Chile Peso Soars as Right-Winger Enters Runoff as Clear Favorite

TL;DR

The Chilean peso rallied after conservative José Antonio Kast advanced as the favorite in the presidential runoff, boosting market optimism. However, a split Congress may hinder his economic reforms, creating uncertainty for future gains.

Tags

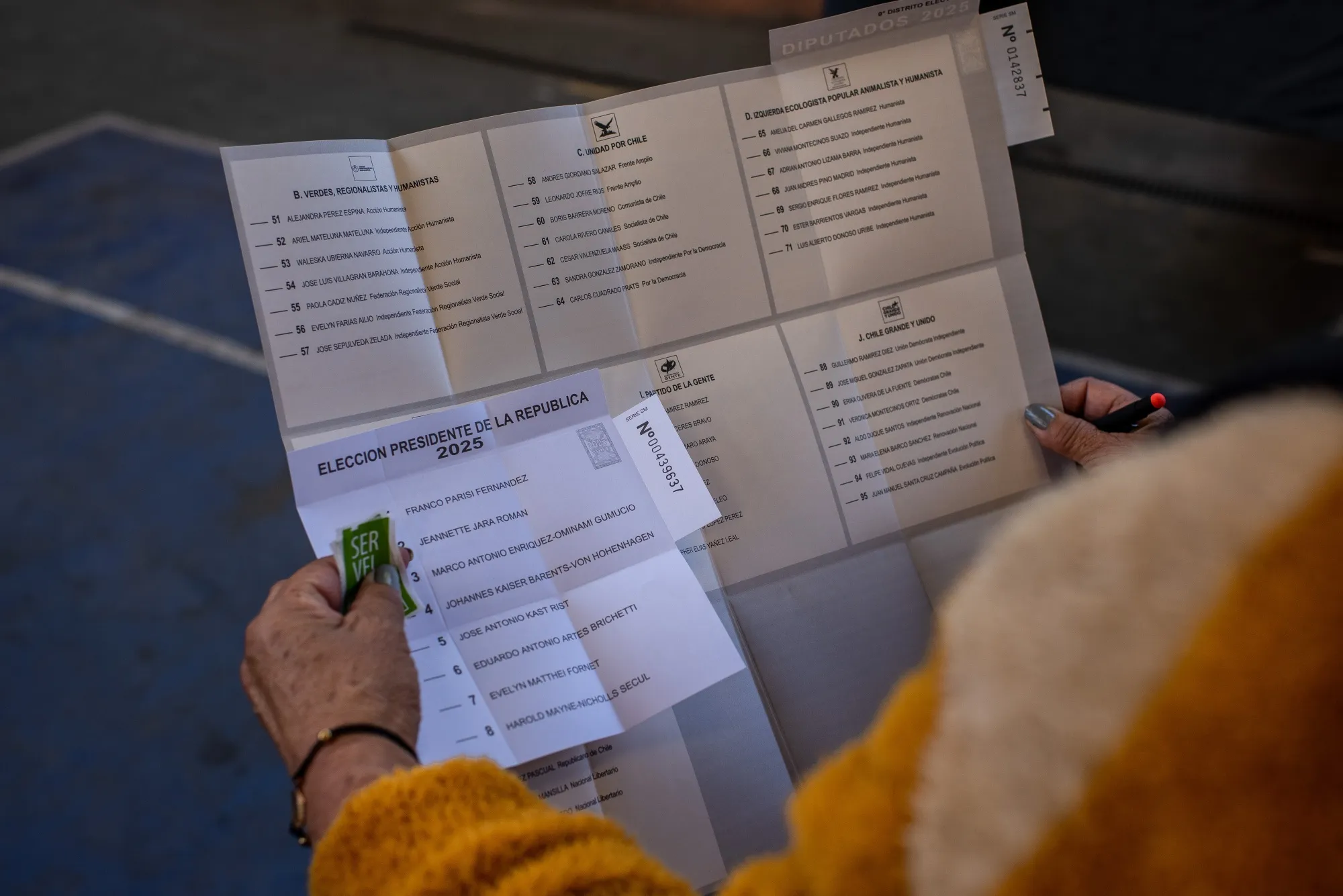

The Chilean peso rallied at market open Monday after arch-conservative José Antonio Kast advanced to the second round of voting as a clear favorite against the communist Jeannette Jara, though a split Congress could complicate the outlook.

The peso rose 1.2% in early trading to 916.5 pesos per dollar, according to Datatec. The rally brought gains this year to 8.3%. The IPSA stock market index starts trading 9:30 am local time.

“Markets are expected to react positively, potentially recovering recent IPSA losses observed in the the second half of last week,” Credicorp analysts Rodrigo Godoy and Samuel Carrasco wrote in a note Monday. “Sectors with high domestic exposure—banking, retail, shopping centers, and construction—are likely to outperform.”

Read More: Chile Right-Wing Surge Sends Kast to Runoff With Left’s Jara

Credicorp sees the IPSA rising up to 10% if Kast becomes the next president after the second round of voting on Dec. 14, reaching around 10,500 points. They target the peso at 900 pesos per dollar to 920 pesos per dollar.

Kast emerged victorious among a field of right-wing candidates whose supporters he’s now likely to pick up, positioning him as the favorite in the runoff. Kast wants to deregulate the economy and slash corporate taxes, while cracking down on criminal gangs and deporting thousands of undocumented migrants. LarrainVial noted Monday reducing red tape and cutting company levies could be stalled by a Senate deadlock.

Kast’s party and other like-minded conservative groups appeared to fall short of a simple majority in both houses of Congress. They’ll probably need to ally with a populist third party to get there in the lower house, while the Senate is just out of reach.

Bank of America strategists Ezequiel Aguirre and Christian Gonzalez Rojas see the peso rallying 4% in the next six months. And according to JPMorgan, the peso could gain as much as 8%.

However, LarrainVial sees Chile’s stock market falling immediately after the right failed to win a outright majority in Congress, and then reversing those losses.

“We assume that asset prices — the peso and Chilean equities — will ultimately reward the stability derived from consensus-building and the reinforcement of the boundaries protecting the checks & balances in an evenly-matched Senate,” LarrainVial’s Leonardo Suarez and Fernanda de la Fuente wrote in a note.