Offshore Investor Buys $6 Billion of Colombian Peso Bonds

TL;DR

Colombia sold $6 billion in peso bonds to a single foreign investor, a record transaction that boosted the peso and bond prices. This private placement aims to address financing needs and reduce debt levels amid market volatility and credit rating downgrades.

Key Takeaways

- •Colombia completed a record $6 billion peso bond sale to a single foreign investor, boosting the currency and bond prices.

- •The transaction is part of a new strategy using private placements to meet financial needs and manage swelling debt levels.

- •The sale follows market selloffs driven by fiscal concerns, political uncertainty, and a recent credit rating downgrade.

- •This operation may reduce market anxiety about Colombia's financing strategy ahead of the 2026 election.

- •Despite short-term gains, significant concerns remain about Colombia's debt and deficit levels.

Tags

Colombia sold the equivalent of $6 billion in peso bonds directly to a foreign investor, the latest in a set of unprecedented debt management operations seeking to meet the nation’s financial needs and reduce the its swelling debt levels.

The 23 trillion pesos ($6 billion) transaction represents a record inflow into Colombian government peso bonds, or TES, Public Credit Director Javier Cuéllar said. The peso appreciated as much as 2.1% Friday, while TES yields fell sharply across the curve. Dollar bonds also gained.

“This operation is the first of several that could potentially be executed with this investor,” the Finance Ministry said later in a statement. It “reflects a vote of confidence in the economy and the market for Colombia’s public debt.”

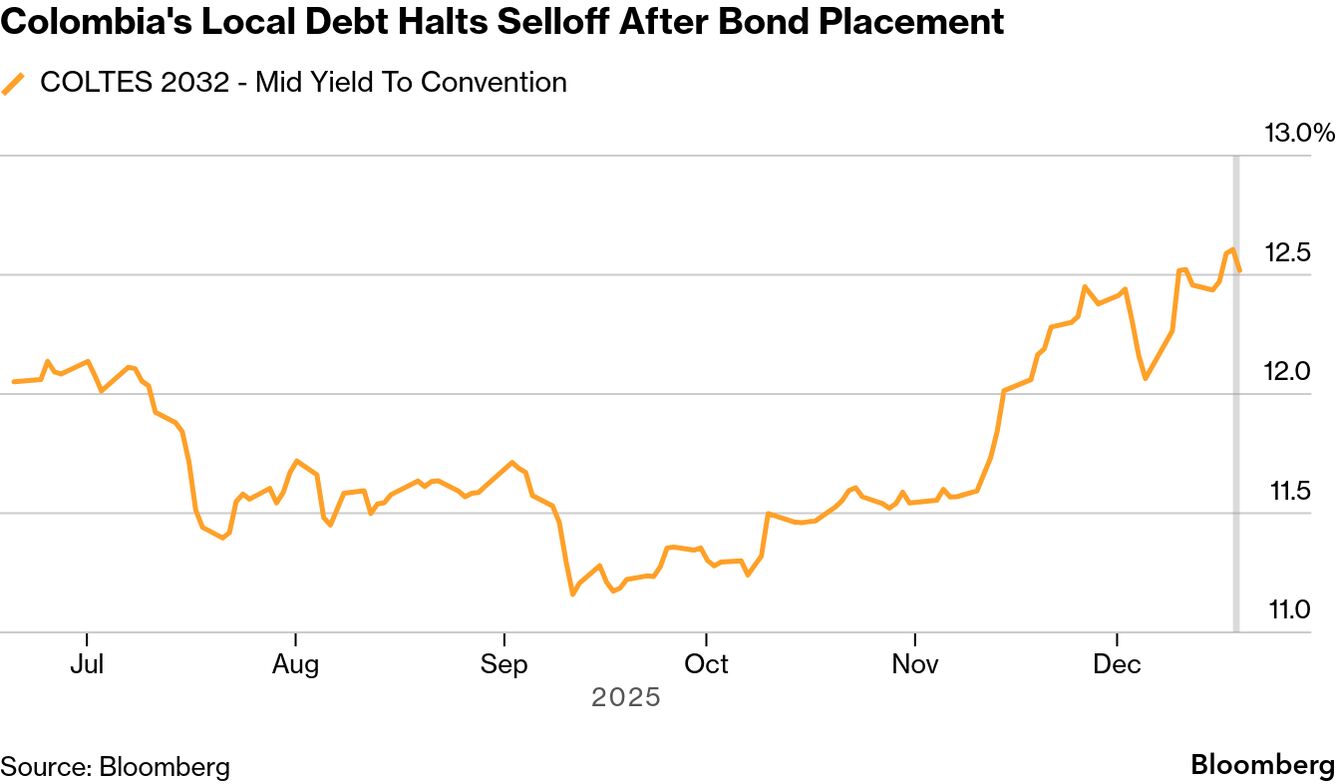

The move follows a sharp selloff in local bonds, as investors focused on the country’s deteriorating fiscal situation, the potential for rate increases and a murky political outlook ahead of elections next year. Policymakers left the key rate at 9.25% Friday, the highest in Latin America after Brazil. The notes have handed investors losses of 4.2% so far this month and are the worst performing local credit in emerging markets.

“The operation should decrease market anxiety around the Republic’s financing strategy ahead of the 2026 election and the expiry of the total return swap signed with international banks,” said Armando Armenta, a senior economist at AllianceBernstein in New York.

Read more: Colombia Gets Market Wake-Up Call With Elections in Focus

Due to confidentiality agreements, the name of the buyer can’t yet be disclosed, Cuéllar said in a phone interview. The fund is a buy-and-hold investor, he added.

“We are not alone in facing the speculative attacks against Colombia by Brazilian hedge funds,” Cuéllar said in a LikedIn post.

The investment is larger than the $4 billion net inflow into EM-dedicated debt funds in the week ended Dec. 17 — the biggest weekly gain since July — according to EPFR Global data compiled by Bank of America Corp.

The operation is part of a new strategy by the finance ministry to increase the use of private placements with investors, according to Cuéllar.

“That transaction alone represents almost 20-25% of the planned TES issuances for 2026,” said Alejandro Arreaza, an economist at Barclays. “This could give them room to reduce the size or postpone a potential return to the markets.”

Part of the recent selloff was also driven by speculation that the ministry’s liability management operations were reaching an end. The latest buyback of global bonds underwhelmed investors, as the government had to issue local-currency bonds to complete the planned repurchase. This week, Fitch Ratings downgraded Colombia’s credit rating one notch deeper into junk territory, citing persistently large budget deficits that will add to the nation’s debt load.

But despite the recent downturn, the strategy has generated some positive results: the government expects its net debt to close at 57.3% of gross domestic product this year, 1.9 percentage points lower than in 2024, despite the fiscal deficit.

“Beyond this short term management, concerns about the debt and deficit levels continue to be significant,” said David Cubides, chief economist at Banco de Occidente.