How Dutch Pensions Overhaul Is Rippling Through Bond Markets

TL;DR

The Netherlands is transitioning its pension system from defined-benefit to defined-contribution by 2028, affecting €1.8 trillion in assets. This shift prompts pension funds to adopt life-cycle investing, reducing demand for long-dated bonds and swaps while increasing market volatility risks.

Key Takeaways

- •The Dutch pension overhaul involves moving from defined-benefit to defined-contribution plans by 2028, with some major funds transitioning in 2026.

- •Pension funds will shift to life-cycle investing, favoring riskier assets like equities for younger workers and safer bonds for those nearing retirement.

- •Reduced demand for long-dated interest-rate hedges and bonds is steepening the euro swaps curve and could complicate government borrowing.

- •Authorities acknowledge potential market volatility but note the staggered transition and anticipation by investors may mitigate surprises.

Tags

The Netherlands is overhauling its pensions to adapt to an aging population and a labor market where people no longer remain with the same employer for their entire working lives.

A complex transition from so-called defined-benefit pensions to a new system involving defined contributions is due to be completed by the start of 2028. Some major pension funds made the move at the beginning of this year.

The shift will have major implications for European financial markets as pension funds invest more in riskier assets and have less need for long-dated assets, namely interest-rate swaps and bonds.

How big is the Netherlands’ pension system?

It’s the largest in the euro area and had almost €1.8 trillion ($2.1 trillion) of assets under management as of the third quarter of 2025.

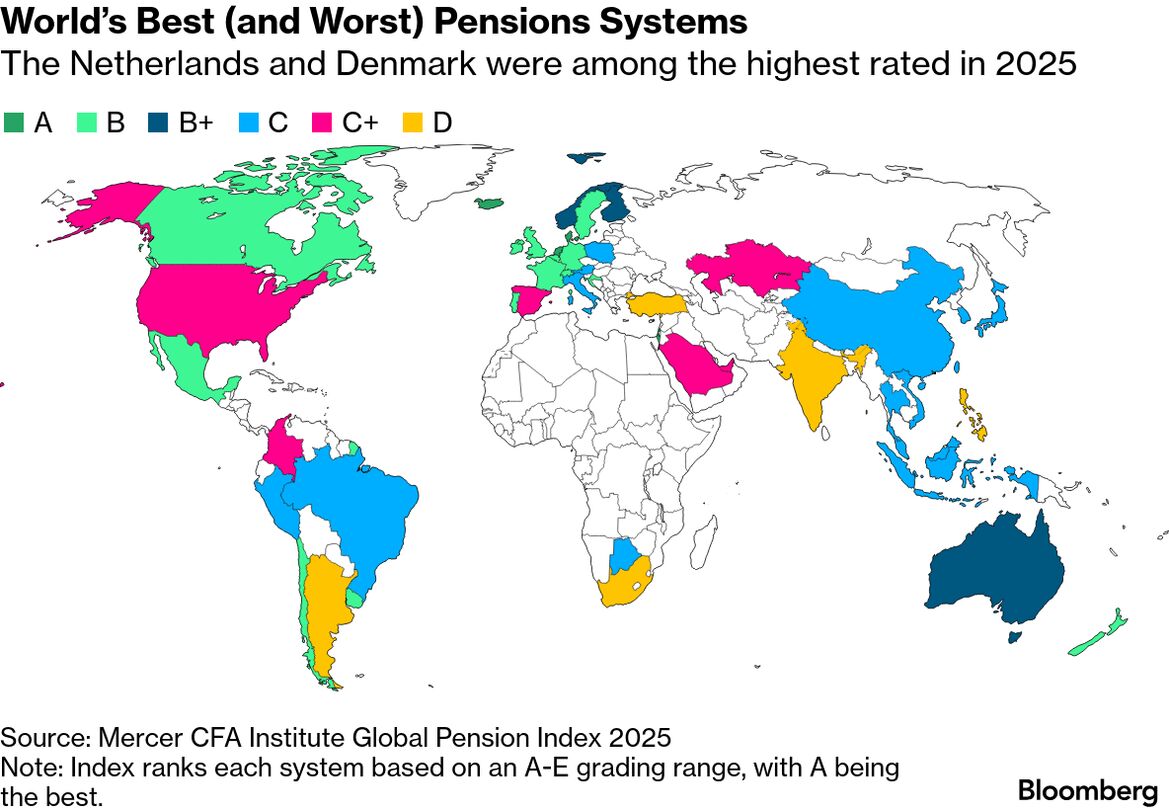

The Dutch pension system also ranks among the best in the world. Even as it undergoes reforms, it retained the top spot in consultancy Mercer’s annual index, which compared 52 pension systems globally on their adequacy, sustainability and integrity.

