Bitcoin’s Slide Sets Up an Unusual Tax Harvesting Opportunity

TL;DR

Bitcoin's 30% decline from its peak is creating a significant tax-loss harvesting opportunity for investors. Unlike stocks, crypto isn't subject to wash-sale rules, allowing immediate repurchase after selling at a loss to offset gains elsewhere.

Key Takeaways

- •Bitcoin's 30% slide from its all-time high is driving increased tax-loss harvesting activity as investors sell underwater crypto positions to offset stock gains.

- •Cryptocurrency offers a simpler tax-loss harvesting strategy than stocks because it's not subject to the IRS wash-sale rule, allowing immediate repurchase after selling at a loss.

- •Investors are increasingly incorporating cryptocurrency tax strategies into their overall financial planning rather than treating crypto investments in isolation.

- •The timing of Bitcoin's decline creates particular opportunities for investors who bought near the October peak, with activity concentrated around year-end tax deadlines.

- •Upcoming IRS reporting requirements starting in 2026 may further influence cryptocurrency tax strategies and market behavior.

Tags

Bitcoin’s 30% slide from its all-time high is creating conditions financial advisers say are likely driving more tax-loss harvesting in digital assets than in previous years.

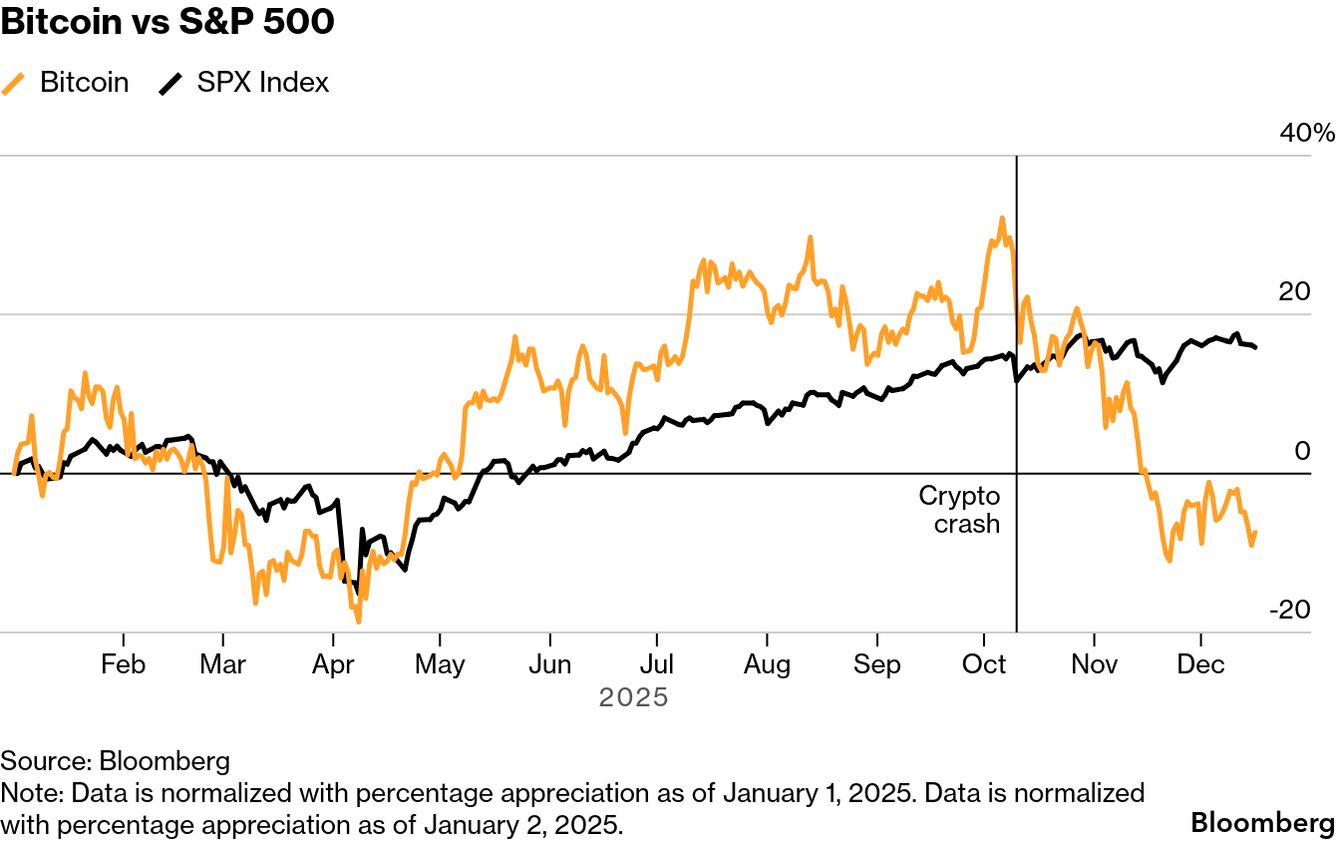

While the world’s largest cryptocurrency by market value is down 5% year-to-date, the equity benchmark S&P 500 has gained roughly 18% in the same time period. This divergence gives investors holding both assets a clear incentive: sell underwater cryptocurrency positions to offset their stock gains before Dec. 31, especially those who bought the digital asset near its October peak.

“Tax-loss harvesting in crypto is being treated as part of the overall tax strategy - especially in a year of strong equity market performance - rather than as a standalone tactic,” said Tom Geoghegan, a certified financial planner and founder of Beacon Hill Private Wealth in Summit, New Jersey.

In the practice of tax-loss harvesting, an investor sells an asset at a loss, and then uses that loss to reduce their taxable income. Initially, losses offset any capital gains dollar-for-dollar. If losses exceed gains, up to $3,000 can be deducted from ordinary income each year, with any additional losses carried forward to future tax years. The result of this? A lower tax bill.

This strategy can be simpler with cryptocurrency than stocks. The IRS wash-sale rule requires equity investors to wait 31 days before repurchasing a stock sold at a loss. If the investor buys back sooner, the IRS prohibits the tax deduction. Spot cryptocurrency, which the IRS classifies as property rather than securities, does not face this restriction. Cryptocurrency ETFs, which are considered securities, are treated differently.

