Bitcoin’s BOJ Stumble Shows Dovish Fed Isn’t Enough for Crypto

TL;DR

Bitcoin's recent drop highlights its growing sensitivity to global central bank policies, not just the Fed. The Bank of Japan's hawkish signals triggered the decline, showing crypto markets now react to a broader macroeconomic landscape.

Tags

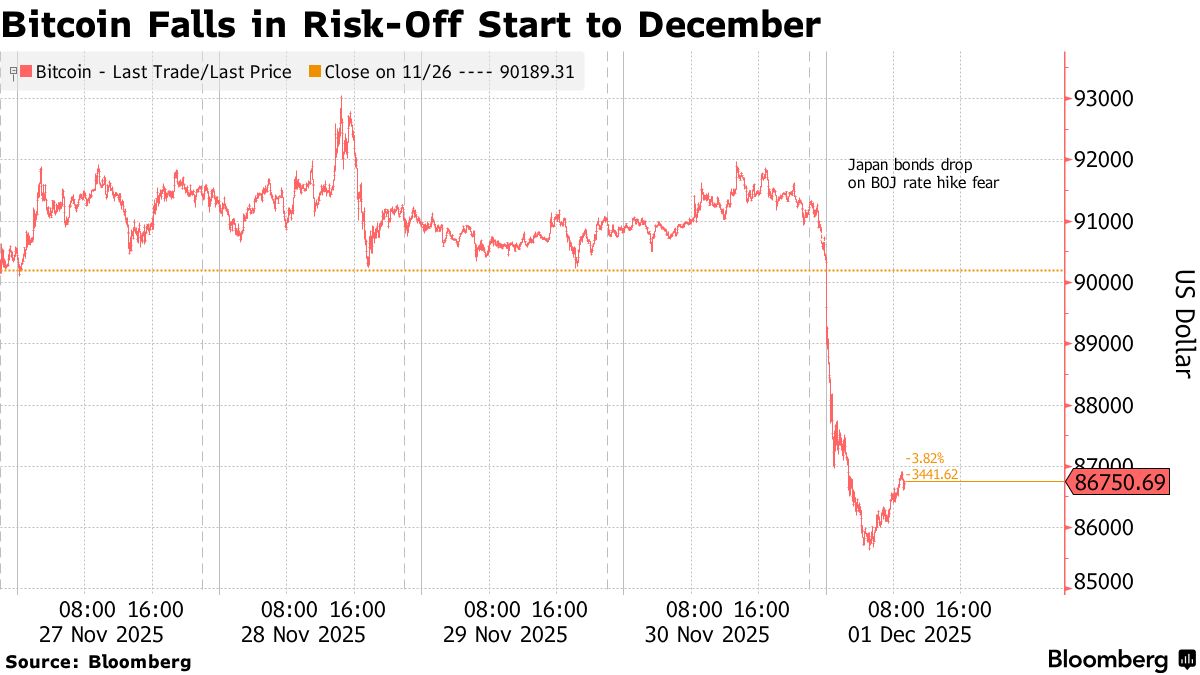

Bitcoin’s sudden drop on Monday was a fresh reminder of how cryptocurrency prices are influenced by an ever-widening array of macroeconomic factors, making it trickier for traders to gauge the market’s direction after the recent selloff.

The biggest token started falling sharply around 8:30 a.m. in Tokyo, just as Japanese government bond futures swooned on expectations that the Bank of Japan would raise borrowing costs at its December meeting. Some 90 minutes later, BOJ Governor Kazuo Ueda said in a speech that his board might increase interest rates soon.

Read more: BOJ’s Ueda Sends Clear Hint at Chance of December Rate Hike

Ueda’s hawkish signal undermined a fragile recovery from a bear market that saw Bitcoin tumble as much as 36% from its early October record. The reaction underscored how crypto investors must now reckon with macro forces far beyond the Federal Reserve, which is widely expected to ease monetary policy at next week’s meeting.

“In the early days, Bitcoin mostly moved to whatever the Fed was signaling, rate cuts, hikes, or balance sheet shifts,” said Rachael Lucas, an analyst at BTC Markets. “These days, Bitcoin reacts to the whole central-bank landscape, not just one player.”

Bitcoin traded around $86,200 at 6:58 a.m. in New York, down 5.4% for the session. Stock markets had a more mixed reaction to Ueda’s comments, with Japanese equities falling sharply on Monday while benchmark indexes in China and Hong Kong advanced.