Bitcoin’s Rout Was Brutal Even by Crypto Standards

TL;DR

Bitcoin's recent selloff has been exceptionally severe, erasing half a trillion dollars in value and causing extreme fear among investors. The downturn is driven by institutional outflows and a shift in market dynamics, contrasting with gains in tech stocks and other sectors.

Key Takeaways

- •Bitcoin's selloff wiped out about $500 billion in value, marking one of its worst months since 2022.

- •Institutional investors are pulling funds from Bitcoin ETFs, contributing to the sharp decline in crypto markets.

- •The Fear and Greed index shows extreme fear in crypto, indicating low investor sentiment.

- •Despite the crypto crash, tech stocks like Alibaba and Google saw gains due to AI developments.

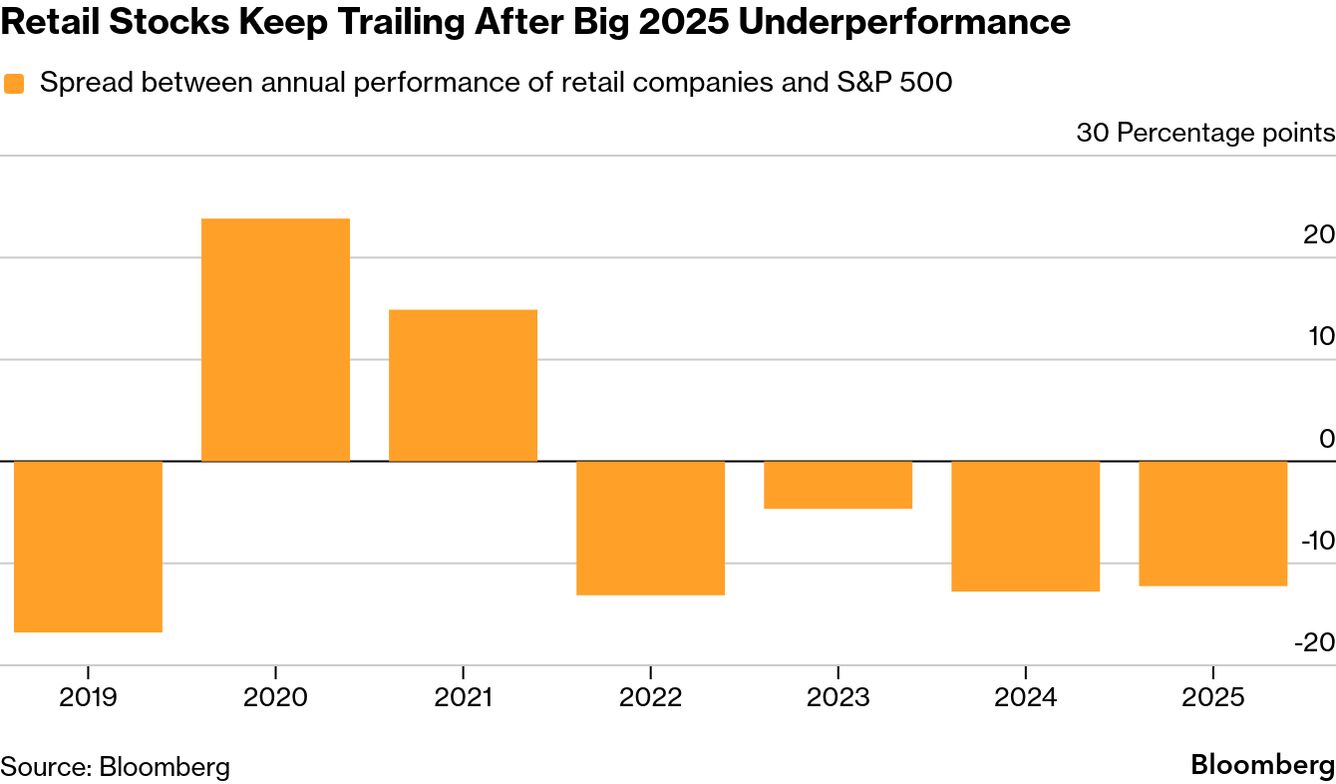

- •Retail sector struggles as consumers cut back on discretionary spending, signaling economic concerns.