The Netherlands and Denmark were among the highest rated in 2025

Note: Index ranks each system based on an A-E grading range, with A being the best.

Why is the Dutch pension system changing?

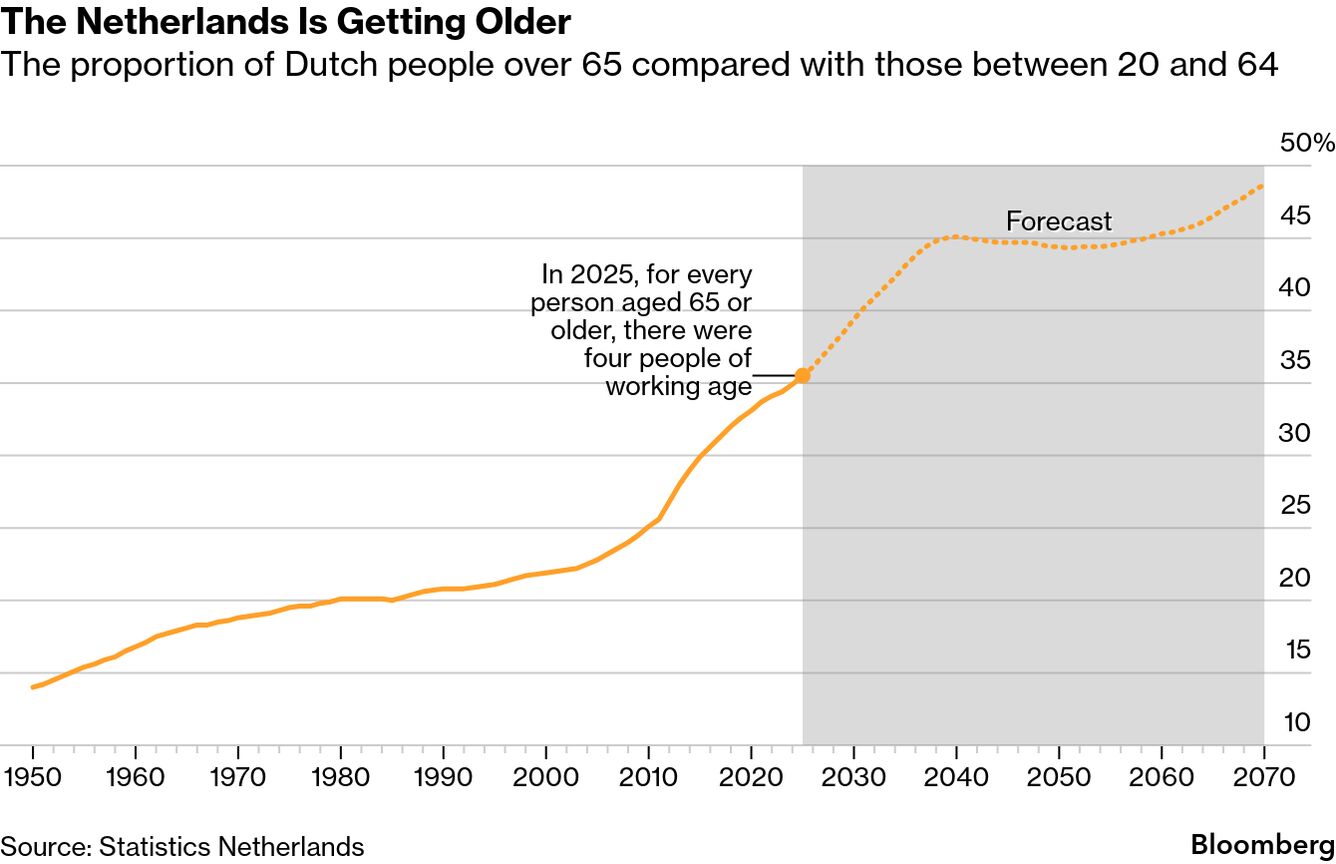

In countries with aging populations, such as the Netherlands, pension providers face a greater risk of funding gaps because there’s a dwindling number of working people paying into pension pots for every retiree who’s drawing from them.

