Fitch Upgrades Greece to BBB, Outlook Stable

TL;DR

Fitch upgraded Greece's credit rating to BBB with a stable outlook, citing continued debt decline and budget surpluses. The government plans aggressive debt reduction, including early loan repayments, aiming for debt-to-GDP below 120% by 2030.

Tags

Fitch Ratings upgraded Greece’s rating status by a notch, saying the country is forecast to continue a debt decline and projected to have another budget surplus despite plans for fiscal easing.

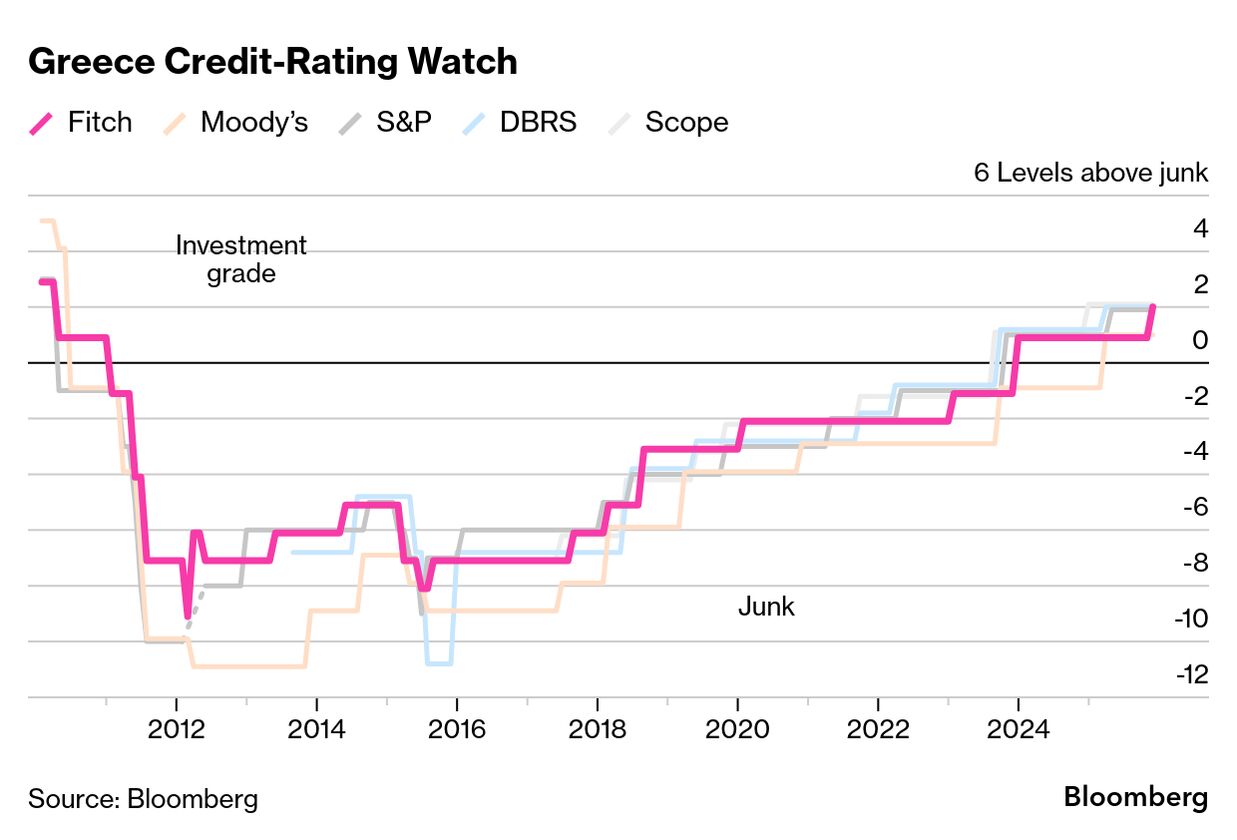

The firm lifted Greece’s long-term sovereign rating to BBB from BBB- with a stable outlook, according to a statement on Friday. Following the move, all major rating agencies now place the country two levels above the junk territory except for Moody’s Rating, which places Greece one notch lower.

“We forecast gross general government debt/GDP will fall by 9pp in 2025 to 145%, following a 10pp decline in 2024,” Fitch said.

The move comes as the government in Athens has pledged to keep producing high budget primary surpluses — the measure of revenue minus spending, excluding interest costs — that will help public debt fall further in the coming years.

Greece is exploring bringing forward an already early repayment of some of its bailout-era loans, Finance Minister Kyriakos Pierrakakis said earlier Friday.

Speaking in an interview with Bloomberg Television, Pierrakakis reiterated the country’s plan to fully pay back 10 years ahead of schedule the loans it received under its first bailout program in 2010 — and signaled that this timeline could even be accelerated.

“We have the most rapid deescalation of debt,” Pierrakakis said. “Our plan is before the decade is out for the Greek debt-to-GDP ratio to be below 120%,” from the record high of 210% of output in 2020. Overall the government wants to be “quite aggressive in terms of debt reduction,” he added.

Last Friday, Scope raised its BBB outlook on the country to positive, citing improved economic resilience, sustained fiscal discipline and debt reduction. For 2026, the government plans to raise as much as €8 billion ($9.3 billion) from markets and cut its debt pile in absolute numbers further.

“We expect debt to continue declining rapidly in the medium term, approaching 120% by 2030 under our baseline, supported by 4% nominal GDP growth and primary surpluses of 3.5% of GDP beyond 2027,” Fitch said.

Yields on Greek 10-year debt climbed to a five-week high at 3.34% on Friday, widening the gap over safer German counterparts to 64 basis points. However the spread still remains close to the lowest since 2008, a far cry from the 35 percentage points reached at the height of the debt crisis more than a decade ago.