Tags

Reversals of fortune are nothing new for Bitcoin diehards. But this time is different.

Five things you need to know

- Bitcoin is falling again after a weekend rebound. (More on the crypto selloff in today's essay). Meanwhile, the tech stocks are leading gains in early trading.

- Alibaba’s Qwen app drew more than 10 million downloads in the week after its relaunch, boding well for a longer-term effort to build a rival to OpenAI’s ChatGPT. Alibaba shares climbed 4.7% in Hong Kong.

- Shares of European defense firms dropped after signs of progress in talks to secure Kyiv’s support for a US-backed peace plan. Rheinmetall declined to the lowest since April, while Leonardo fell almost 3%. Ukraine’s dollar bonds jumped and eastern European currencies strengthened.

- BHP Group has walked away from a fresh takeover approach for Anglo American, ending a short-lived attempt by the world’s largest miner to thwart a planned tie-up between its smaller rival and Canada’s Teck Resources.

- Kohl’s is expected to name Michael Bender as its permanent CEO as early as Monday, according to a person familiar with the matter. The company, which reports earnings on Tuesday, has endured a year of disarray after its previous CEO was fired.

A brutal stress test

Reversals of fortune are nothing new for Bitcoin diehards — euphoric rallies, then brutal selloffs. They happen every few years, or whenever sentiment snaps.

None of those previous episodes, though, have prepared traders for the speed and scale of the past few weeks. The reversal was sharper than expected even if it lacked the systemic stress of prior crashes.

Friday’s drop sent Bitcoin to a low near $80,500, putting it on track for its worst month since Terra’s $60 billion collapse in 2022 set off the bankruptcies that ended in the demise of FTX. Altogether, about half a trillion dollars in Bitcoin value has been wiped out. And that’s before tallying the carnage across the altcoin complex.

The original cryptocurrency remains on the back foot. After regaining some ground over the weekend, Bitcoin fell as much as 2.6% to dip below $86,000 on Monday.

Bitcoin is still comfortably up since President Donald Trump’s election victory, but much of the heady run has vanished in his first year back in office, the very stretch he hailed as crypto’s golden age. And for the first time since exchange-traded funds helped bring Wall Street and retail into the market, those positions are under pressure.

Decline in value across Bitcoin's worst months since November 2018

Note: Data for Nov. 2025 as of Nov. 21

It’s hard to spot the selloff’s trigger. These new ETFs didn’t exist during the last big crypto crash. Investors have pulled billions from the 12 Bitcoin-linked funds this month, Bloomberg data show. The slew of digital-asset treasury firms inspired by Michael Saylor’s Strategy Inc. have seen even steeper outflows as investors question the value of corporate shells built solely to hold tokens.

What’s clear is that crypto has become much bigger than the retail traders and techno futurists who are committed to HODLing through thick and thin. It’s now woven into the fabric of Wall Street and the broader public markets, bringing a whole new set of finicky players to the table.

“What’s happened these last two months was like rocket fuel, as if people were expecting this to crash,” said Fadi Aboualfa, head of research at Copper Technologies Ltd. “That’s what institutional investors do. They’re not there to hold, they don’t have that mentality. They rebalance their portfolio.”

Overall, any positive vibes left in the industry appear to be hurtling toward rock bottom. The Fear and Greed index — a tool that measures sentiment in crypto markets — sat at a score of 11 out of 100 on Friday, according to CoinMarketCap. That’s deep in “extreme fear” territory. —Emily Nicolle

On the move

- Baidu rises 2.8% in premarket trading after JPMorgan raised its recommendation to overweight, turning more positive on the search engine firm’s cloud and AI businesses.

- Google parent Alphabet gains 2.3%, extending last week’s rally on optimism about the latest version of its Gemini AI model.

