French Inflation Decelerates to Seven-Month Low on Energy

TL;DR

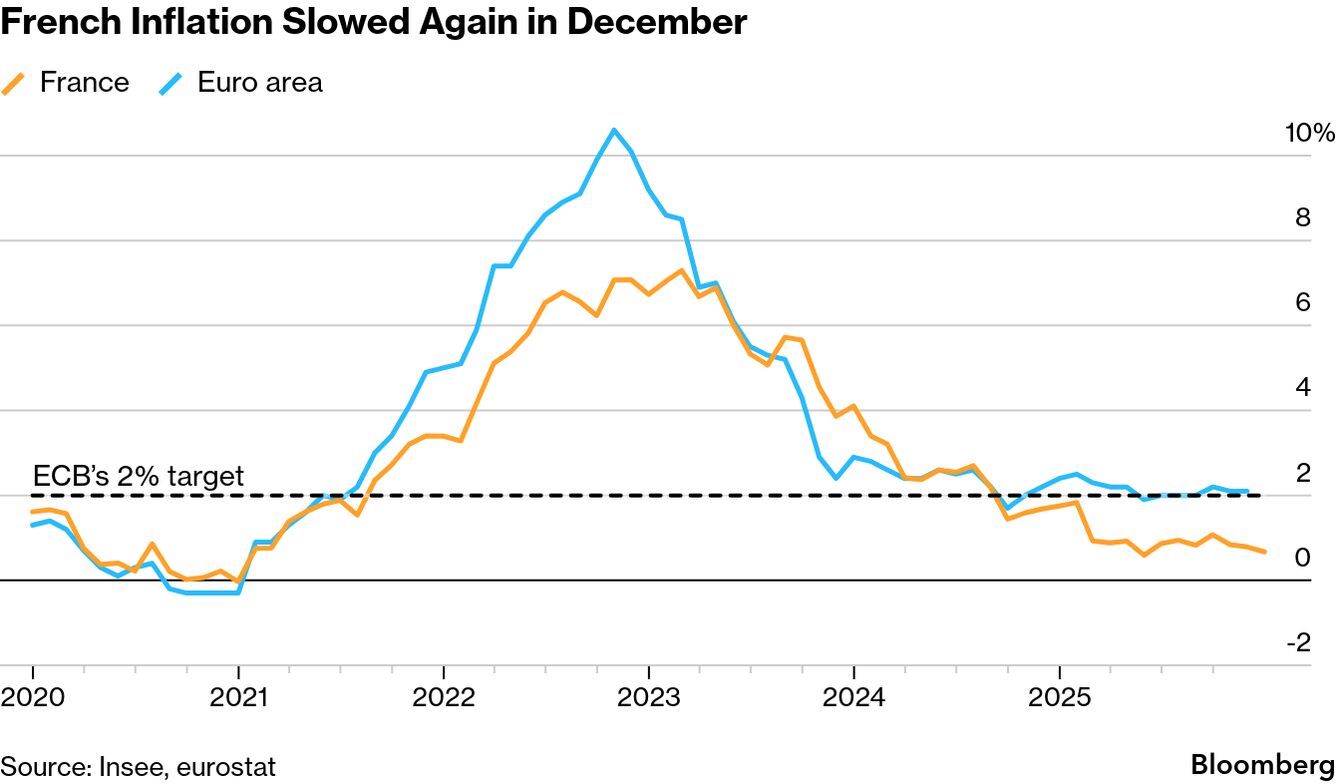

French inflation slowed to 0.7% in December, a seven-month low driven by falling energy costs, supporting the ECB's decision to keep interest rates on hold. The data aligns with expectations and highlights regional variations in price growth across the euro area.

Key Takeaways

- •French inflation decelerated to 0.7% year-on-year in December, down from 0.8% in November, primarily due to declining energy costs.

- •The ECB has maintained unchanged interest rates since June, with inflation near its 2% target, and markets expect the easing period to be over.

- •Inflation varies across the euro area, with Germany expected to see a slowdown to 2.2%, while France's low rates may support real incomes and favorable borrowing conditions.

- •Risks to inflation remain tilted to the downside, influenced by factors like potential disinflation from China and a stronger euro, with French inflation projected to hover around 1% in the near term.

- •The French economy faces uncertainty in 2026 due to a lack of a full budget, relying on emergency legislation that could hinder new investment.

Tags

French inflation slowed slightly in December as energy costs fell, indicating little change in the backdrop that has allowed the European Central Bank to keep interest rates on hold.

Consumer prices in the euro area’s second-largest economy rose 0.7% from a year earlier after November’s 0.8% reading, statistics agency Insee said. The number is in line with the median estimate in a Bloomberg survey of economists.

The ECB left borrowing costs unchanged at its final decision of 2025 with inflation near its 2% target. It hasn’t altered policy settings since June, and markets and most analysts now predict that the period of easing is over.

While France has recorded price increases below 2% for more than a year, rates are higher elsewhere and data for the whole euro area on Wednesday is expected to show inflation was exactly at the ECB goal in December.

German numbers are due later on Tuesday, with economists predicting price growth will decelerate to 2.2%. Regional data suggest the gauge may slow to 2.1%, according to Martin Ademmer of Bloomberg Economics.

German bonds edged higher after those reports from the country’s states, with the 10-year yield falling two basis points to 2.85%.

Read More: GERMANY REACT: Regional Data Flag Steeper Inflation Drop

Bank of France Governor Francois Villeroy de Galhau is among officials arguing the ECB must not rule out further changes to policy. He said last month that risks to inflation are “particularly to the downside” and urged colleagues to keep full “optionality” regarding future moves.

Speaking in Paris on Tuesday, Villeroy said that France’s 0.7% inflation reading is “positive news for real incomes in France and for maintaining favorable interest rates.”

The data showed a steeper decline in energy costs in December, while inflation in services was steady at 2.2%. Manufactured goods prices fell 0.4% after a 0.6% drop in November.

What Bloomberg Economics Says...

“Looking ahead, we expect French inflation to hover around 1% in the coming months, supported by rising services and food prices, before accelerating from the second quarter on higher electricity prices. The risks are still tilted to the downside, reflecting potential imported disinflation from China and a stronger euro.”

—Jean Dalbard, economist. For full React, click here

The French economy is on an uncertain footing at the start of 2026 after lawmakers failed to adopt a full budget by the Dec. 31 deadline. The country is relying on emergency legislation to roll over spending and taxation provisions — a system that puts new investment on hold.

| Read More on the ECB: |

|---|

Euro Zone’s Growing Eastern Wing Wants Seat at ECB’s Top Table |