Reeves Gets Boost From Trio of Economist-Defying UK Data Points

TL;DR

UK Chancellor Rachel Reeves receives unexpected economic boosts with record budget surplus, strong retail sales, and rising PMI, defying earlier recession warnings despite political challenges.

Key Takeaways

- •UK achieved record budget surplus in January with tax revenues soaring and retail sales hitting 20-month high

- •S&P Global PMI rose to 53.9 in February, indicating solid private sector growth momentum

- •Economic data defies warnings about slump from Labour's £26 billion tax hikes, though unemployment remains high

- •Reeves faces political challenges with Labour low in polls and upcoming elections, despite economic improvements

- •Lower gilt yields reduce debt-interest payments, helped by capital gains tax revenue and wage growth

Tags

Rachel Reeves’ future was in the balance this time last year — Britain’s borrowing costs had surged, forcing the Chancellor of the Exchequer to consider more tax hikes or spending cuts. Still, she survived and one year on the UK economy is treating the Labour government to some pleasant surprises.

When Reeves delivers her Spring Statement on March 3 she’ll be able to boast of the biggest budget surplus on record, which landed in January. Tax revenues have soared, according to the Office for National Statistics, which also said Friday that retail sales hit a 20-month high.

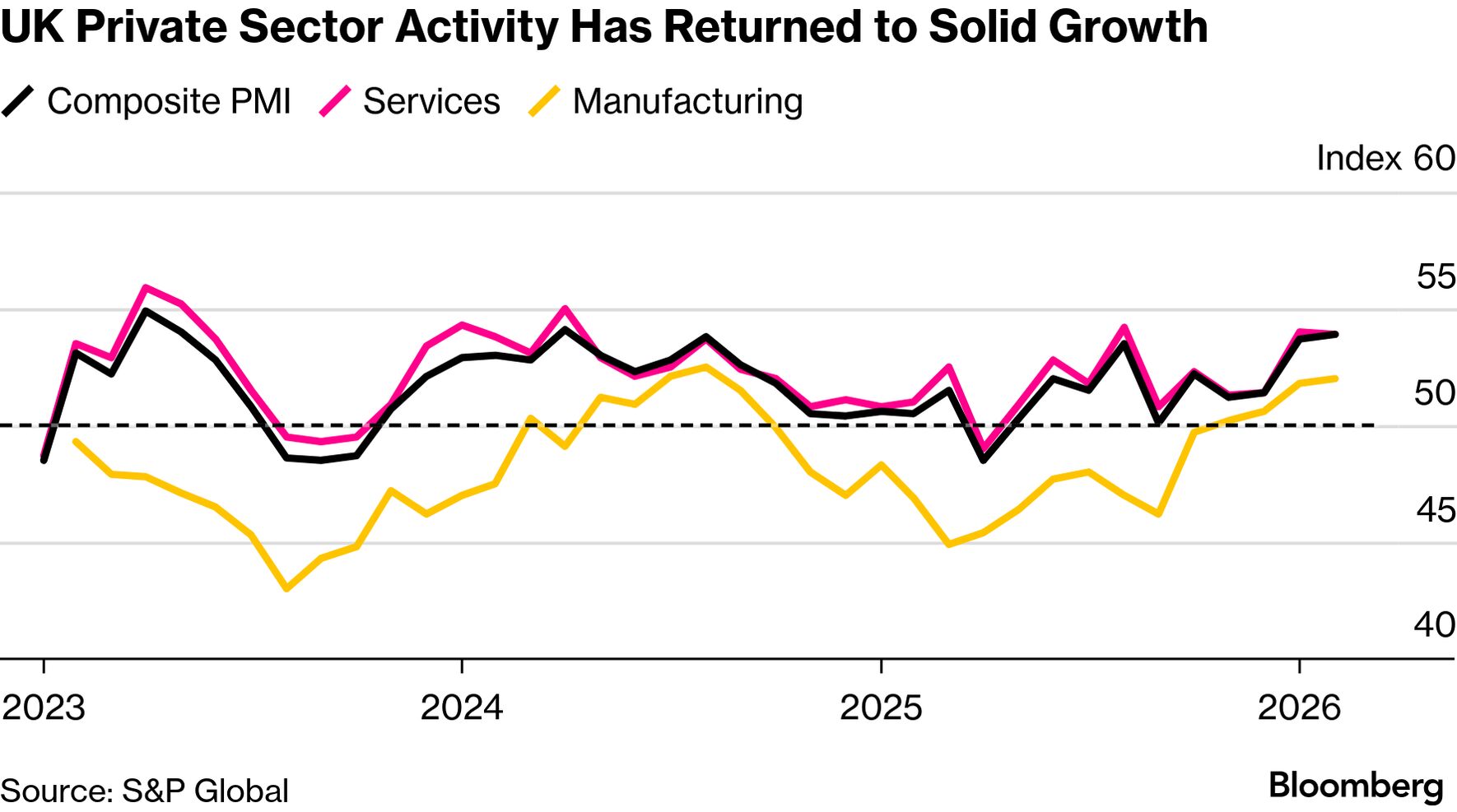

The double-dose of good news was swiftly followed by evidence of the economy maintaining its momentum to the current day. S&P Global’s purchasing managers’ index rose to 53.9 in February’s flash estimate, beating forecasts to hit the highest level since April 2024.

These are the latest of a string of bullish data points since the turn of the year, which have defied warnings of an economic slump triggered by Labour’s £26 billion of extra tax hikes in its November budget. The Bank of England only expects a 0.9% expansion of GDP in 2026, alongside a City consensus of 1.1%, leaving the Chancellor to argue that she will beat economists’ predictions and meet her longstanding pledge to kick-start growth.

