Here’s What to Watch for Silver’s Next Move After Wild Ride Past $80

TL;DR

Silver's price surged to record highs above $84 an ounce before crashing to near $70, driven by speculative buying in China and ETF inflows. Key factors to watch include technical indicators signaling overbought conditions and high borrowing costs in London.

Key Takeaways

- •Speculative buying in China, particularly on the Shanghai Gold Exchange, has been a major driver of silver's price volatility and record premiums.

- •Inflows into physical-backed silver ETFs have surged by over 150 million ounces this year, tightening supply in an already constrained market.

- •Technical indicators like the Relative Strength Index (RSI) above 70 suggest silver is overbought, increasing the risk of a selloff.

- •High borrowing costs in the London market and increased margins on Comex futures contracts add to headwinds and volatility.

- •The gold-to-silver ratio has shifted lower recently, indicating silver's catch-up rally after gold's earlier surge, with historical patterns suggesting silver often moves twice as far as gold.

Tags

Silver’s exceptional volatility in recent days has captured the zeitgeist — with even the likes of Elon Musk drawing attention to the metal’s ferocious rally to all-time highs.

The metal rose to a record above $84 an ounce early Monday, before promptly crashing closer to $70 in thin, post-holiday trading. It was one of silver’s largest price reversals ever.

Prices remain up about 140% this year. Now the big question is: where does silver go from here?

Here are key charts to watch in the silver market to evaluate what happens next.

Chinese Buying

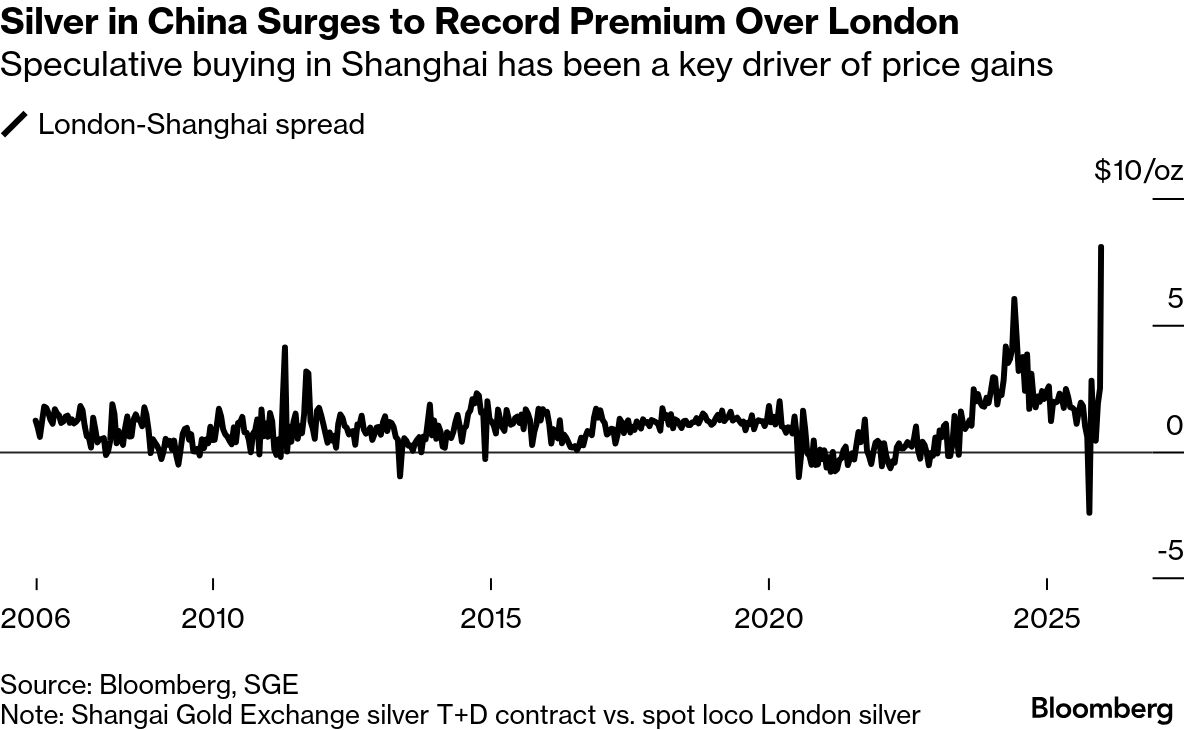

Surging investor interest in China has been a key driver of silver prices in recent days. Speculators piled into the precious metal, mirroring a similar dynamic playing out in platinum. Elevated buying in the Shanghai Gold Exchange’s silver contract in December has pushed premiums to a record high, dragging other international benchmarks along.

Speculative buying in Shanghai has been a key driver of price gains

Note: Shangai Gold Exchange silver T+D contract vs. spot loco London silver

The blistering rally provoked the country’s only pure-play silver fund to turn away new customers last week, after repeated risk warnings went unheeded. The fund’s manager announced the unusual step Friday after multiple actions — from tighter trading rules to cautionary advice about “unsustainable” gains — failed to quell an eruption of interest fueled by social media.

Read More: Precious Metals Craze Prompts China Fund to Turn Away Investors

ETF Inflows

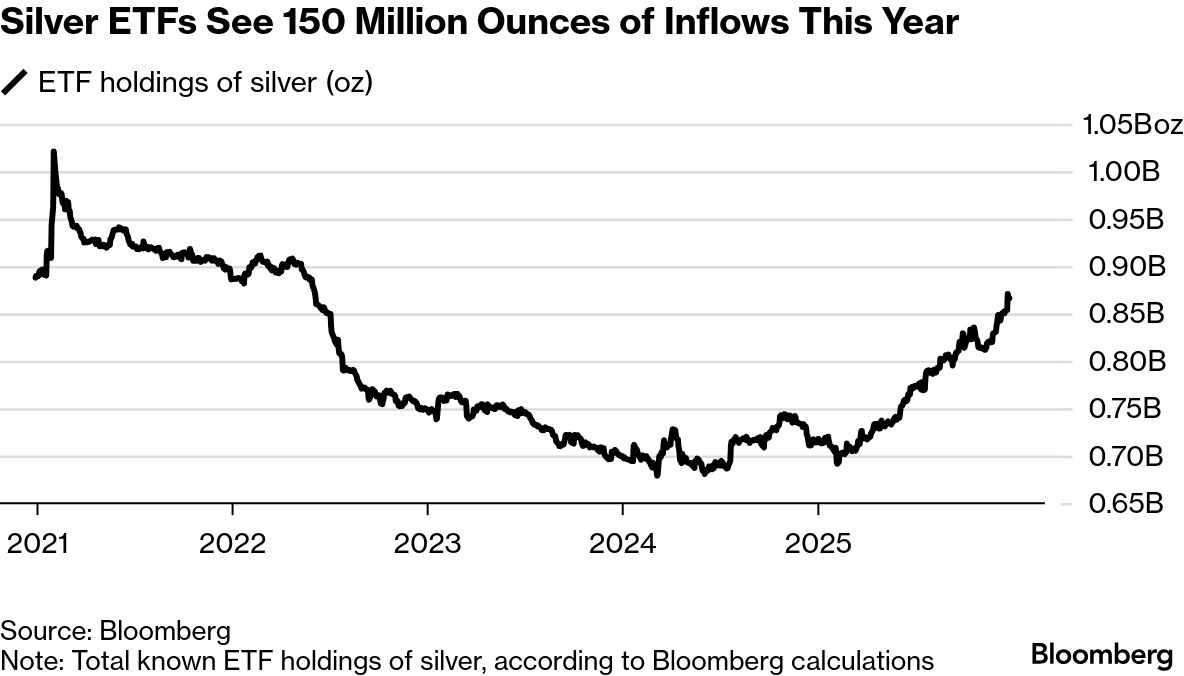

Holdings in physical-backed silver exchange-traded funds have surged this year, rising by more than 150 million ounces. The total amount of metal held by the funds is still below a peak set during a Reddit-driven retail investment surge in 2021, but the inflows have been instrumental in eroding available supplies in an already tight market. Holdings in the funds have risen every month but one this year, according to Bloomberg calculations.

