Ex-Jefferies Banker Charged With Insider Trading by UK’s FCA

TL;DR

A former Jefferies banker was charged with insider trading for leaking confidential information on a GCP Student Living takeover. His associate allegedly profited nearly £70,000 from the trades, discovered via FCA monitoring.

Tags

A former banker at Jefferies Financial Group Inc.’s UK arm was charged with insider dealing by the markets watchdog.

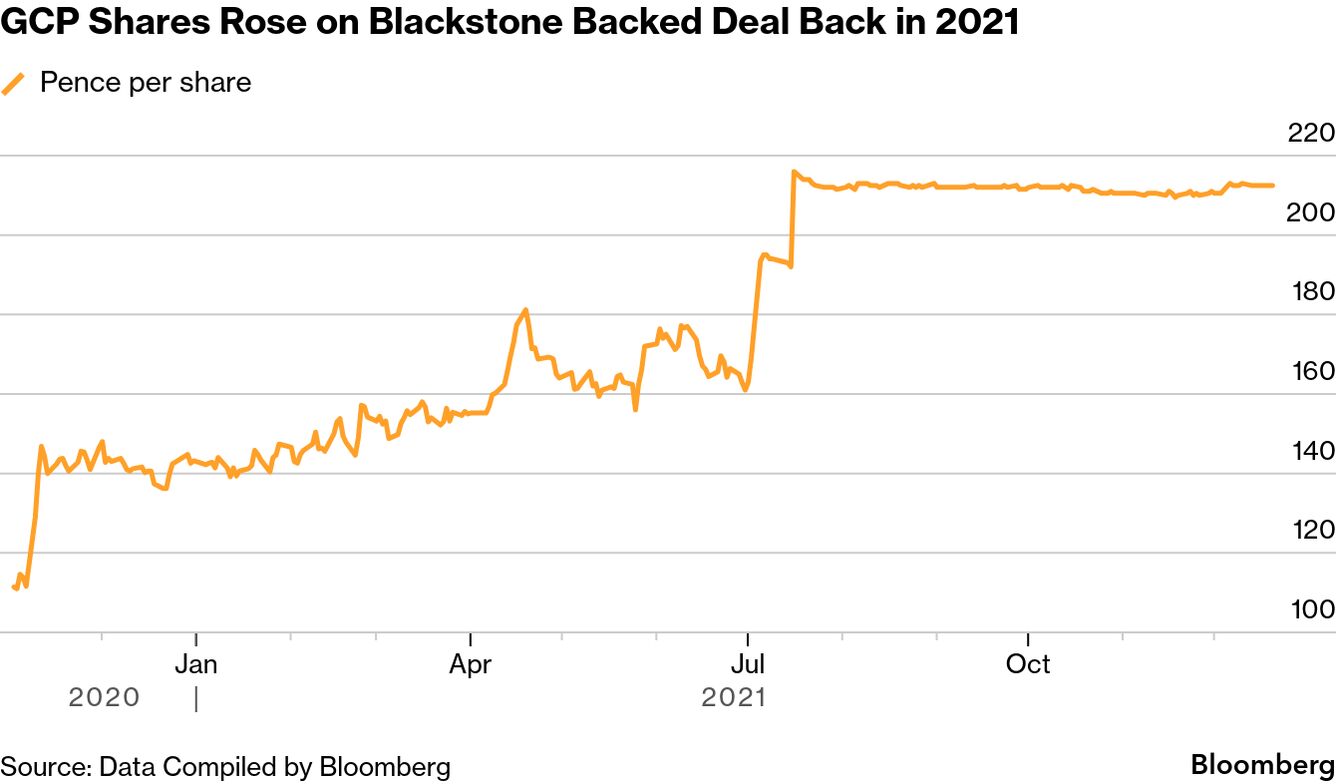

Bobosher Sharipov is charged with leaking inside information to a friend and business associate while advising GCP Student Living Plc on a potential takeover, the Financial Conduct Authority said Wednesday. The associate, Bekzod Avazov, is alleged to have used the insider information to trade in GCP shares and make a profit of nearly £70,000 ($92,407) in 2021.

Both men appeared at Westminster Magistrates Court on Wednesday and did not enter a plea, the FCA said in its statement. The case has been sent to Southwark Crown Court.

The FCA said that public records enabled them to discover that the two men were former colleagues and roommates. The regulator’s market monitoring systems identified Avazov’s trades as suspicious. Jefferies, who isn’t accused of wrongdoing, has co-operated fully with the FCA’s investigation, the regulator said.

GCP was purchased by a consortium formed by Backstone-backed iQ and Scape Living in a deal that valued the firm at close £1 billion in 2021. The share price rose by more than 31% over the course of July, when the purchase was announced. iQ and Scape split the GCP portfolio between themselves, according to a press release in December 2021.

A Jefferies spokesperson declined to comment. A number for SFM Global Ltd., a company Avazov is listed as a director of, did not work.

“The integrity and cleanliness of our markets rely on trust. It is right that this case is heard by the courts,” Steve Smart, executive director of enforcement and market oversight at the FCA, said.