With defined-benefit (DB) pensions, employees expect to receive pre-defined payouts upon retirement. If the pension provider lacks the funds to make those payouts, it can trigger an urgent scramble to fill the gap.

Defined-contribution (DC) plans shift the risk and responsibility onto the employee: The payouts they eventually receive depend on the contributions they and their employer made to an individual retirement pot and on the returns from investing this money.

The Netherlands and many other nations are moving from DB to DC arrangements as governments adapt pension systems to a more dynamic labor market.

Previously, when more people stayed loyal to the same employer for their entire working lives, the young had a greater incentive to join their employer’s pension plan. They’d start out subsidizing the retirement of their older colleagues, but would benefit from those early contributions on reaching retirement. Today, many people change jobs several times during their career or become self-employed. This has eroded the incentives that fostered the sense of a shared interest across different age cohorts.

The Netherlands’ new system is also intended to make pension allocations more transparent and personalized. Employees will be able to track how much they and their employer have contributed toward their pensions and how those assets are growing.

The proportion of Dutch people over 65 compared with those between 20 and 64

When will the pension reforms take effect?

The changes approved by lawmakers in an updated Pensions Act came into force on July 1, 2023. All pension providers in the Netherlands have been given a deadline to transition to the new framework by Jan. 1, 2028.

Some major Dutch pension funds — including PFZW, the fund for the health care and social welfare sector, and PMT, a fund for workers in the metals industry and technical sectors — transitioned on Jan. 1, 2026. Ahead of the shift, ING Groep NV estimated that around €550 billion in assets would move at the start of the year.

How will the changes impact pension funds?

The shift from a system of defined benefits to defined contributions is expected to prompt pension funds to switch to life-cycle investing — a strategy that adjusts the risk profile of portfolios depending on how close an individual is to their expected retirement age. This approach exposes participants to a more varied mix of assets.

For those further out from retirement, the emphasis is on capital growth. The long investment horizon means there’s more time to compensate for potential losses, so funds are more likely to invest in riskier assets such as equities.

For those nearer to retirement, it’s preferable to preserve capital and avoid sudden losses, so asset allocation will be less risky and favor stable income from instruments such as bonds.

Dutch pension funds have been a whale in fixed-income markets. They accounted for around 65% of the sovereign bonds held by euro-area pension funds, according to data cited by the European Central Bank in November.

How will the pension reforms affect bond and swaps markets?

The switch to life-cycle investing means the way pension funds use financial hedging instruments to reduce interest rate risk will differ for the portfolios of younger and older participants. Overall, the need for long-dated interest-rate hedging contracts will recede, leading to lower demand for swaps — contracts that pay a fixed stream of interest.

