BHP’s New Anglo Pitch Puts Copper Growth Plan in Focus

TL;DR

BHP's renewed attempt to acquire Anglo American highlights its focus on copper growth, but Anglo rejected the offer in favor of its planned merger with Teck Resources. BHP's copper pipeline is strong but costly, and future acquisition targets remain uncertain.

Key Takeaways

- •BHP made a new, unsuccessful approach to Anglo American, which was rejected as inferior to Anglo's planned merger with Teck Resources.

- •BHP has long desired Anglo's copper assets in Chile and Peru, but the Teck deal makes them less accessible.

- •Anglo's improved position and investor support for the Teck deal have made a BHP takeover more challenging compared to 18 months ago.

- •BHP faces a drop in copper output and high costs for its growth projects, emphasizing its need for acquisitions.

Tags

Welcome to our guide to the commodities driving the global economy. Today, mining reporter Thomas Biesheuvel takes a look at BHP Group’s new approach for Anglo American, 1 1/2 years after its first proposal.

Until this weekend, BHP Group had put out two very clear messages since it got rejected by Anglo American Plc in early 2024: It had moved on from the deal, and had its own incredible copper growth pipeline.

Yet the Australian miner’s last-minute attempt to hijack Anglo’s looming takeover of Teck Resources Ltd. seems to cast doubt over those positions.

Bloomberg News reported Sunday that Anglo had rebuffed a new approach from BHP, deciding it wasn’t superior to the planned combination with Teck.

BHP subsequently confirmed it had held preliminary discussions with its smaller rival, but had now abandoned the endeavor.

BHP has long coveted Anglo’s copper business, based around three giant mines in Chile and Peru.

Yet ever since Anglo announced its tie-up with Teck, those assets have been rapidly moving out of reach.

BHP’s management — when and if they discuss the latest proposal publicly — will surely argue that they had a duty to make one final tilt at Anglo and present their case for a merger as the best deal for the industry and shareholders.

In the end, though, events moved firmly against the Melbourne-based giant.

Eighteen months ago, when BHP first pitched a takeover, things were much more in its favor. Anglo was in disarray, having slashed production at its flagship copper business, and many in the industry were confidently predicting its demise.

But even then, BHP — constrained by its shareholders and a commitment to deal discipline — never got close to pushing its acquisition over the line.

This time around, Anglo has made progress on a radical restructuring, emboldening its executive team, and — crucially — the Teck deal is broadly popular with investors.

The valuations of BHP and Anglo have also diverged, worsening the deal math. The latter’s outperformance means BHP would’ve had to offer Anglo shareholders about a quarter of the combined company, far more than initially proposed, according to Bloomberg Intelligence.

What next for BHP? The company does have impressive copper growth lined up, but none of that new production will be online in time to offset an expected drop in output — and it’s expensive.

What’s clear is the firm wants to snap up more of the red metal. Time will tell whether Anglo owns the only copper mines it covets.