Note: Total known ETF holdings of silver, according to Bloomberg calculations

Technical Indicators, Margins

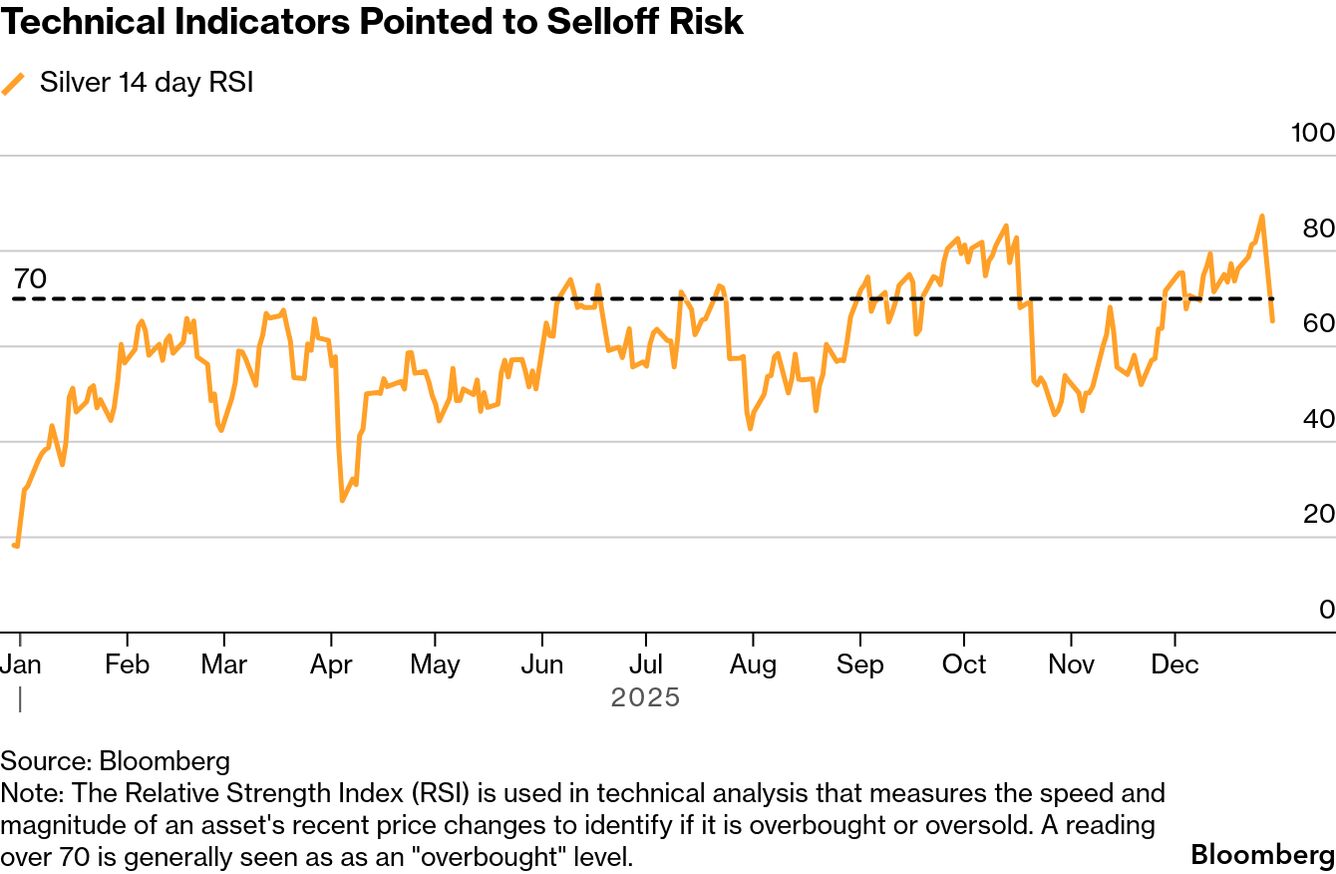

Silver prices jumped more than 25% in December alone, on track for the biggest monthly increase since 2020. The speed of the gains means that some technical indicators are signaling that prices have run too far, too fast. The metal’s relative strength index — a gauge of buying and selling momentum — has stayed above 70 for most of the past few weeks. A reading higher than 70 usually indicates that too many investors bought it in a short period.

Note: The Relative Strength Index (RSI) is used in technical analysis that measures the speed and magnitude of an asset's recent price changes to identify if it is overbought or oversold. A reading over 70 is generally seen as as an "overbought" level.

Some exchanges are moving to rein in risk amid heightened volatility. The margins for some Comex silver futures contracts will be raised from Monday, according to a statement from CME Group Inc. That’s adding to headwinds since traders will need to put up more cash to keep their positions open. Some speculators won’t want to do that and will be forced to shrink or close their trades instead.

Options Frenzy

One indication of speculative fervor has been the level of buying for call options, both on silver futures and related ETFs. Call options, which give the buyer the ability to buy a security at a pre-determined price level, are typically seen as a cheap way to bet on market upside.

For iShares Silver Trust (SLV), the largest silver ETF, total call open interest hit the highest since 2021 this week. The cost of buying calls on silver futures relative to the cost of buying equivalent puts, which protect against price declines, has also jumped to historical highs in recent weeks.

Note: Buying call options is one way for investors to bet on higher prices. Chart shows spread between price of 25 delta call options versus put options on the most active Comex silver futures contracts, expressed in vol terms.