- Bayer gains nearly 10% after the German company said an experimental stroke-prevention drug showed positive results in a late-stage study.

- Ubisoft shares jump as much as 15% after the company closed a deal with Tencent for an investment in Vantage Studios, a unit carved out for its Assassin’s Creed, Far Cry and Tom Clancy’s Rainbow Six franchises. —Henry Ren

The week ahead

The US will clear more of its data backlog with September retail sales and durable goods due for release. The Fed’s Beige Book will provide additional insight into the health of the economy. US markets are closed Thursday for Thanksgiving.

Chancellor Rachel Reeves will deliver the UK budget on Wednesday following months of speculation about potential tax increases. In Asia, Japan sells 40-year bonds after the cabinet approved the largest round of extra spending since the pandemic. Click here for the full rundown on the week ahead.

Monday: German IFO survey, Chicago Fed national activity index and Dallas Fed manufacturing activity

Tuesday: Earnings from Alibaba, Dell Technologies, Workday, HP, Best Buy, Kohl’s, Dick’s Sporting Goods; US retail sales, PPI, consumer confidence, pending home sales, business inventories, house price index and Richmond Fed manufacturing index

Wednesday: Earnings from Deere; UK budget, ECB financial stability review; Australia CPI, New Zealand rate decision; Japan 40-year bond auction; US jobless claims, durable goods orders and Chicago PMI, Fed Beige Book

Thursday: US markets closed; China industrial profits, Euro-area consumer confidence, ECB minutes; South Korea rate decision

Friday: Japan jobless rate, industrial production, retail sales; GDP from Canada, France, Italy and Switzerland; ECB consumer expectations survey; CPI from Germany, France, Italy and Spain

Retail stocks need a holiday miracle

The American consumer is limping into the holiday season.

That’s the upshot from big-box retailer earnings that signal shoppers are increasingly worried about a softening job market and persistent inflation.

Target earnings last week showed the retailer cut prices at the expense of profits, with customers pulling back from nonessentials like apparel and home goods. Home Depot lowered its outlook as strapped homeowners hold off on big-ticket purchases. Shares in both companies came under pressure.

Even Walmart, the belle of the retailer ball with huge profits and a rosy forecast, sent an economic warning of sorts. The growth it reported came largely from groceries and mid-tier customers looking for bargains — both signs of shopper skittishness.

Taken together, the results showed that a growing number of consumers are questioning discretionary purchases while trading down for essentials to stretch every dollar. More worryingly, wealthier Americans who have powered the economy for most of the year are becoming cost-conscious.

“I worry that Corporate America’s revenue growth will slow from here and margins will get squeezed,” said Timothy Chubb, CIO at Girard.

Other than Tuesday’s retail data, investors will get a few more shopping season forecasts this week when Best Buy, Dick’s Sporting Goods, Abercrombie & Fitch and Urban Outfitters report results. — Jess Menton and Janet Freund

Word from Wall Street

divPlay Alphadots!

Our daily word puzzle with a plot twist.

Today’s clue is: A bloody failure?

One number to start your day

byTheNumbersBig cities' second-hand home prices have slid more than 30% from peak levels

What else we’re reading

-

Ray Dalio Says ‘Pod Shop’ Hedge Fund Model Is Unlikely to Last

-

CEOs Threaten to Cut UK Investments If Budget Costs Them More

-

Canary Wharf Crisis Eases as Dimon Sends Bankers Back to Office

-

Crypto Crash Is Eroding Wealth for Trump’s Family and Followers

-

Bond Rally of 2025 Faces New Data Vacuum as Waiting Game Begins

Please share your thoughts on how we’re doing and what we’re missing. Contact us at [email protected].

Enjoying Markets Daily? You might also like:

- Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway’s daily newsletter on the newest market crazes

- Supply Lines for daily insights into supply chains and global trade

- Money Stuff for Bloomberg Opinion’s Matt Levine’s newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion’s John Authers’ daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters.