Saks Mulls Bankruptcy Year After Raising Billions for Turnaround

TL;DR

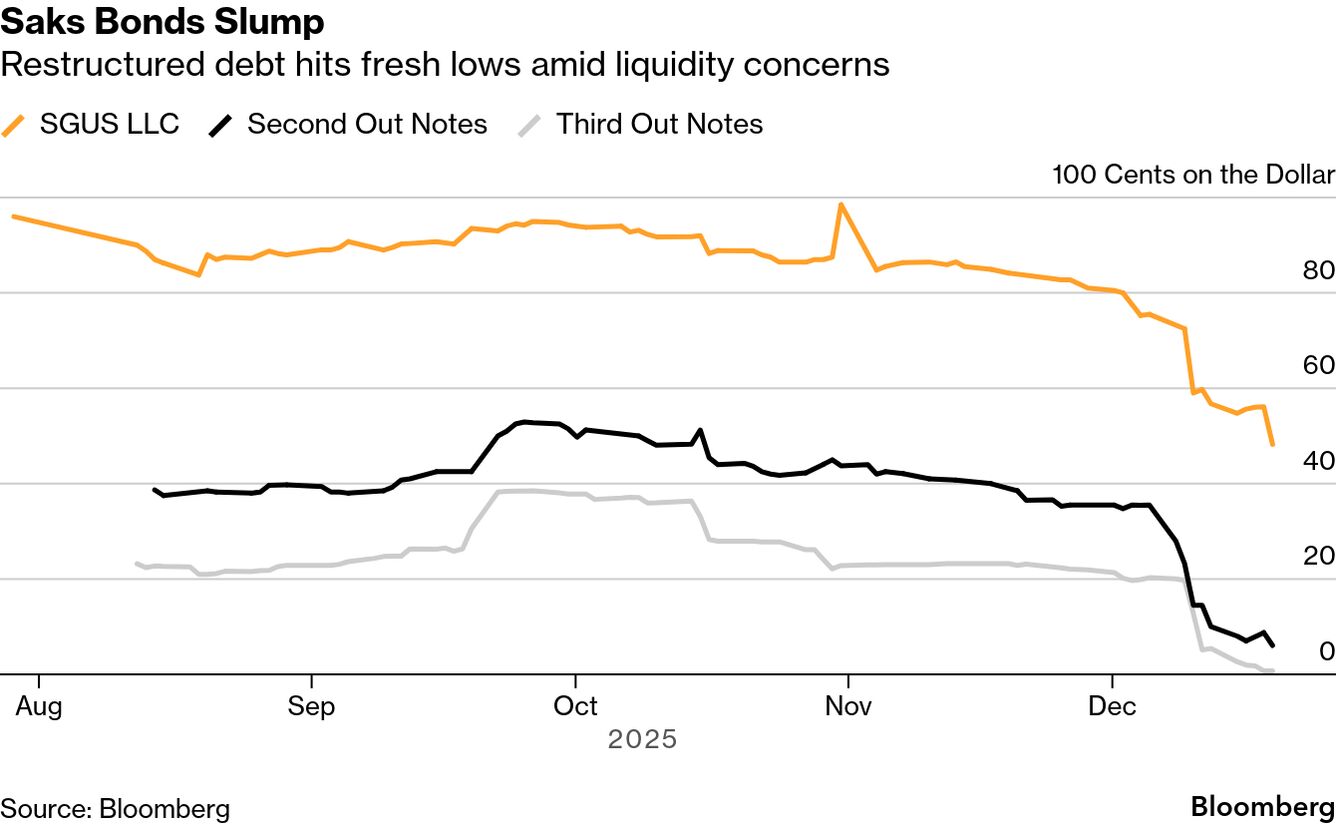

Saks Global Enterprises is considering Chapter 11 bankruptcy as it faces a $100+ million debt payment due this month, despite raising billions last year for a turnaround plan. The company's acquisition of Neiman Marcus worsened its debt and vendor issues, leading to plunging bond values and liquidity concerns.

Key Takeaways

- •Saks is weighing Chapter 11 bankruptcy as a last resort ahead of a $100+ million debt payment due at month-end.

- •The company's turnaround plan, including the Neiman Marcus acquisition, deepened debt and failed to resolve vendor payment issues.

- •Saks bonds have plummeted in value, with some trading as low as 7.5 cents on the dollar, reflecting investor concerns.

- •The company is exploring emergency financing, asset sales, and potential debtor-in-possession loans to address liquidity needs.

- •Saks previously restructured debt in June but continues to face declining sales and inventory management challenges.

Tags

Saks Global Enterprises, facing limited options ahead of a more than $100 million debt payment due at the end of this month, is considering Chapter 11 bankruptcy as a last resort, according to people with knowledge of the situation.

The company is also weighing additional ways to shore up liquidity, including raising emergency financing or selling assets, the people said, asking not to be identified because they’re not authorized to speak publicly. Separately, some Saks lenders have held confidential talks in recent days to assess the company’s cash needs, according to other people familiar with the matter. Those discussions have focused on a potential debtor-in-possession loan, a form of bankruptcy funding.

Saks raised billions of dollars from bond investors late last year to finance a bold turnaround plan centered on the acquisition of Neiman Marcus, betting that scale would revive the struggling luxury retailer. Instead, the deal deepened the company’s debt burden and failed to resolve long-running issues with vendors, many of whom halted shipments amid missed payments, accelerating losses.

In June, Saks persuaded creditors to provide hundreds of millions of dollars more as part of a debt deal that reshuffled repayment priorities, creating multiple tiers of bondholders with differing claims on the company’s assets. Even those securities have since plunged, underscoring concern among investors that the turnaround effort is running out of time.

“Together with our key financial stakeholders, we are exploring all potential paths to secure a strong and stable future for Saks Global and advance our transformation while delivering exceptional products, elevated experiences and personalized service to our customers,” a representative for Saks said via email. PJT Partners, which is advising the company, declined to comment.

Restructured debt hits fresh lows amid liquidity concerns

The tie-up with Neiman last year was intended to create a multibrand luxury giant powered by the technology of new high-profile investors, which included Amazon.com Inc. and Salesforce Inc. But by May, bondholders were already facing paper losses of more than $1 billion as the plan stumbled.

Following the restructuring, Saks in October cut its full-year guidance after reporting declining sales tied to inventory management challenges, as it continued to delay payments to some vendors to conserve cash.

Saks faces interest payments of more than $100 million due Dec. 30, according to data compiled by Bloomberg. The $941 million portion of Saks’ second-out notes restructured in August traded at about 7.5 cents on the dollar on Monday, down from roughly 36 cents two weeks earlier, according to Trace pricing. About $762 million of more senior debt was quoted at around 48 cents.