Citadel Heads for Lowest Gain Since 2018 as Gas Profits Fall

TL;DR

Citadel is heading for its lowest annual gain since 2018, with a 9.3% return through mid-December, as natural gas profits decline. Despite this, it remains profitable across multiple strategies and marks its 17th straight year of positive returns.

Key Takeaways

- •Citadel's flagship fund gained 9.3% through Dec. 18, on track for its worst annual return since 2018, largely due to fizzled natural gas wagers.

- •The firm has historically relied heavily on commodities trading, which contributed about half of its profits in 2022 and a third in recent years.

- •Citadel is expanding its physical operations, including deals in the Haynesville shale basin and acquisitions like FlexPower, to capitalize on future energy market opportunities.

- •Volatility in natural gas markets has subsided, with prices down about 40% this year due to mild weather and ample supplies, impacting energy trading across the industry.

Tags

Ken Griffin’s Citadel is on track for its worst annual return since 2018 after wagers on natural gas — previously a major driver of the hedge fund’s profits — fizzled.

The flagship fund gained 9.3% through Dec. 18, according to a person familiar with the results. It made money in stocks, fixed income, credit and quantitative strategies, and even eked out a profit from commodities, including natural gas, after clawing back from losses earlier in the year. A representative for Citadel declined to comment.

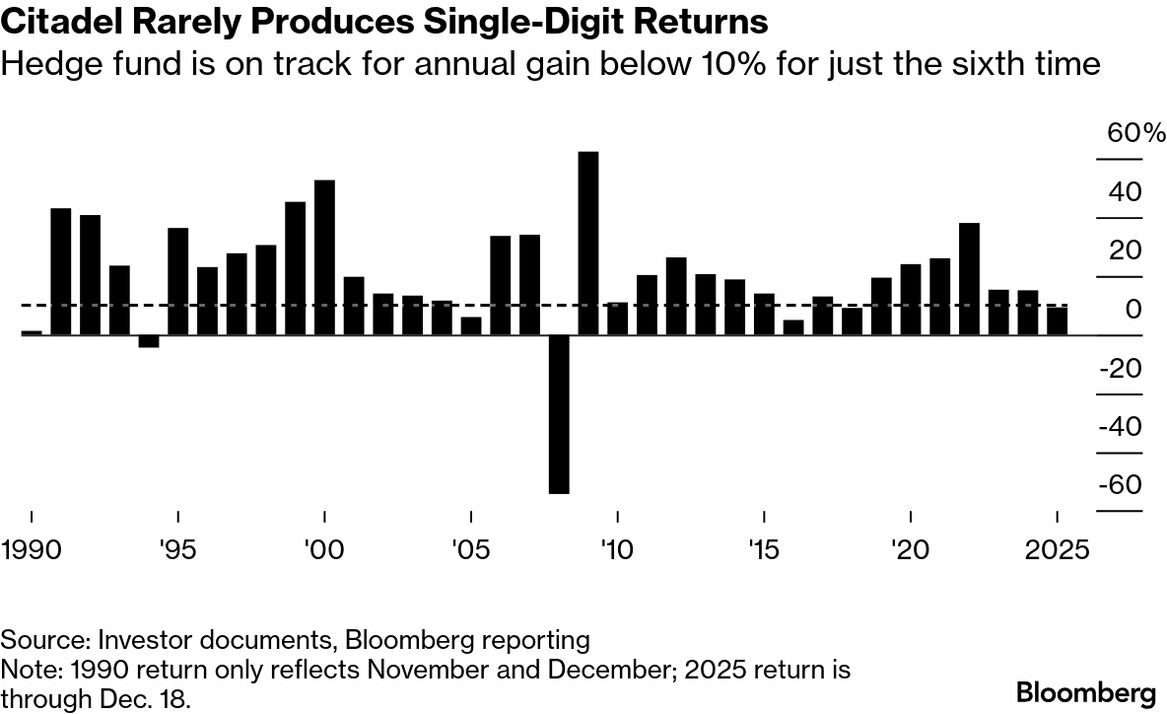

Even so, with less than two weeks of trading left, this year could end up being just the sixth since Citadel’s 1990 inception that returned less than 10%, underscoring how much the firm has depended on commodities trading to supercharge returns in recent years.

With $72 billion of assets, Citadel has grown into a behemoth in commodities markets since Sebastian Barrack joined to lead the business in 2017. Natural gas quickly became a big contributor to the firm’s success, with Citadel among the first hedge funds to build a merchant trading arm involved in transporting and storing the fossil fuel in North America.

It’s a stark change for a firm that made $8 billion — about half of its profits — in commodities in 2022, after Russia’s invasion of Ukraine triggered a global energy crisis and record volatility, especially in natural gas. Citadel earned about $4 billion from commodities in each of the following two years. That represented about a third of its total gross gains in those years, according to a person familiar with the matter.

Still, a 9.3% gain would be the firm’s 17th straight year of positive returns, a track record that has allowed Citadel to amass billions more from investors and attract some of the industry’s top talent.

Hedge fund is on track for annual gain below 10% for just the sixth time

Note: 1990 return only reflects November and December; 2025 return is through Dec. 18.

Citadel isn’t alone in hitting an energy-trading rough patch. Big oil companies, merchant traders and other hedge funds have all struggled to profit as erratic swings triggered by geopolitical turmoil and President Donald Trump’s tariffs made it tougher to put on trades and stick with them.

Almost all of Citadel’s multistrategy peers struggled to notch big gains in energy this year, according to people familiar with the matter. Yet these funds hadn’t built up their energy trading apparatus as much as Griffin, so the underperformance didn’t weigh as much on returns.

Citadel has been bulking up its physical operations to help give it another source of revenue and an information edge. In the US, the hedge fund made a flurry of deals this year that give it access to natural gas production in the key Haynesville shale basin. That region is seen as vital to taking advantage of an anticipated boom in liquefied natural gas exports and demand, given the growing power needs of artificial-intelligence data centers.

Griffin’s firm is also positioning itself to capitalize on volatility in power markets. Earlier this year, it agreed to buy German power-trading company FlexPower, which helps customers — including renewable-energy producers and battery operators — hedge the risk from price swings.

Other big shops such as Jane Street Group and Qube Research & Technologies have followed Citadel’s move and are also looking to expand in physical natural gas trading.

Volatility in European natural gas markets has largely subsided after surging in 2022 and is now back to pre-crisis levels. Gas prices have also plummeted and are down about 40% this year, helped by mild temperatures, ample supplies and renewed US efforts to broker peace in Ukraine.