—Thomas Biesheuvel, Bloomberg News

Chart of the day

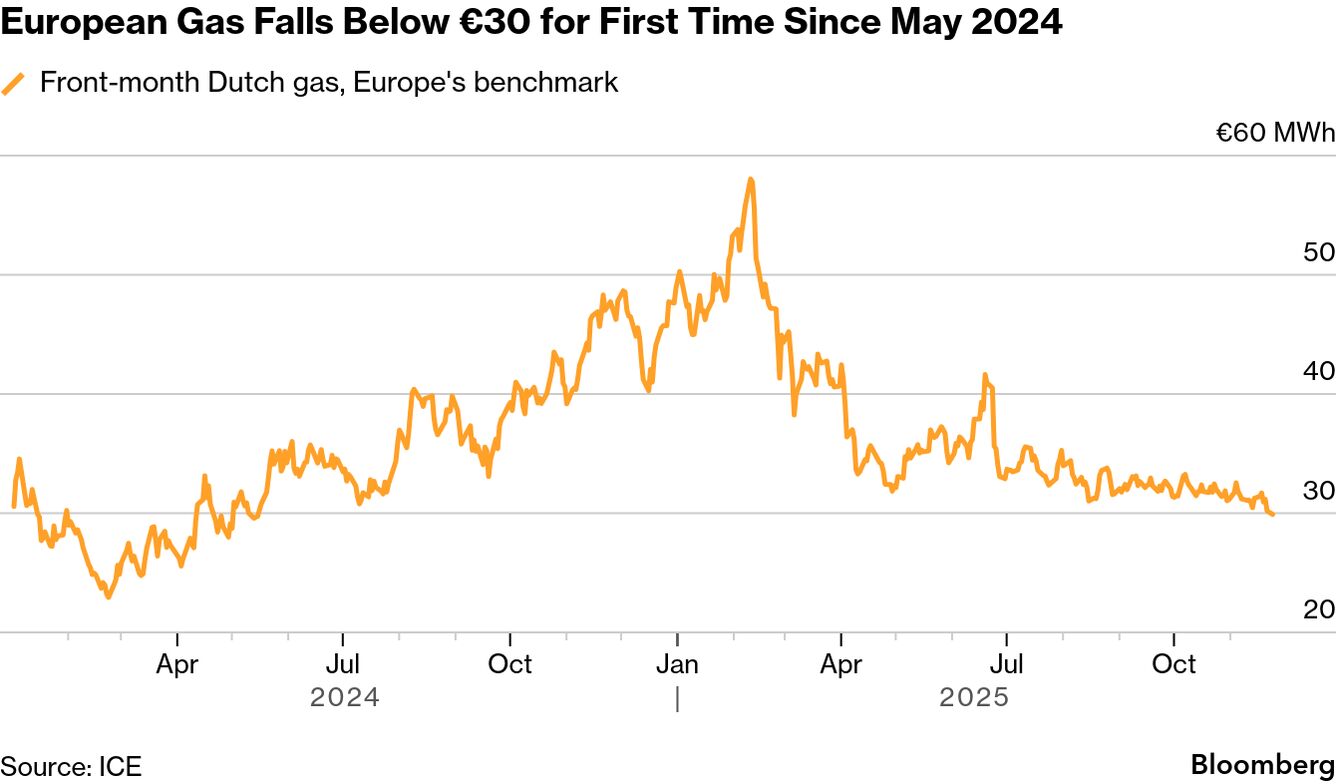

European natural gas fell below €30 a megawatt-hour for the first time in more than a year, weighed down by rising imports and talks to end Russia’s war in Ukraine. The milestone demonstrates the turnaround in prices after initial expectations of a difficult winter. Strong LNG arrivals and steady Norwegian flows have recently eased pressure, and temperatures are now expected to rise above seasonal norms in early December, helping to push prices lower.

Top stories

Saudi Aramco is considering plans to raise billions of dollars by selling a range of assets, people familiar with the matter said, deals that could rank as its most significant disposals ever.

A pricing mechanism underpinning global copper processing faces a major stress test, with negotiations coming to a head at a time when geopolitical tensions are high, metal is limited and China’s dominance has left smelters elsewhere struggling to survive.

The cost of hiring an oil supertanker on a benchmark route spiked to the highest in more than five years as buyers sought alternatives to sanctioned Russian crude amid increased supply from Middle East and US producers.

Almost 200 nations ended fraught climate talks with an agreement Saturday on new efforts to help guide their transition away from fossil fuels. Yet the accord at the United Nations’ summit left many countries unhappy.

Russia’s flagship Urals crude is being offered to India’s refiners at the cheapest price in at least two years after US sanctions on top producers Rosneft PJSC and Lukoil PJSC upended a lucrative trade.

Weekly agenda

Monday: EU-African Union summit, Luanda, Angola (through Nov. 25)

Tuesday: BNEF Summit in Shanghai (through Nov. 26); Equinor Autumn Conference, Oslo; Energy Risk Europe, London; American Petroleum Institute weekly report on US oil inventories; Inpex Corp. investor day

Wednesday: Genscape weekly crude inventory for Europe’s ARA region; Energy Information Administration weekly report on US oil inventories; EIA weekly report on US natural gas inventories; Baker Hughes weekly rig count

Thursday: Singapore onshore oil-product stockpile weekly data; Insights Global weekly oil-product inventories in Europe’s ARA region; Recharge WindPower Summit, Hamburg

Friday: Shanghai exchange weekly commodities inventory; Petroleo Brasileiro SA to unveil 2026-30 business plan; earnings from China Gas Holdings Ltd.

BNEF today

US power sector gas consumption

Note: Based on forecasts as of Nov. 6, 2025. Dotted lines are forecasts, while solid lines are historical data.

US power-sector gas demand is trending below last year’s levels on the back of elevated prices, which have spurred a shift to coal, according to BloombergNEF. In October, the sector’s gas use was down 1.7 billion cubic feet a day, year-on-year, while coal-fired generation rose by a whopping 10.3 gigawatts. Average electricity output was 17.2 gigawatts higher than last year, driven partly by colder weather.

Coming up

Businessweek podcast Everybody’s Business invites Bloomberg.com subscribers to a special live taping hosted by Max Chafkin and Stacey Vanek Smith, with editor Brad Stone and technology reporter Ellen Huet.

Bloomberg Invest: Join the world’s most influential investors and financial leaders in New York on March 3-4 to examine how artificial intelligence, geopolitical uncertainty, shifting central-bank policy and the convergence of public and private markets are reshaping global finance. Learn more here.

More from Bloomberg

- Economics Daily for what the changing landscape means for policymakers, investors and you

- Business of Food for a weekly look at how the world feeds itself in a changing economy and climate, from farming to supply chains to consumer trends

- Green Daily for the latest in climate news, zero-emission tech and green finance

- Hyperdrive for expert insight into the future of cars

- Supply Lines for daily insights into supply chains and global trade

You have exclusive access to other subscriber-only newsletters. Explore all newsletters here to get most out of your Bloomberg subscription.