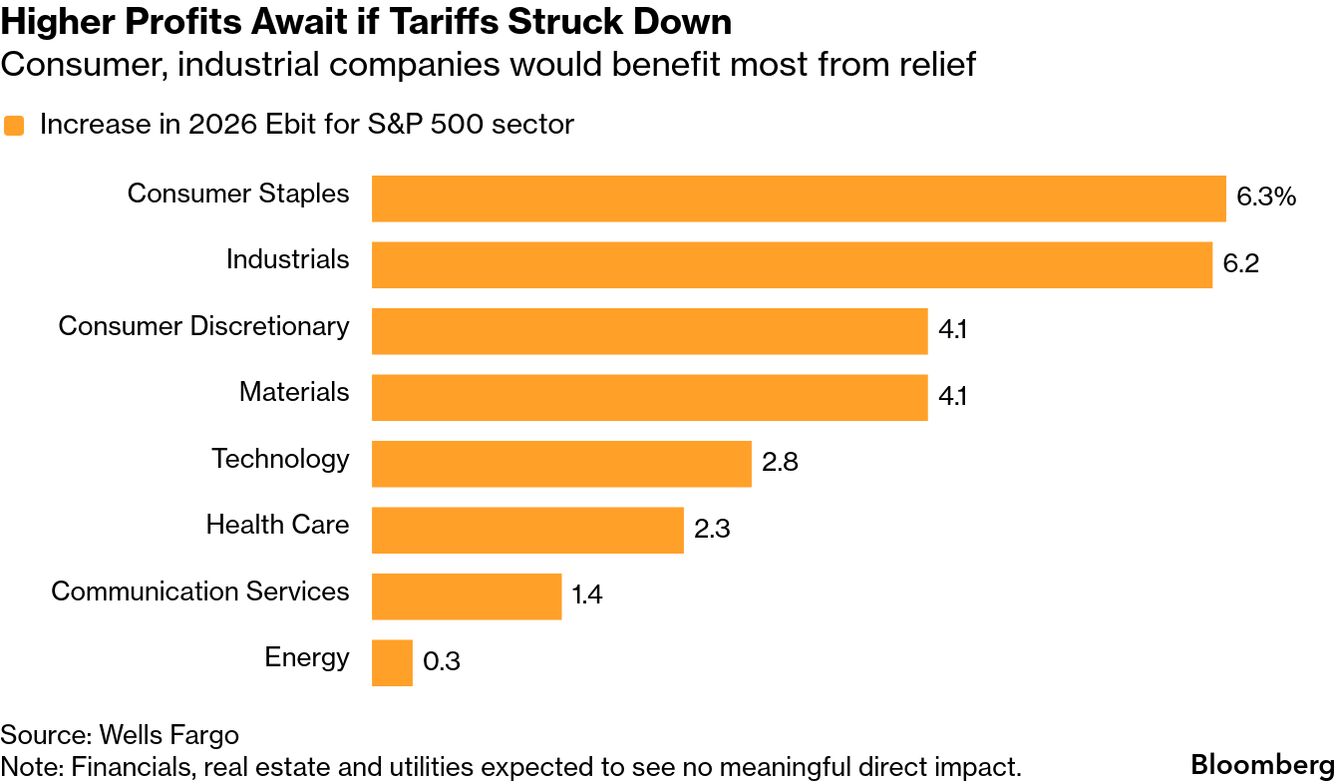

Overall, a ruling against the tariffs would boost the earnings of companies in the S&P 500 Index, before interest and taxes, by 2.4% in 2026 compared to current-year levels, Wells Fargo & Co. Chief Equity Strategist Ohsung Kwon estimated in October.

“That’s good for the market generally, because they look at tariffs as a tax,” said James St. Aubin, chief investment officer at Ocean Park Asset Management. “This will be a catalyst for a little bit of a rally.”

Consumer, industrial companies would benefit most from relief

Note: Financials, real estate and utilities expected to see no meaningful direct impact.

Some companies, and their stocks, stand to benefit more than others. The tariffs have been particularly painful for those that are heavily dependent on imported goods, such as apparel companies and toymakers. Financial firms, for their part, stand to benefit from a more confident or flush consumer.

“On the flip side,” said Haris Khurshid, chief investment officer at Karobaar Capital, “materials, commodities and domestic producers that benefited from protectionism might lag a bit.”

| Read More: |

|---|

Stocks Poised to Win on a Trump Tariff Reversal: Markets Pulse Supreme Court Likely Ends IEEPA Tariffs Yet Timing Could Be 2026 |

Here’s a look at some of the sectors and companies with the most at stake when the decision does come:

Consumer

Clothing and toy companies — both heavily dependent on imports from China and other Asian countries targeted with some of the highest tariffs — are seen as clear winners, according to BI. Nike Inc. and Mattel Inc. are potential standouts.

Others include Deckers Outdoor Corp., Under Armour Inc., Crocs Inc., and American Eagle Outfitters Inc., all of which have struggled with tariff-related uncertainty. Home furnishing stocks have been volatile too, including Wayfair Inc., Williams-Sonoma Inc. and RH.

Texas Capital’s Eric Wold singled out some potential winners among the leisure-related companies he follows: boat-maker Brunswick Corp., toymaker Funko Inc. and Topgolf Callaway Brands Corp.

Industrials

Industrial manufacturing giants Caterpillar Inc. and Deere & Co. are among the firms set to benefit the most from tariff refunds, according to Wells Fargo’s Kwon. Stanley Black & Decker Inc., Fortive Corp. and Lennox International Inc. also make the list.

Note: Data based on 100 Markets Pulse respondents who anticipate a negative ruling for Trump.

Shares of automakers General Motors Co. and Ford Motor Co. advanced during the Supreme Court hearing last month, when the justices’ skepticism about the administration’s arguments increased market speculation that the tariffs would be struck down. While the case doesn’t affect the industry-specific tariff on automakers, they stand to gain from a stronger consumer.

Hedgeye also sees positive implications for transport stocks, expecting a boost if the tariffs are struck down and importers move to snap up inventory before any new ones are imposed. That could benefit United Parcel Service Inc., FedEx Corp. and trucking companies.

Financials

Major banks such as JPMorgan Chase & Co. and Goldman Sachs Group Inc. faced volatility earlier this year, alongside private equity giants like Blackstone Inc., amid concerns that Trump’s trade war will slow economic activity. Financial-technology companies such as Affirm Holdings Inc. and Block Inc. are prone to big swings, as are stocks linked to cryptocurrencies.

Lower tariffs may ease pressure on US consumers and support the broader economy. If inflation expectations move lower, it’ll also support the case for more rate cuts by the Federal Reserve, Clear Street analyst Owen Lau said.

Lower interest rates encourage “loan growth, refinancing, stronger equities markets and even higher consumer spending,” Lau said, “which will fundamentally benefit financial stocks in general.”