“You can sell that Bitcoin, buy it on that same day, and it doesn’t trigger that limitation,” said Robert Persichitte, a certified public accountant and certified financial planner at Delagify Financial outside of Denver.

Note: Data is normalized with percentage appreciation as of January 1, 2025. Data is normalized with percentage appreciation as of January 2, 2025.

The timing of Bitcoin’s price decline this year matters. Investors who bought near its peak now have losses to harvest, and this year’s volatility amplifies the opportunity, said Will Cong, a finance professor at Cornell University’s Samuel Curtis Johnson School of Management.

“A 30% decline from an autumn peak tends to create precisely that situation for more recent entrants, which historically amplifies year-end selling pressure,” Cong wrote in an email to Bloomberg.

Unlike equity investors, who must plan around the 31-day exclusion window, cryptocurrency holders can sell and repurchase in the same session. This tends to bunch activity into the final days of the year rather than spreading it across the fourth quarter.

“The lack of a wash-sale constraint makes the ‘harvest-and-rebuy’ trade easier to execute immediately, and that tends to concentrate activity around the most tax-salient dates,” Cong said.

Some advisers note that cryptocurrency investors are approaching their tax-harvesting strategy more deliberately than in previous years. Geoghegan said that while the mechanics of tax-loss harvesting have not changed, clients are increasingly incorporating cryptocurrency investments more intentionally into their overall tax strategy.

“In some cases, clients are harvesting losses and re-establishing exposure quickly; in others, they’re using harvested losses to offset realized gains elsewhere, such as equities or private investments, rather than treating crypto in isolation,” Geoghegan said. Clients are more “deliberate and informed” this year, he added.

Whether or not a January rebound for Bitcoin will take place in 2026 is an open question. Cong’s research shows cryptocurrency did not exhibit the classic “January effect” until after the IRS tightened enforcement in 2018. This enforcement is set to intensify: starting in 2026, exchanges and brokers must report their gross proceeds from crypto sales to the IRS for the first time via a new form, 1099-DA.

“More volatility makes this more important to consider,” Persichitte said. “If you can harvest that loss with very little restriction or consequences, it makes the loss a lot more palatable.”