Bitcoin Daredevils Leave Market on Edge as Levered Bets Misfire

TL;DR

Bitcoin's expected rebound failed, trapping leveraged traders as prices fell 30%. High open interest and positive funding rates indicate risky bottom-fishing bets, increasing market fragility amid institutional retreat.

Key Takeaways

- •Leveraged traders are exposed due to failed Bitcoin rebound bets, with prices dropping sharply and funding rates staying elevated.

- •Open interest in Bitcoin perpetual futures surged, highlighting aggressive speculation and heightened risk of market squeezes.

- •Institutional demand has faded, creating a sentiment divide with retail traders, potentially leading to further declines.

- •The market remains fragile with limited new buyers, as seen in past similar episodes where Bitcoin typically fell.

Tags

The Bitcoin bounce never came — and now leveraged traders are trapped.

After peaking at just over $126,000 in early October, Bitcoin has dropped 30% — breaking through key thresholds, spooking ETF investors, and rattling holders big and small. One group in particular remains exposed: traders who bet on a rebound — and now find themselves underwater while paying for it.

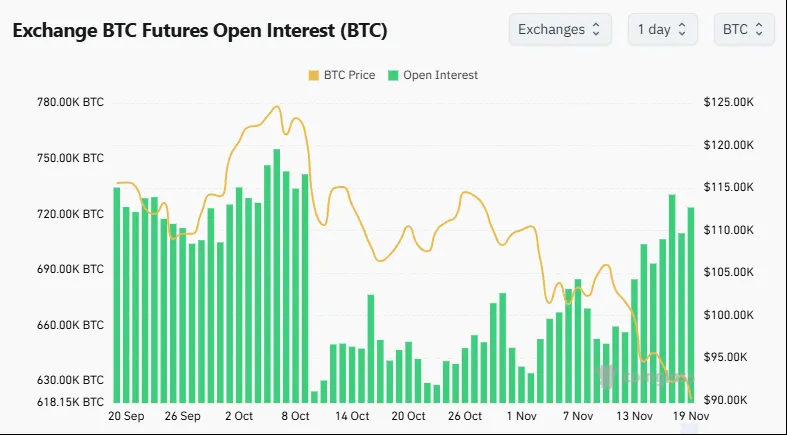

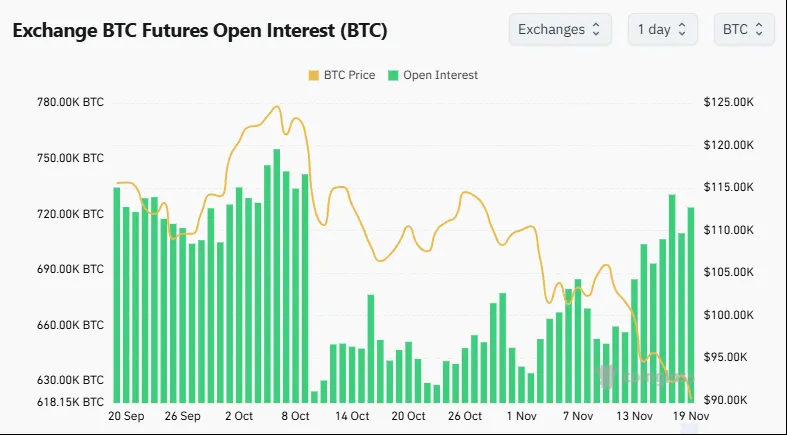

That pressure is building, with the world’s largest cryptocurrency sinking to as low as $88,522 in Wednesday trading in New York. On offshore exchanges like Binance, open interest in Bitcoin perpetual futures — the most popular venue for leveraged speculation — surged by more than 36,000 tokens last week, equivalent to over $3.3 billion. It was the biggest weekly jump since April, according to K33 Research. At the same time, funding rates, which rise when bullish bets dominate, stayed elevated.

That’s notable because in a falling market, funding rates typically turn negative as longs pull back — underscoring how aggressively traders doubled down of late. Together, the metrics point to bottom-fishing bets that threaten to unravel.

“Perp open interest is back at its October peak,” said Vetle Lunde, head of research at K33. “That systematically increases the risk of squeezes ahead.”

It all happened as Bitcoin slid below $98,000. Instead of buying immediately, many traders had placed resting limit orders — instructions to buy automatically if the price dropped to a specific level, in hopes of catching the knife. The idea was to grab Bitcoin at a discount and ride a rebound. But prices kept falling, triggering those orders and creating real, leveraged exposure just as the market turned lower.

This unusual combination — elevated leverage with no follow-through price rebound — has left the market fragile.

The downturn began with a violent liquidation cascade on Oct. 10, when more than $19 billion in derivative positions were wiped out in a single session. Since then, crypto exchange-traded fund flows have reversed, digital-asset treasury firms have pulled back, and institutional demand has faded, with many funds now trading near or below their average entry levels.

The current setup — risk-taking by smaller traders alongside retreating institutional flows — is one K33 has seen before. In seven prior episodes with similar dynamics, Bitcoin declined in six. The average one-month drop: 15%.

Today, the split in sentiment is stark. Activity on the Chicago Mercantile Exchange, a futures market favored by US institutions, remains quiet, with premiums narrow. Meanwhile, offshore exchanges like Binance have seen rising bullish exposure — likely underscoring the divide between retail and institutional outlooks on whether a rebound is near.

“The October 10th liquidation event created a significant liquidity vacuum that the market still hasn’t recovered from,” said Satraj Bambra, CEO of hybrid exchange Rails. “There simply aren’t sufficient new buyers stepping in to absorb supply, and we’re seeing more sellers than buyers across spot and derivatives markets.”

Compared with the October crash, the current level of leverage looks more restrained. Open interest in perpetual futures is outsized but this time round, liquidation volumes have been modest and price declines more orderly. According to Lunde, that suggests traders may be using more conservative bets, at least for now. Still, metrics like open interest and funding rates only capture part of the market’s structure — and they point to pressure, not relief.