Goldman Recommends Investors Ditch Debt of Apollo’s Wagamama

TL;DR

Goldman Sachs advises clients to sell Wagamama bonds after a recent price rally, citing high cash prices and worsening fundamentals. A potential price drop may occur in May with Apollo-backed Wagamama's Q4 2025 earnings report.

Tags

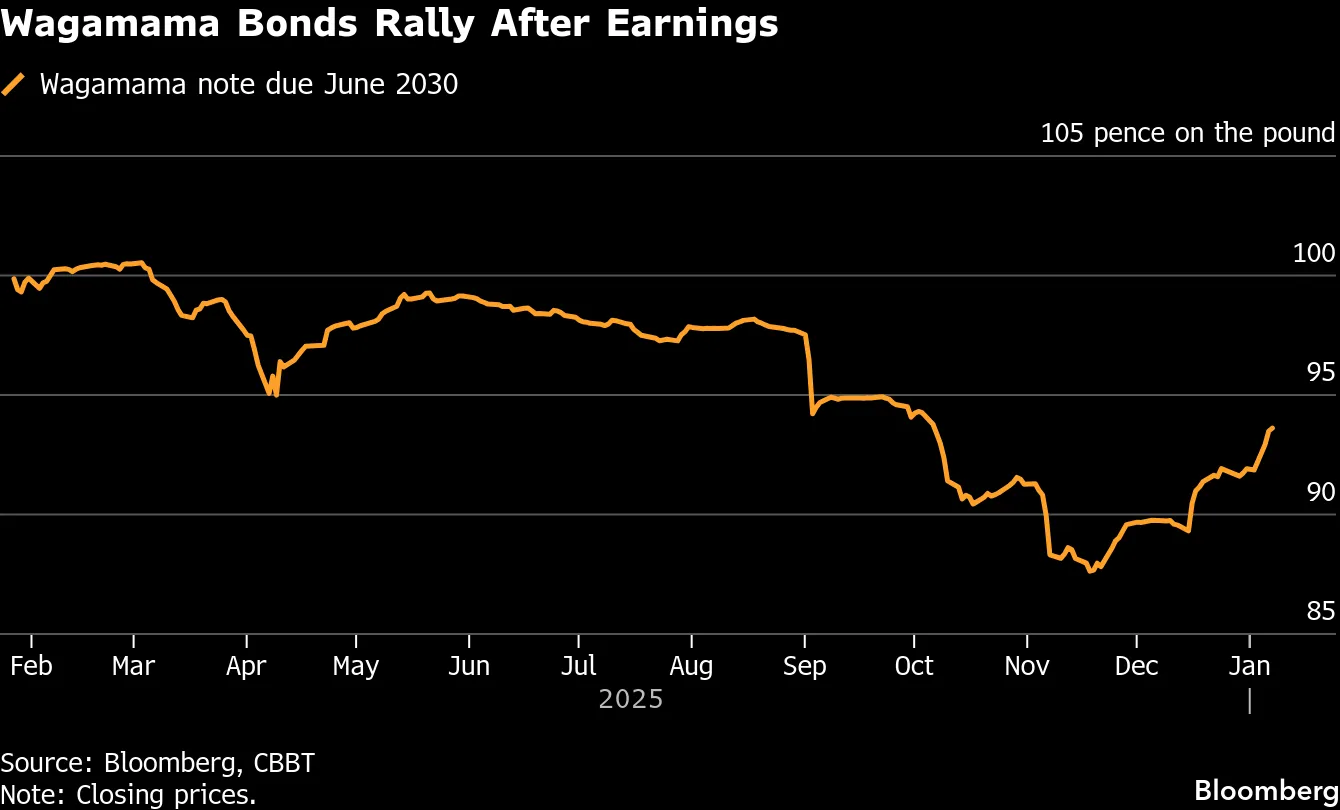

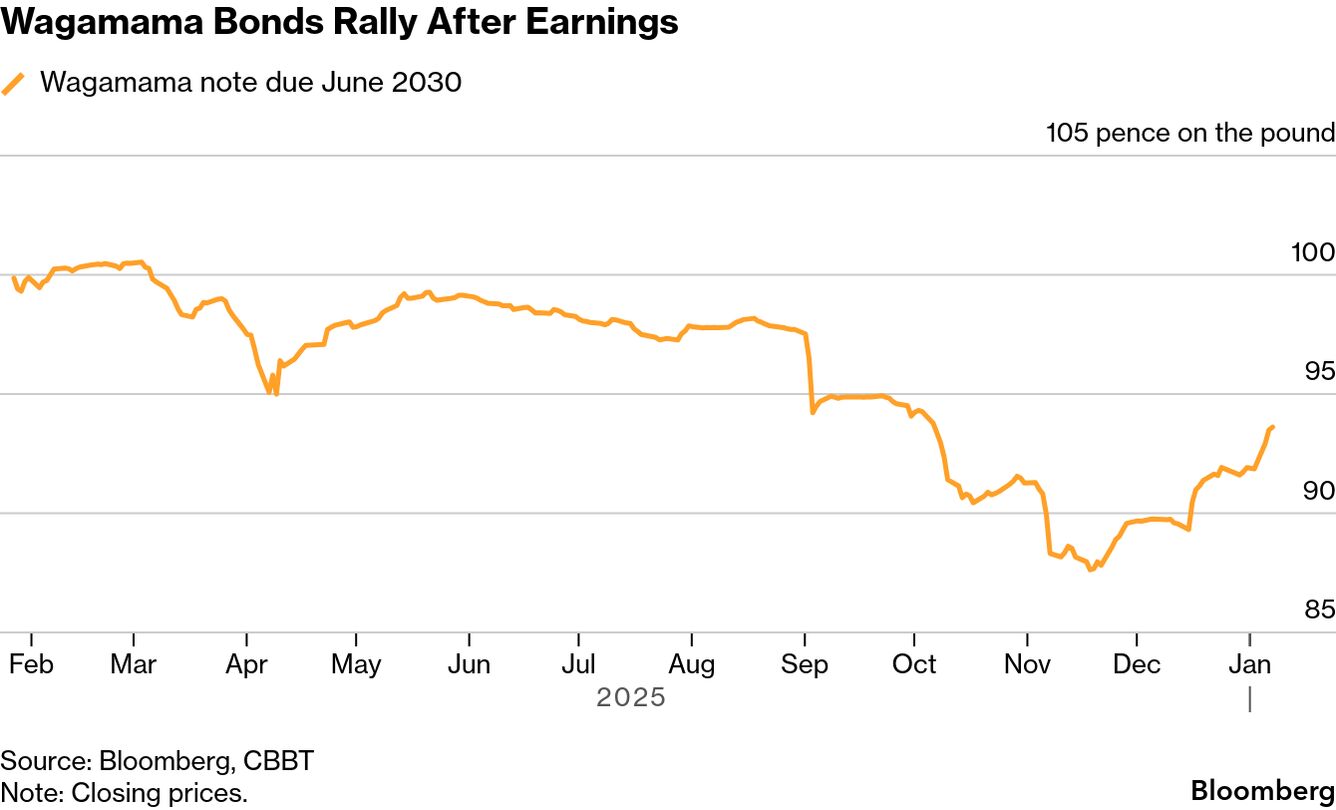

Goldman Sachs Group Inc.’s credit traders are recommending their clients exit positions in bonds issued by UK restaurant chain Wagamama Holdings Ltd following a recent rally in the price of the debt.

The US bank’s trading and sales team said investors should sell out of positions in Wagamama’s bonds on what it sees as a relatively high cash price and worsening fundamentals, according to a note sent to clients this week and seen by Bloomberg News.

The catalyst for a move lower in the bond prices could come in May, when the Apollo Global Management-backed company is expected to present its earnings for the final quarter of 2025, the note said.

Wagamama, Apollo and Goldman Sachs declined to comment.

Wagamama’s £330 million ($446 million) notes have gained more than 4 pence on the pound since the company reported its results for the first three months of 2025 in mid-December. They currently trade at around 93.6 cents, according to data compiled by Bloomberg.

Note: Closing prices.

UK high street businesses came under pressure last year, hit by a rise in the minimum wage, higher employer insurance contributions and weaker consumer sentiment. However, Wagamama, which serves pan-Asian food in the UK and internationally, posted volume growth and broadly stable revenues in its December earnings.