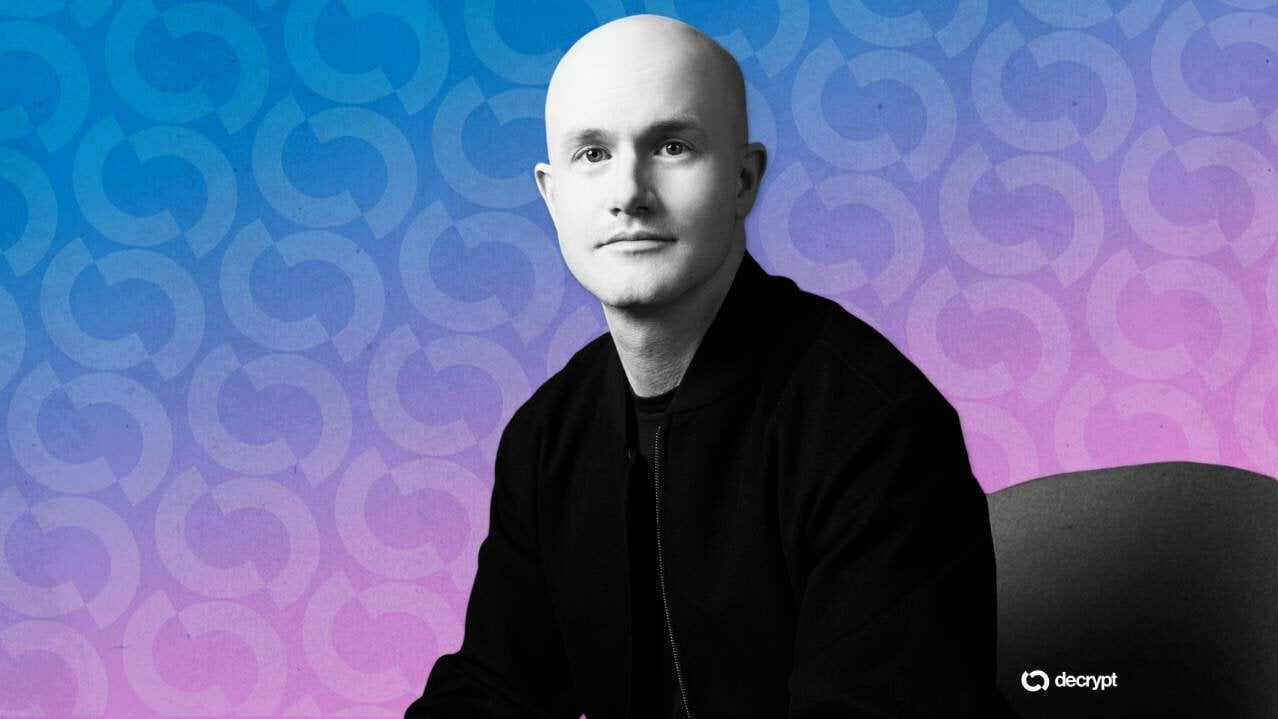

Coinbase CEO Says Quantum Computing 'Solvable Issue' for Crypto

TL;DR

Coinbase CEO Brian Armstrong says quantum computing is a 'solvable issue' for crypto, not a blockchain-breaking threat. The company has formed a quantum advisory council and is working with major networks to upgrade to post-quantum cryptography.

Key Takeaways

- •Coinbase CEO Brian Armstrong dismisses quantum computing as a blockchain-breaking threat, calling it a 'very solvable issue'.

- •Coinbase has established a quantum advisory council and is collaborating with major blockchain networks to prepare for post-quantum cryptography upgrades.

- •Industry-wide preparations are underway, with Ethereum Foundation prioritizing post-quantum security and Solana testing quantum-resistant signatures.

- •Experts believe there is sufficient time to upgrade encryption standards across Bitcoin, Ethereum, and other chains before quantum computers become a practical threat.

- •Armstrong also discussed Coinbase's opposition to the CLARITY Act, citing concerns about stablecoin rewards, but expressed confidence in reaching a legislative compromise.

Tags

Quantum computing will not “break the blockchain,” Coinbase CEO Brian Armstrong said Wednesday, calling the concern “a very solvable issue” and pointing to ongoing work with major networks to prepare for future advances.

Armstrong spoke to CNBC at the World Liberty Forum in Mar-a-Lago alongside Sen. Bernie Moreno (R-Ohio), when interviewer Sara Eisen asked, “One thing I’ve heard is that quantum is going to break the blockchain. Is that true?”

“No, that’s not true,” Armstrong replied. “I think that’s a very solvable issue.”

He said Coinbase has been “very front-footed on this,” noting the company has put together a quantum advisory council and is “in regular contact with the major blockchains about a path to upgrade to a post-quantum cryptography world.”

“We’re going to stay engaged on that, and I think it’s very solvable,” he added.

Quantum computing and crypto

The comments come as quantum computing shifts from a distant theoretical risk to a long-term engineering consideration for blockchain developers.

While current quantum machines are far from capable of breaking widely used public-key cryptography, researchers have warned that transitioning global financial systems and decentralized networks to new standards could take years.

Last month, Coinbase formalized its efforts by convening an independent advisory board that includes University of Texas professor Scott Aaronson, Stanford cryptographer Dan Boneh, Ethereum Foundation researcher Justin Drake, and Coinbase Head of Cryptography Yehuda Lindell.

The group is expected to publish research assessing quantum-related risks and outline migration strategies.

“Quantum computing’s main risk for Bitcoin is breaking the private keys of the SHA-256 encryption,” Pranav Agarwal, independent director at Jetking Infotrain India, the country’s first listed Bitcoin treasury company, told Decrypt.

“However, when a fast and large enough quantum model is close to readiness is still a matter of debate, and it is much easier to upgrade the encryption,” he added.

Agarwal noted that while some observers may believe the window is closing, the industry itself sees sufficient runway to strengthen cryptography across major networks.

“There is enough time” to upgrade encryption standards, he said, not only for Bitcoin or Ethereum, but for other chains as well.

Across the industry, preparation has strengthened as last month the Ethereum Foundation elevated post-quantum security to a top strategic priority.

Ethereum co-founder Vitalik Buterin has urged developers not to delay adopting quantum-resistant cryptography, arguing the network should aim to be secure for decades without relying on emergency upgrades.

In December, the Solana Foundation said it had begun testing quantum-resistant digital signatures on a testnet, while Bitcoin developers have advanced proposals such as BIP 360, aimed at reducing quantum-exposed key paths.

Coinbase and the CLARITY Act

In the interview, Armstrong also discussed ongoing negotiations on U.S. market-structure legislation, stablecoin reward debates, and prediction markets, while backing the Commodity Futures Trading Commission’s authority over event contracts.

The Coinbase CEO addressed the exchange’s decision to oppose the previous draft of the market structure bill, referred to as the CLARITY Act, saying the company had “some issues with it,” particularly around the treatment of stablecoin rewards.

He pushed back on claims that Coinbase “blocked” the legislation, saying instead that its concerns brought lawmakers “back to the table,” and expressed confidence that a compromise could still move forward, potentially reaching the President’s desk in the coming months.