Stocks Gain as Bitcoin Rebounds; Boeing Soars on FCF Forecast

TL;DR

US stocks gained modestly as Bitcoin stabilized near $90,000, with Boeing surging on a positive cash flow forecast. Investors are eyeing economic data and Fed signals while US equities underperform globally.

Key Takeaways

- •US stocks advanced slightly (S&P 500 +0.2%, Nasdaq 100 +0.6%) despite erasing earlier gains, with tech and industrials leading.

- •Bitcoin steadied after a 5% drop, but US equities are having one of their weakest years versus international peers.

- •Boeing shares jumped 9.2% on a positive free cash flow forecast, while MongoDB surged 23% on strong results.

- •Investors are focused on upcoming economic releases and Fed signals, with dovish expectations providing short-term support.

- •US equity short sellers suffered significant losses in late November, and mid-cap stocks outperformed in November.

Tags

US equities climbed Tuesday alongside a sharp rally in cyptocurrencies as risk sentiment improved and traders bet on the potential for a more dovish pivot by the Federal Reserve.

The S&P 500 Index closed 0.3% higher, led by the industrials and information technology sectors. Boeing Co. saw the biggest gains in the index as the planemaker’s stock jumped 10%, the most since April, after signaling it would generate positive free cash flow next year.

The blue-chip Dow Jones Industrial Average rose 0.4%, while the tech-heavy Nasdaq 100 ended the day 0.8% higher.

The market rally comes amid a rebound in investors’ risk appetite. Bitcoin rose after a tumble on Monday, which triggered nearly $1 billion in liquidations of leveraged crypto bets. Retail traders who piled into ETFs tied to Strategy’s volatile stock have taken sharp losses recently.

With the final month of a turbulent year underway, US equities remain on course for one of their weakest showings versus international peers since the post-crisis period. Investors are now turning to a series of economic releases due later this week, with the Fed entering the quiet period ahead of its next meeting.

“After such a strong September and October, seasonally weaker months, there may not be as much left for the year-end as usually occurs,” said Louis Navellier, chief investment officer at Navellier & Associates, referring to the potential of a year-end rally.

Traders are also bracing for next week’s Fed decision on interest rates as well as positioning for the potential for a dovish policy pivot under a new chair. “Markets are looking for dovish signals via strong demand for short-duration Treasuries and fresh support for a December Fed rate cut,” wrote Tom Essaye, president of the Sevens Report, referring to a six-week bill auction that was scheduled for Tuesday.

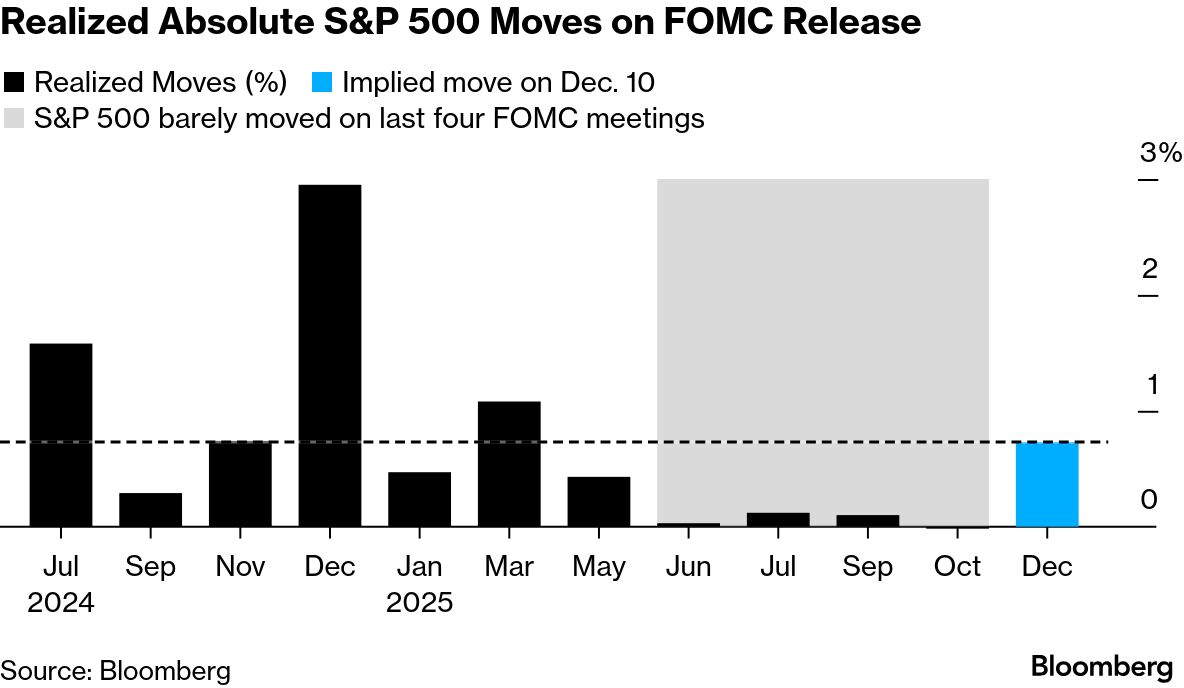

Strategists at Barclays noted that implied moves in the S&P 500 ahead of Fed decisions have been shrinking since early 2023, with actual price swings close to negligible — indicating, they argue, that monetary policy is exerting less sway over markets.

And, while dovish Fed expectations provide a short-term tailwind, their intermediate-term breadth indicators remain in “sell” territory, according to Piper Sandler’s Craig Johnson. With most micro groups and individual stocks still in defined downtrends, Johnson expects more “backing and filling” as major indexes attempt to establish new highs.

The US this year ranks near the bottom of the 14 largest equity markets around the world, in both local and dollar terms, Bloomberg Intelligence’s Gillian Wolff and Izabella Wieckowska highlighted. The underperformance raises the question of whether the AI trade can continue to drive leadership or whether volatility tied to early-stage tech is acting as a drag.

But, according to 22V Research, investors looking to bet against US stocks this month should consider the strength of the American economy and ongoing enthusiasm around AI. US equity short sellers were down $80 billion in mark-to-market losses, or roughly 4.8% in the final week of November, wiping out the bulk of what had been nearly $95 billion in month-to-date profits prior to last week, per data compiled by S3 Partners LLC.

Mid-cap stocks outperformed all other size classes in November, with the group’s tech shares falling less than their small-cap peers and a wider breadth of sector outperformers, BI’s Michael Casper wrote.

Meanwhile, early holiday spending offered a mixed read on the consumer. Promotions were widely described as underwhelming, yet traffic and spend held up, with shoppers targeting teens, essentials and strong brand franchises pulling in the most dollars. That mix fits the “anxious but still active” consumer backdrop that has been building all year.