ASX Outage Halts Company Reports for Hours in Latest Snafu

TL;DR

A technical outage at ASX Ltd. halted company announcements for hours on Monday, adding to past issues that have increased regulatory scrutiny and calls for competition. The problem, not cyber-related, disrupted trading for stocks like Metcash Ltd. and follows other global exchange disruptions.

Tags

A technical outage at ASX Ltd. halted company announcements on Australia’s main stock market for hours on Monday, adding to a string of mishaps that have intensified regulatory scrutiny of the exchange and fueled calls for more competition.

The disruption started about an hour before the market opened, when the exchange stopped publishing statements after 8:59 a.m. Sydney time. ASX typically posts releases from 7 a.m. to 8:30 p.m. after adjusting for daylight saving, according to its website.

The exchange first acknowledged the problem at 9:39 a.m., saying it was investigating an issue impacting the dissemination of announcements. It added that the market would open at 10 a.m. as usual, though shares of companies with price-sensitive updates affected by the outage would be halted until the statements could be issued.

Announcements started flowing through around 12:12 p.m. after a three-hour communication blackout. While the exchange eventually published statements received since 11:22 a.m., a backlog of updates filed before then were still being worked on through the afternoon.

At 4:40 p.m., after the market close, ASX said it had contacted all firms that submitted announcements before 11:22 a.m., and that any stocks with unreleased statements will remain paused. In its latest statement, the stock exchange said it has largely resolved the issue.

ASX was still due to give another update on the situation at 8 a.m. on Tuesday, it said on its website.

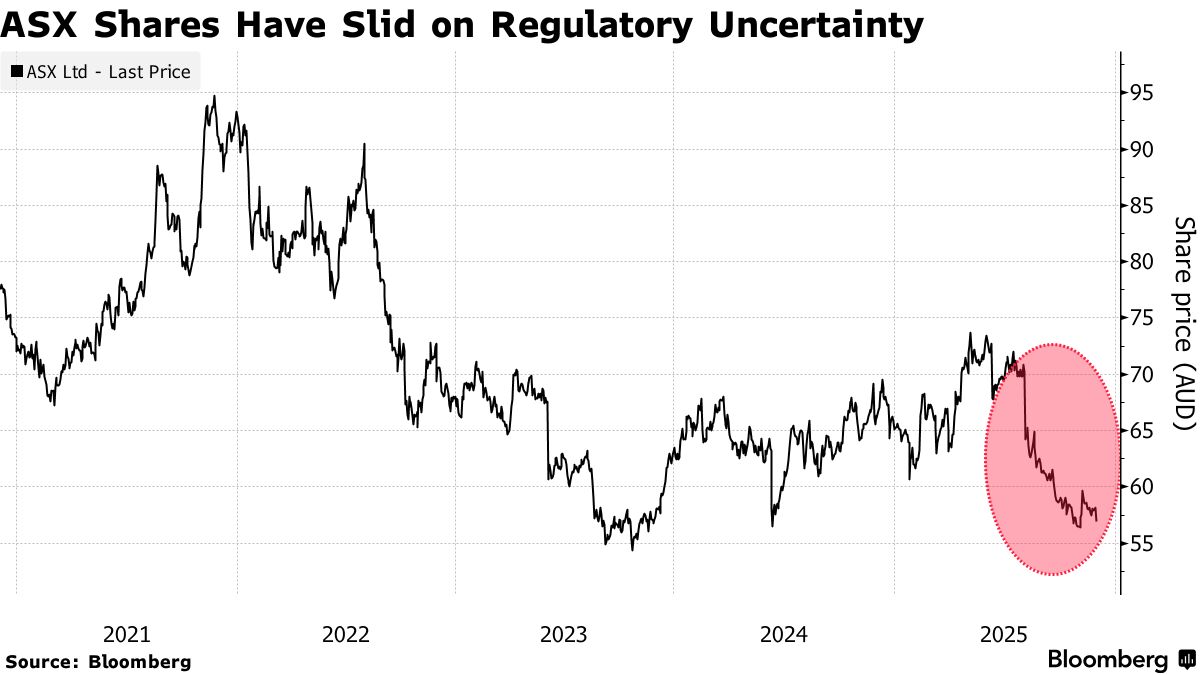

The ordeal follows years of setbacks at the ASX, including a botched clearing and settlement platform upgrade that triggered a wide-ranging regulatory probe into governance and risk management practices. Chief Executive Officer Helen Lofthouse is facing demands for accountability as the company contends with potential competition from rivals.

Stocks affected by Monday’s disruption include Metcash Ltd., which started trading roughly four hours after the market open due to the delayed publication of its results presentation. The grocery store operator dropped 9.2% after a profit miss.

The delays also come after Friday’s 10-hour shutdown at the Chicago Mercantile Exchange, an interruption that roiled global markets when investors found themselves unable to trade contracts tracking the S&P 500 Index and many other assets ahead of month-end. That outage stemmed from cooling problems at a crucial data center in the Chicago area.

Read more: CME’s Data Center Adds More Cooling After Outage, CyrusOne Says

The exchange said it doesn’t see Monday’s technical issue with the announcements platform as cyber-related, and the problem hasn’t impacted clearing or settlement processes. ASX shares fell 2.8%, the most since Aug. 7.