Borrowing Costs

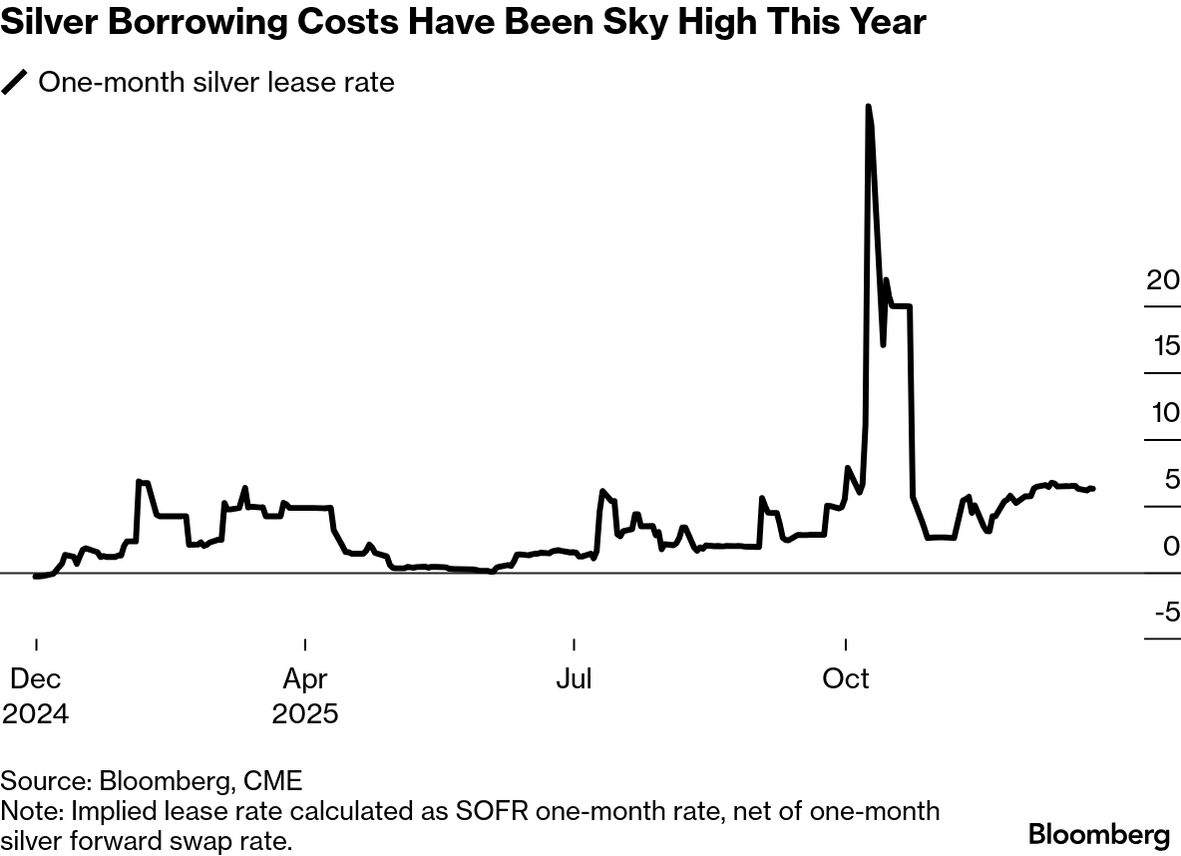

Thanks to a tariff-related trade, much of the world’s available silver still remains in New York warehouses. Meanwhile, the market is still awaiting the outcome of a US Section 232 probe into critical minerals, which could lead to levies or other trade restrictions on the metal.

The surge of metal into the US had pushed the London market into a full blown squeeze in October, and borrowing costs in the London market still remain well above their normals levels of close to zero. That helped set the stage for increased volatility and frequent price spikes.

Read More: Sold Out in India, Panic in London: How the Silver Market Broke

Note: Implied lease rate calculated as SOFR one-month rate, net of one-month silver forward swap rate.

Catching Up With Gold

Precious metals generally have seen a surge in investment demand this year, supported by a sagging US dollar, President Donald Trump’s aggressive moves to remake global trade and threats to the Federal Reserve’s independence.

Gold was the first to rally, benefiting additionally from strong buying by global central banks. Some market watchers hold as a rule of thumb that when gold makes a decisive move, silver will eventually move twice as far in the same direction — this year, of course, they would have been right.

Many investors also track the ratio between the two commodities. After gold’s initial surge in the early months of this year, that ratio stretched above 100 to 1, signaling to some that it was time to buy the white metal. But in recent weeks, the ratio has rapidly shifted lower.

Note: Spot gold price per ounce divided by spot silver price