Bitcoin ETF Investors in the Red After $89,600 Level Breaks

TL;DR

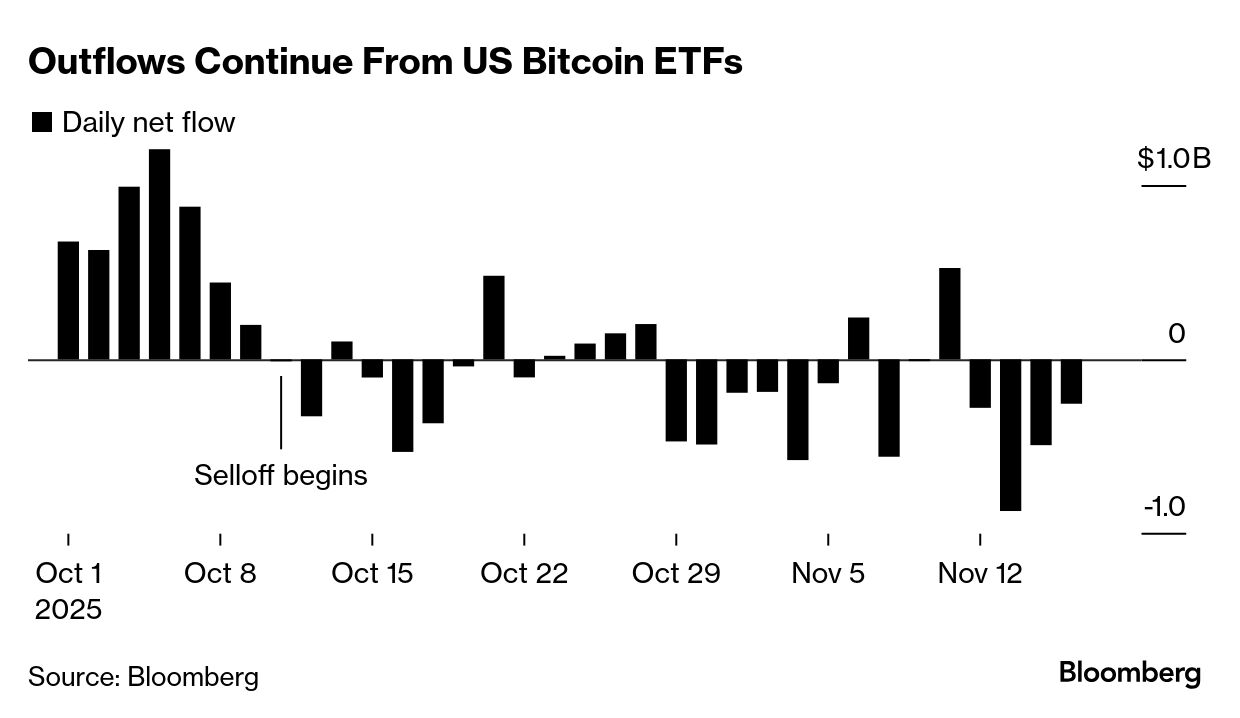

Bitcoin ETF investors are now facing losses as Bitcoin's price drops below the average cost basis of $89,600. This decline, over 30% from recent highs, tests investor resolve amid ongoing ETF outflows.

Tags

The Bitcoin rally that welcomed a wave of new investors through easy-to-access ETFs has officially gone underwater.

Investors in US exchange-traded funds that offer direct access to the cryptocurrency are now sitting on collective losses. The average cost basis across all ETF inflows sits at approximately $89,600, according to Sean Rose at Glassnode — a level Bitcoin breached on Tuesday.

That figure reflects the flow-weighted average price of all ETF inflows since launch. When Bitcoin trades below that line, the cohort is in the red.

The good news: a slew of purchases made when the coin was between $40,000 to $70,000 are still in profit, per Rose.

The milestone underscores how fast optimism has faded in crypto markets. After surging to records in early October, Bitcoin has now dropped more than 30%, fueled by risk-averse traders and longer-term holders cashing out.

Though cryptocurrencies are famously volatile, the decline has caught Wall Street off guard, given the influx of institutional cash that flooded the industry since Donald Trump’s presidential victory.

The breach marks a test of mettle for both retail and institutional investors, many of whom rode crypto’s momentum over the past year on the promise of fresh gains ahead. The ETF wrapper has a been hailed as a safer, regulated entry point into digital assets, but the recent drop is a reminder that crypto’s notorious volatility hasn’t vanished just because Wall Street showed up.

Billions of dollars have flooded Bitcoin-focused ETFs this year, with the lineup proving so popular that issuers have launched products beyond funds focused on the largest token and its brethren, Ether. More than 110 crypto-minded ETFs currently trade in the US, according to data compiled by Bloomberg.

The group of 12 ETFs dedicated to Bitcoin have seen net outflows of about $2.8 billion so far in November.