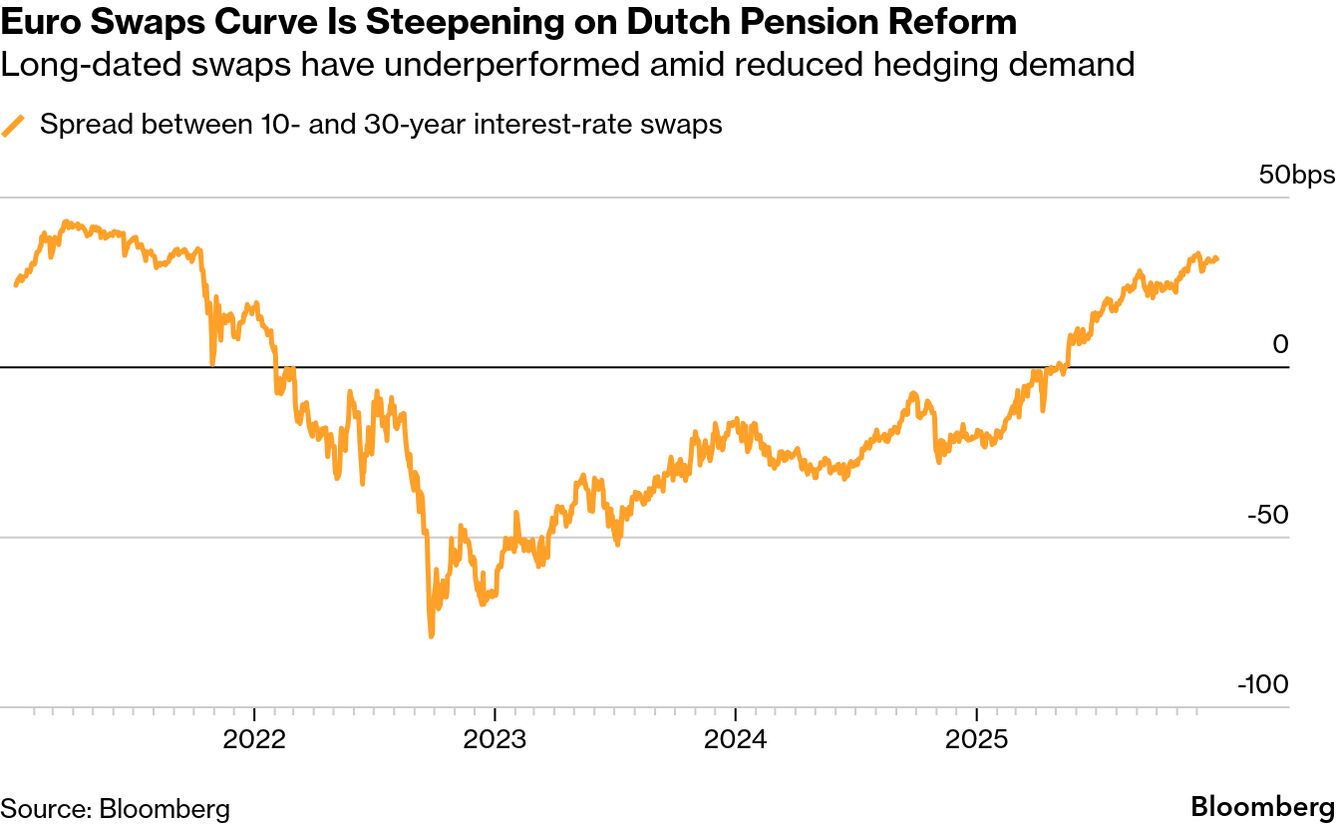

As a result, longer-dated swap rates will rise relative to shorter ones — a so-called steepening move that’s already underway. This could fuel bouts of volatility in the swaps market, potentially spilling over to other asset classes, particularly if a lot of pension funds try to unwind these hedges at the same time.

Weaker appetite for long-dated debt could also complicate European governments’ efforts to fund higher defense and other public spending by ramping up bond sales. Some sovereign issuers, including the Dutch, have indicated they will gradually tilt borrowing toward shorter-dated bonds to reflect the demand shift.

Long-dated swaps have underperformed amid reduced hedging demand

| Read more about how the changes are impacting markets: |

|---|

Are authorities worried about the potential volatility?

The Dutch central bank said investment policy adjustments by pension funds could affect financial markets. “Multiple large transactions in a short time could lead to temporary stress, but we see various tempering factors,” according to a De Nederlandsche Bank statement in October.

Firstly, DNB noted that the transition to the new system will be staggered. Most funds will transition in almost equal measure on either Jan. 1, 2026 or exactly a year later. Secondly, the reform has been in the works for years, and investors have anticipated these changes, so the “likelihood of surprises is low,” the central bank said.

To address the risk of bottlenecks, the government has given pension funds an extra year to reduce their interest-rate hedges once they’ve transitioned to the new pension system. But the flipside of that is elevated uncertainty about the exact volume of flows the market will see and when.

The ECB has also flagged potential risks from the transition, including a selloff in long-maturity bonds and interest-rate swaps given the Dutch pension system’s large footprint in Europe’s sovereign bond market.