Iron Ore Slips to Lowest in Month as Traders Watch China Policy

TL;DR

Iron ore prices dropped to a one-month low, nearing $100 per ton, as traders await China's Central Economic Work Conference for policy cues. Weak steel demand and high stockpiles in China are pressuring prices, despite recent supply constraints from BHP.

Tags

Iron ore fell to the lowest in a month, extending declines ahead of a key meeting of Chinese officials this week that will provide details on policy priorities for next year.

Futures for the steelmaking commodity slipped for a third session in Singapore toward the psychologically important $100 a ton level. China’s Central Economic Work Conference is expected to take place in the coming days, and follows a meeting of the Communist Party’s decision-making Politburo. The group made strengthening domestic demand their top economic priority for 2026.

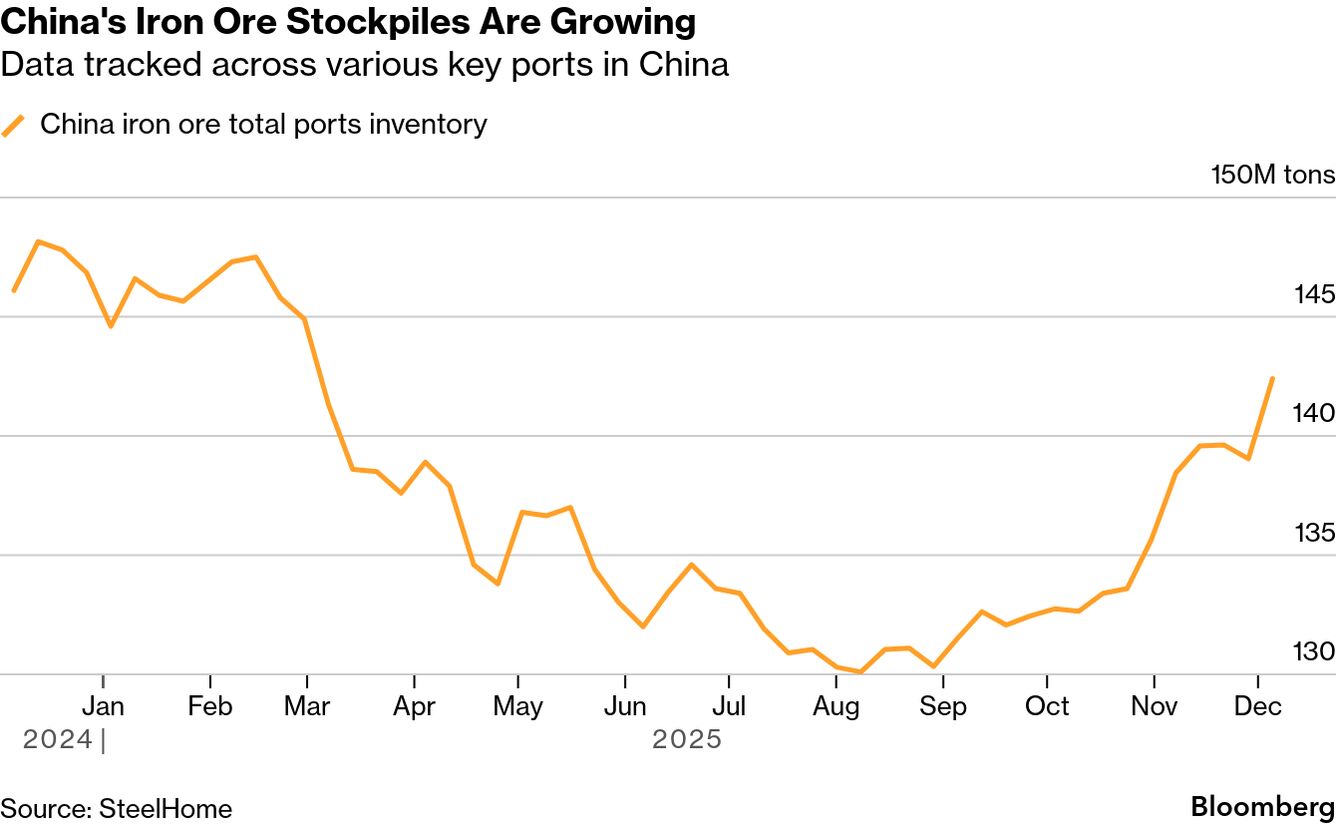

China’s prolonged property sector downturn has weighed on steel demand, but the nation’s iron ore imports have been robust this year, climbing to a record over the 11-month period through November. Stockpiles at major Chinese ports are above the seasonal average, though lower than 2024.

Data tracked across various key ports in China

“Combined with China’s negative steel mill margins and weak crude steel output, the case for lower iron ore prices is becoming stronger,” said Vivek Dhar, an analyst at Commonwealth Bank of Australia.

A ban on some supply from BHP Group by China’s state-backed iron ore trader has provided support to prices in recent months, but a resolution could lead to a rush of product hitting the market and further downward pressure.

Read More: BHP Iron Ore Discounts Widen on CMRG Stand-Off, Macquarie Says

Iron ore futures were 0.9% lower at $101.10 a ton as of 11:04 a.m. Singapore time after falling as low as $100.85 earlier. Yuan-priced futures on the Dalian Exchange dropped 0.6% to 773.5 yuan a ton, while steel contracts in Shanghai also declined.