Dutch Tilt Bond Sales Toward Shorter Debt Amid Pension Shift

TL;DR

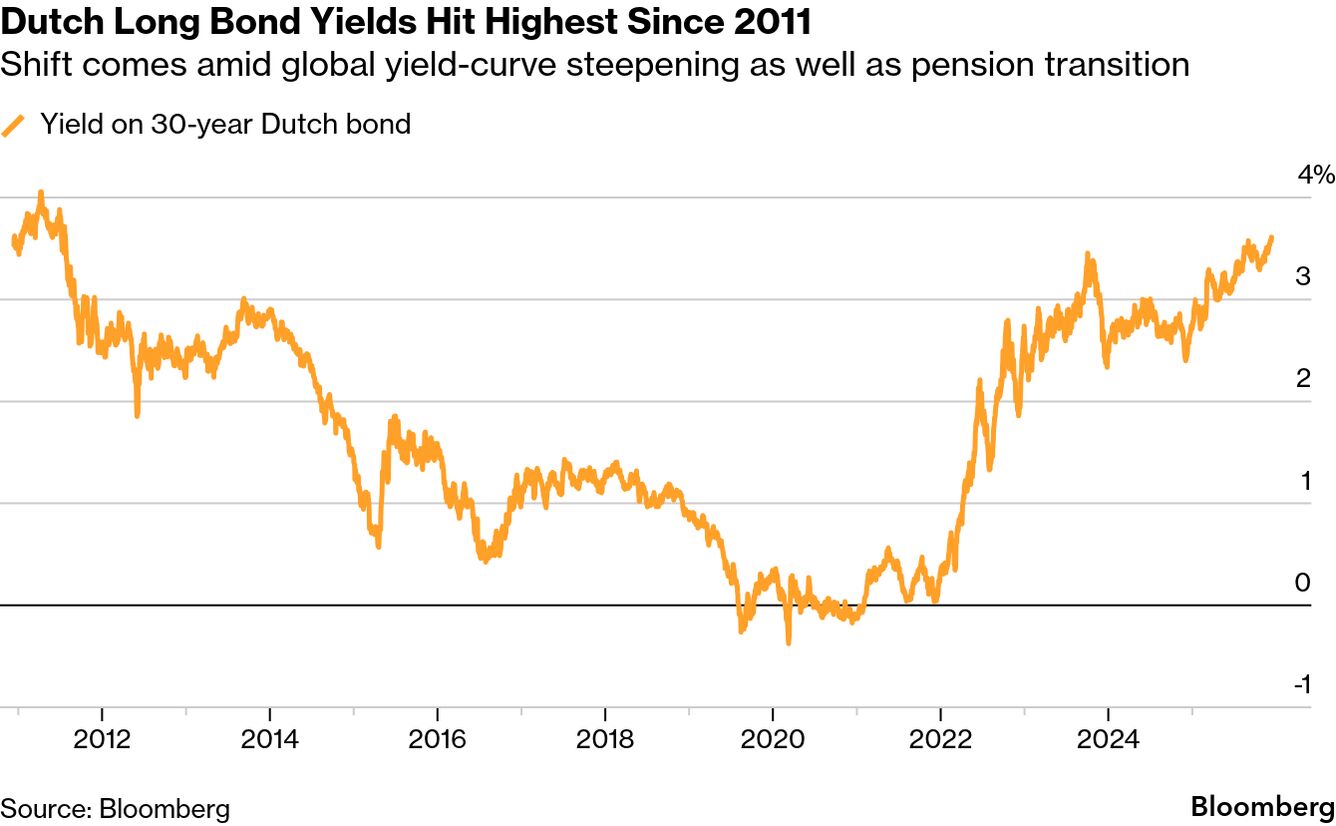

The Dutch government is shifting its bond issuance toward shorter maturities due to reduced demand for long-term debt from pension funds undergoing reform. This has contributed to steepening yield curves, with the Netherlands' 30-year yield reaching its highest since 2011.

