Largest Indian Cigarette Maker ITC Plunges on Higher Tobacco Tax

TL;DR

ITC shares plunged after India announced a significant tobacco tax hike, potentially raising cigarette prices by over 15% and impacting volumes. The tax increase could lead to a shift to illicit markets, with ITC and Godfrey Phillips India seeing sharp stock declines.

Tags

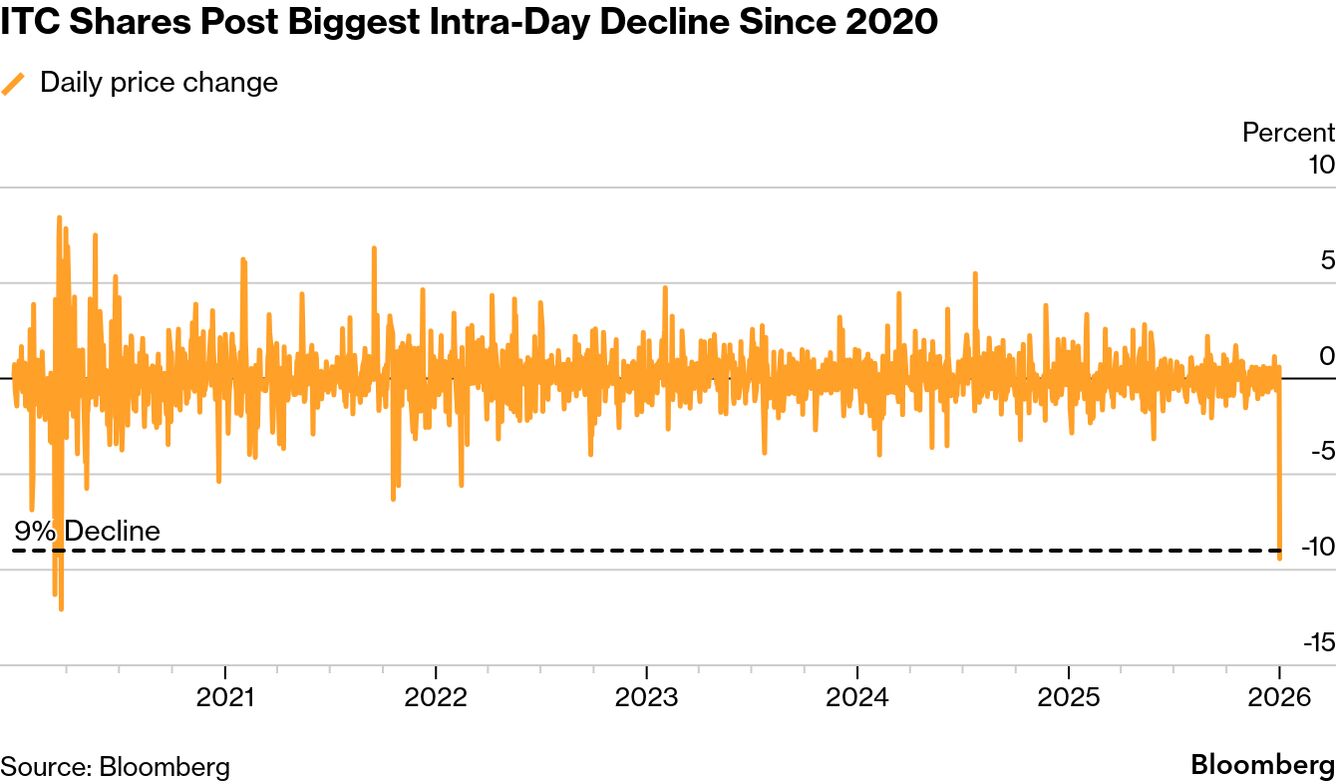

Shares of ITC Ltd., India’s largest cigarette maker, plunged the most in nearly six years after the country announced higher taxation on tobacco products.

Cigarettes will be charged an excise duty ranging from 2,050 to 8,500 rupees per 1,000 sticks from Feb. 1, according to a government notification late Wednesday. The higher charges imply a tax hike of over 30% if National Calamity Contingent Duty continues, Jefferies Financial Group Inc. said.

Shares of the cigarette-to-cookie maker dropped as much as 9.8%, the most since 2020, while Godfrey Phillips India Ltd. dropped 17.6% during trading in Mumbai. ITC sells cigarette brands like Classic and Gold Flake, while Godfrey sells Marlboro and Four Square.

The latest levy is in addition to the Goods and Services Tax, or GST, of 40% on tobacco-based products and cigarettes — also kicking in from Feb. 1 — and aimed at boosting the exchequer as the government loses tax revenue from other product categories.

In September, the Narendra Modi-led administration had announced sweeping tax cuts for other products to boost domestic consumption and blunt the hit from punishing 50% US tariffs.

Read more: India Cuts Taxes on Soaps to Cars as Steep Tariffs Kick In

India has over 253 million people who are tobacco users, making it the second-highest population globally. The tax burden on the so-called ‘sin goods’ is higher than previously anticipated by analysts and investors.

“While we are still unsure on the final outcome, if confirmed, this will be a clear negative as volumes will be impacted and concerns would also re-emerge on risk of losing some volumes to illicit industry,” Jefferies analysts led by Vivek Maheshwari wrote in a note Jan. 1.

ITC might need to hike prices by “at least 15%” to pass on the overall impact to consumers, if not higher, analysts wrote. ITC gets over 40% of its revenue from cigarettes.

The two firms did not immediately respond to emailed requests for comments.

British American Tobacco Plc, ITC’s largest shareholder, has been selling down its stake in the Indian cigarette maker. In May, it sold about $1.5 billion worth of stock to pare its holding to 22.91%.