Mom-and-Pop Business Bankruptcies Hit a Record as Debts Rise

TL;DR

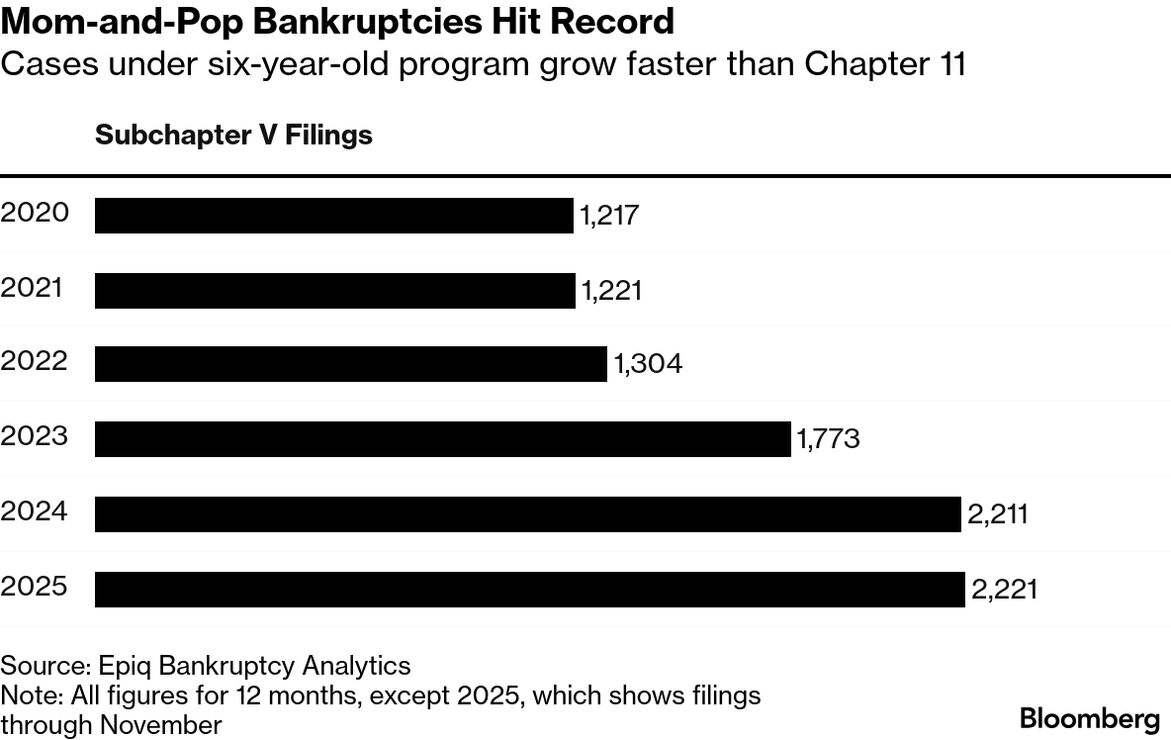

A federal program for small business bankruptcies, Subchapter V, has seen record filings, with over 2,200 cases this year. High debts, borrowing costs, and economic pressures are driving the increase, outpacing overall Chapter 11 bankruptcy growth.

Tags

A six-year-old federal program designed to help the smallest American businesses cut debt and get a fresh start has set a record for the number of cases filed, court data show.

More than 2,200 people and small firms filed bankruptcy this year under the so-called Subchapter V rules, which make it cheaper and faster to win relief from creditors, according to data provider Epiq Bankruptcy Analytics.

“Creditors are just breathing down their necks,” said Carol Fox, a court-approved trustee who oversees more than two dozen cases filed in Southern Florida.

High borrowing costs, cautious consumers and the Trump administration’s trade war are weighing on earnings for the smallest businesses while owners’ optimism fell to a six-month low in October. The number of Subchapter V cases is rising faster than the overall rate for Chapter 11 bankruptcies, which businesses and wealthy individuals typically use to restructure their debts.

Cases under six-year-old program grow faster than Chapter 11

Note: All figures for 12 months, except 2025, which shows filings through November

Year to date through November, Subchapter V cases increased more than 8% to 2,221, compared to the same period last year, Epiq data show. At the same time, Chapter 11 petitions are up about 1% to a little more than 6,000. Epiq collects information from the federal courts on the various types of bankruptcies filed every day in the US.

The Subchapter V program began in 2020 as a way to let individuals and small businesses with less than $7.5 million in debt avoid the cost and delay of using the traditional court reorganization process. The debt limit was reduced last year to about $3 million, making it harder for bigger businesses to qualify, but instead of slowing the growth of the program, the number of filings has increased.

The process is mostly used by small companies, Fox said. But most individuals she works with have filed Subchapter V with business debts as well as consumer debts, she said.

Consumer bankruptcy cases, typically filed under the Chapter 13 rules, are also up compared to recent years when an unusually low number of individuals sought protection from creditors. So far, more than 180,000 Chapter 13 cases have been filed, or nearly 5% more than the first 11 months of last year.