Key Takeaways

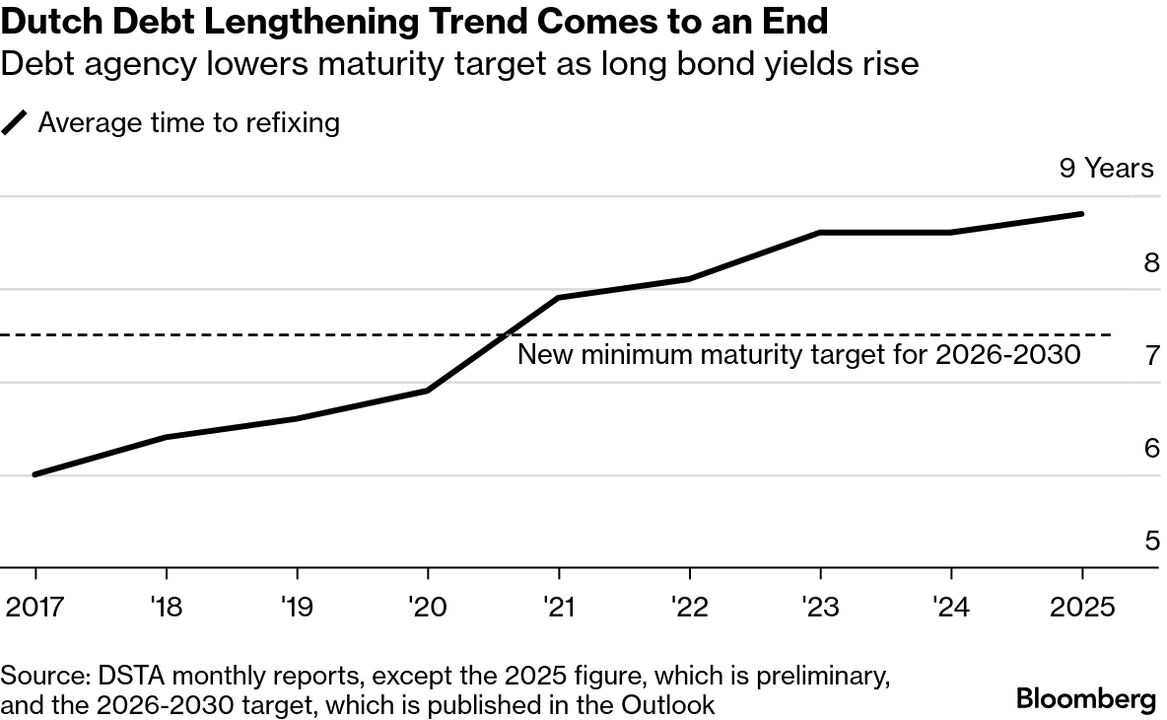

- •The Netherlands is reducing its debt maturity target to a minimum of 7.5 years from 8 years, reversing a decade-long trend of lengthening maturities.

- •Pension fund reforms are expected to weaken demand for ultra-long bonds as funds no longer need them to match long-term liabilities.

- •Dutch 30-year bond yields have reached their highest level since 2011, with the yield curve steepening more than in Germany.

- •The government plans gradual adjustments to its borrowing strategy while increasing total bond issuance to €50 billion next year.

- •Market impact remains uncertain, but officials anticipate mild effects over time rather than sudden disruptions.

Tags

The Dutch government is tilting its borrowing toward shorter-term bonds in response to shifts in market demand and the expectation that an overhaul of the nation’s €1.7 trillion ($2 trillion) pension industry will further weaken buying of long-term securities.

The Netherlands reduced the target for the average maturity of its debt to a minimum of seven-and-a-half years, down from eight previously. That’s a “slight but clear structural shift” from the increases in maturities seen over the past decade, the nation’s treasury agency (DSTA) says.

Debt agency lowers maturity target as long bond yields rise

The new strategy comes ahead of Dutch pension funds moving to a new model which is expected to reduce their demand for ultra-long bonds. That’s because they will no longer need such assets to match against liabilities going out decades into the future. Most transitions are set to start from next month.

Read more: Dutch Pension Overhaul to Fuel Pivot From Long Bonds in EU

The pension system is an outsized player in Europe, and its buying of long-dated assets has been been a boon to governments who can sell these bonds to lock in financing costs for decades. The Netherlands, for example, extended its average maturity from less than four in 2012.

While the Dutch funds buy from all over Europe, their preference for domestic debt makes the upcoming change especially pertinent at home. They hold almost a fifth of the nation’s bonds and are “particularly present” at the long end, according to the DSTA.

Yield Curve

Investors have anticipated the shift, and yield curves have steepened across Europe, meaning long-term rates are rising relative to shorter ones.

Shift comes amid global yield-curve steepening as well as pension transition

But the move in the Netherlands stands out. Its 30-year yield reached the highest since 2011 on Friday. The premium investors demand to hold that debt relative to five-year notes has risen more than 60 basis points this year, compared with about 55 points for German bonds.

“It’s logical that part of this steepening is caused by the pension system,” Saskia van Dun, head of the Dutch State Treasury Agency, said in an interview with Bloomberg. “It’s logical for us to shorten, but we won’t do that at once. We will take a gradual process.”

Read more: Dutch Pension Changes Will Ripple Through Swap Market: QuickTake

Van Dun said the market impact from the transition remains uncertain. The DSTA saw no drop in demand for long bonds from funds in sales this year.

She also noted “mitigating factors,” with much of the portfolio shift expected to impact long-dated interest-rate swaps rather than bonds. The funds will still prefer bonds for older members, too.

“People can say a lot about it, but you just don’t know,” she said. “There will be an effect, but we think it will be mild and over time.”

Multiple countries, including the UK and Japan, are also grappling with waning demand that has steepened yield curves. Austria’s Treasury said last week it was maintaining its target maturity band for its debt, but has “room to go lower” within that range if needed.

Read more: Bond Investors Are Driving Governments Into Short-Term Debt

“The curve has steepened significantly in recent years, making long-term issues relatively expensive,” said Jaap Teerhuis, a senior rates strategist at ABN AMRO Bank NV and a former official at the Dutch treasury. “Although the reduction in the minimum maturity is relatively small, it does give the DSTA more flexibility.”

The Netherlands needs to finance an estimated borrowing requirement of €112 billion for the coming year, according to the plans published Friday. Bond issuance plans are set to increase to €50 billion from €40 billion this year.

| Borrowing requirement | 2025 Estimate (€ billion) | 2026 Estimate |

| Capital market redemptions | 19.9 | 28.8 |

| Net money market ultimo (excluding cash collateral) | 37.5 | 42.2 |

| Cash deficit | 29.7 | 41 |

| Total borrowing requirement | 87.1 | 112 |

| Source: DSTA |

“We just need more money,” van Dun said. “But we always want to make a good balance between the call on the capital markets and the call on the money markets.”

The DSTA will also review sales of green bonds, which are linked to government spending on environmentally-friendly projects. That’s after Denmark became the first country to adopt the European Union’s new standard for such debt, which is stricter than the industry guidelines most issuers voluntarily abide to.

Separately, Banco Santander SA was announced as a new market maker, which van Dun said would expand the geographic reach of its investment network.

Non-bank market-maker Citadel Securities LLC has made inroads into the European government bond space, traditionally a role reserved for banks. It gained primary dealer accreditation in Germany and is preparing to launch in France. The Netherlands said it could do similar in time, but not right now.