Tech Stocks, Oracle Lead S&P 500 Higher With Sentiment Improving

TL;DR

Tech stocks, led by Oracle and AI-linked companies like Nvidia, boosted the S&P 500 and Nasdaq 100 as consumer sentiment improved, despite volatility from a record options expiration. Gains were supported by positive news on the TikTok deal and chip sales, with inflation data and Fed comments also influencing market sentiment.

Tags

Mega-cap technology stocks helped drive key indexes higher Friday as traders parsed an uptick in US consumer sentiment, even as traders had braced for volatility with a record options expiration.

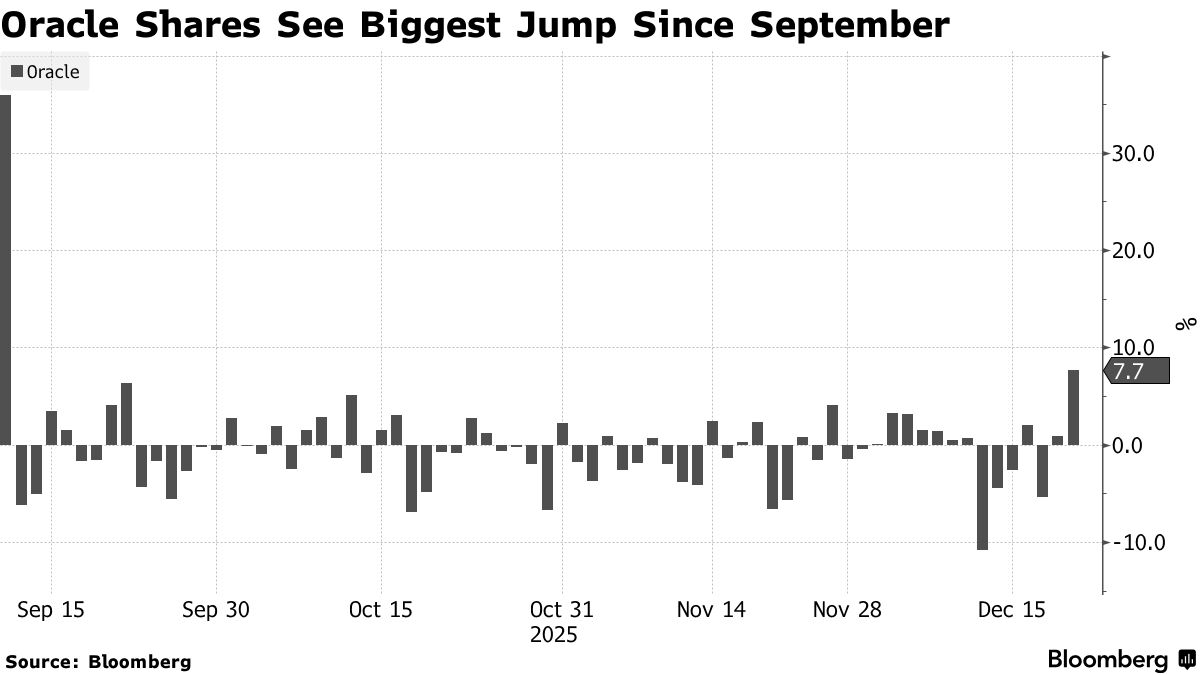

The S&P 500 Index extended gains to 0.9% as of 12:45 p.m. in New York and is now on pace to end the week higher. Information technology was the top-performing sector with gains from AI-linked stocks including Nvidia Corp., which was cleared to finalize an investment in Intel Corp. Oracle Corp. shares rose the most intraday since September as the TikTok purchase is seen as a positive.

The tech-heavy Nasdaq 100 Index rose 1.2%, while the blue-chip Dow Jones Industrial Average rose 0.6%. A University of Michigan survey showed consumer sentiment ticking higher. Existing home sales also showed a small gain in November.

The TikTok deal and optimism about Nvidia chip sales are “helping the sector extend its Micron-driven gains,” Vital Knowledge founder Adam Crisafulli wrote Friday. He added that Thursday’s inflation data and Micron’s better-than-expected forecast are “still bolstering equity sentiment.”

New York Fed President John Williams said Friday there’s no urgency to further cut interest rates, and recent employment and inflation data have done little to change his outlook. The comments followed a cooler-than-expected inflation report a day earlier.

The Bank of Japan raised interest rates by 25 basis points to their highest level in 30 years overnight. The move was “no worse than feared” and helped push equities markets modestly higher, Sevens Report founder Tom Essaye wrote Friday morning.

Meanwhile, a record $7.1-trillion triple-witching options expiration will make parsing specific moves in the stock market Friday extra difficult, said Matt Maley, chief market strategist at Miller Tabak + Co LLC.

Goldman Sachs Group Inc. strategists predicted that the next phase of the market will come with more volatility. The bank’s trading desk also expects a Santa Claus rally through the end of 2025 — a view that is shared by multiple firms on Wall Street.

“There is still time for stocks to stage a Santa Claus rally, which historically comes during the final few trading days of the year,” said Alexander Guiliano, chief investment officer at Resonate Wealth Partners.