To be sure, Reeves’ political career remains on thin ice — but now for political, rather than economic reasons. Labour sits low in the polls and faces the prospect of an embarrassing by-election defeat next week, before an expected drubbing in May’s local elections across the country.

While Prime Minister Keir Starmer saw off a potential revolt this month over his appointment of Peter Mandelson as ambassador to the US — despite his links to deceased sex criminal Jeffrey Epstein — the prospect of a leadership challenge lingers.

Read more: Starmer Is Helming an Economic Revival He May Not Get to Enjoy

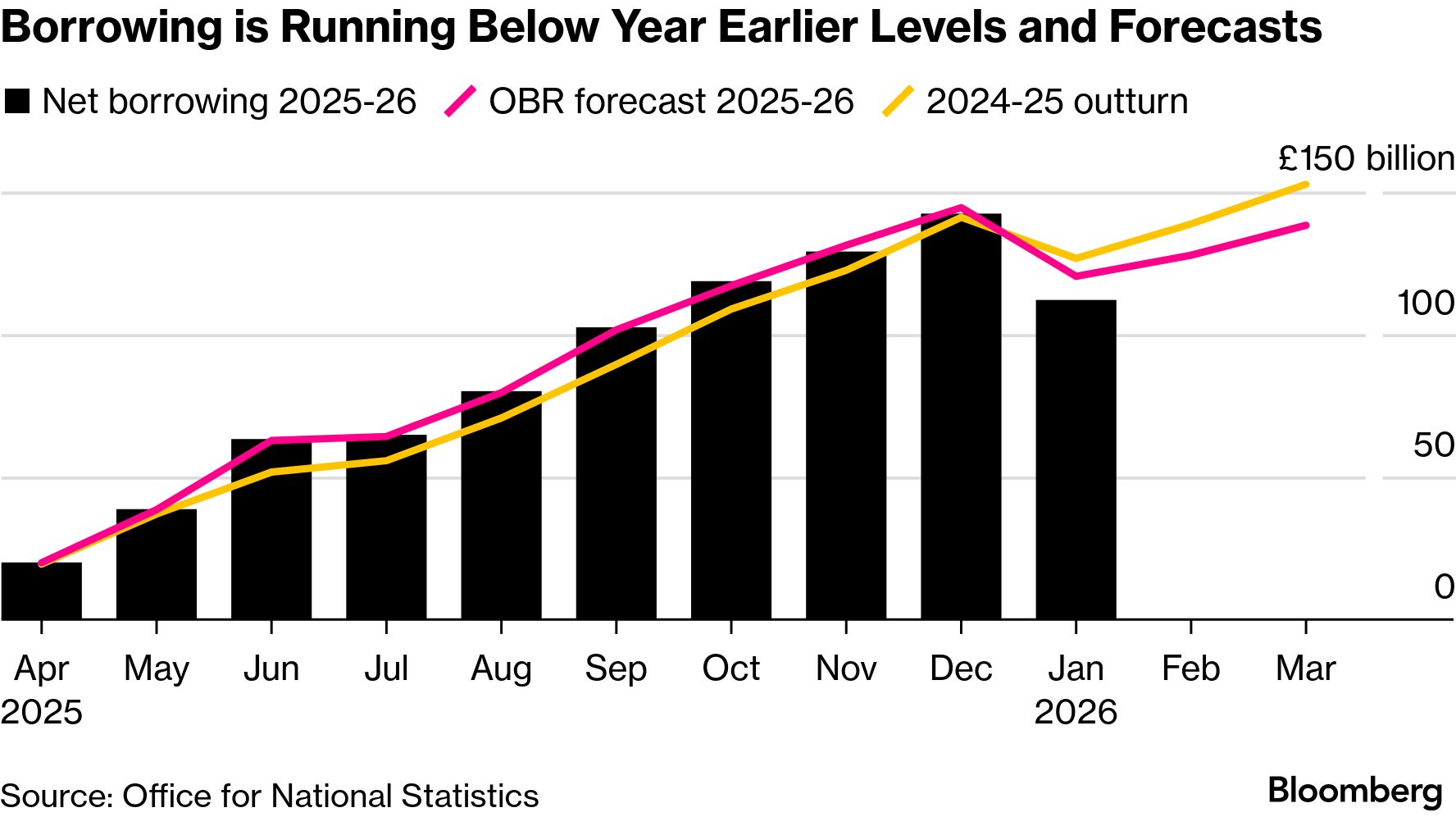

A new PM would likely want to install a new chancellor, yet Reeves could reasonably argue her case. Government revenues exceeded spending by £30.4 billion ($41 billion) in January — £15.9 billion more than the gap a year earlier, and higher than the £24 billion forecast by the Office for Budget Responsibility.

The numbers helped gilt yields lower. The 10-year bond is trading around 4.349%, roughly 26 basis points down on a year ago, helping to reduce debt-interest payments.

A one-time boon from capital gains tax — triggered by a tax hike in Reeves’ first budget — contributed to the lower deficit, yet underlying revenue was also strong, helped by persistent wage growth.

The spread of optimism since Reeves’ Nov. 26 budget was largely unpredicted. In total, Labour has hiked taxes by almost £60 billion since coming to office in 2024, and unemployment is now at a five-year high and forecast to rise further.

Capital Economics commented Friday that this will likely keep a lid on UK growth for 2026, and in recent years the UK has had a habit of losing steam during the second half. For now, at least Reeves will bank Friday’s exceptionally positive data and hope for more pleasant surprises to come.