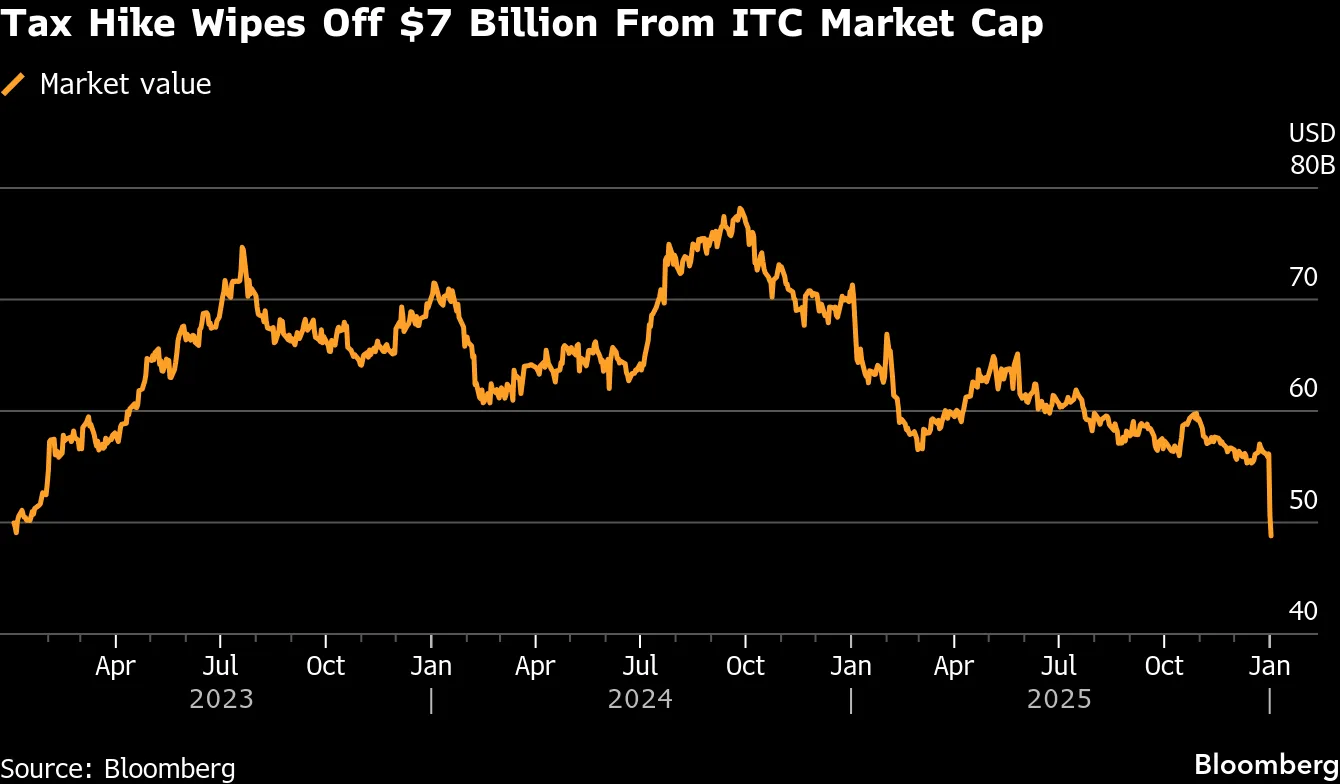

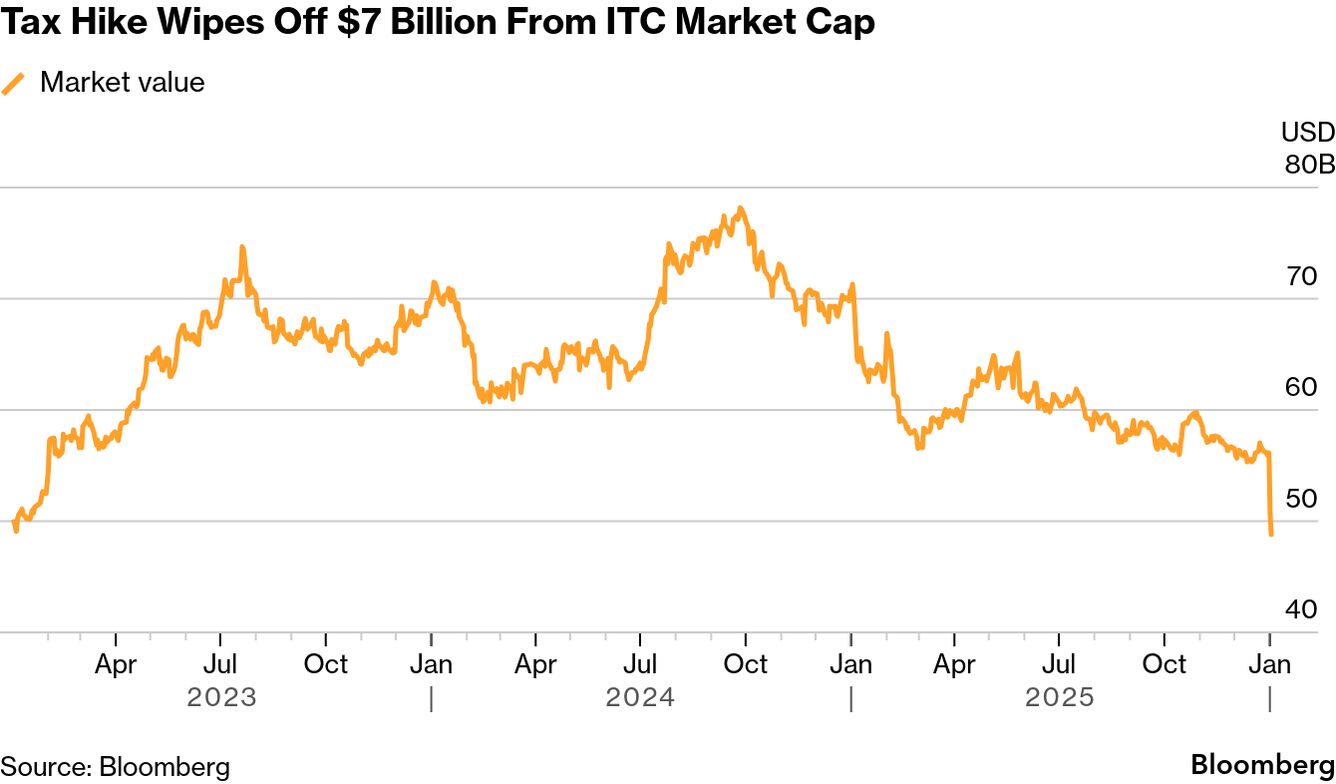

India’s ITC Sheds $7 Billion as ‘Tax Shock’ Triggers Rating Cuts

TL;DR

India's ITC lost $7 billion in market value after a government tax hike on tobacco led to brokerage downgrades and stock price declines, with concerns over profitability and potential sales volume drops.

Tags

India’s largest cigarette maker ITC Ltd. wiped out about $7 billion in market value after a government tax hike on tobacco products triggered a wave of brokerage downgrades.

Shares of the firm fell as much as 5.1% on Friday, touching the lowest level since February 2023 and extending a near 10% slide from the previous session. At least 11 brokerages, including Goldman Sachs Group Inc., JPMorgan Chase & Co. and Morgan Stanley, downgraded the stock after the government hiked excise duty on cigarettes this week.

The stock could see more pressure in the near term on the ‘big tax shock,” Jefferies Financial Group Inc.’s analysts, led by Vivek Maheshwari, wrote in a note, downgrading the stock to hold from buy.

Cigarettes will face higher excise duties ranging from 2,050 rupees to 8,500 rupees per 1,000 sticks from Feb. 1, according to a government notification issued late Wednesday.

Most market participants now expect some price increases to help offset the tax hike, potentially weighing on demand. An industry body warn the higher levies would hurt the tobacco business and fuel illicit cigarette trade. Higher-than-expected tax burden has stoked concerns over profitability of Asia’s second-largest cigarette maker.

The move also roiled shares of other cigarette makers across the country. Shares of Godfrey Phillips India Ltd. declined more than 20% in two sessions to Friday.

Read More: Largest Indian Cigarette Maker ITC Plunges on Higher Tobacco Tax

Analysts at Morgan Stanley said cigarette prices may need to rise by as much as 40% to fully pass on the impact of higher levies to consumers, likely leading to a decline in sales volumes.

“We believe the share price reaction already reflects the impact, but stock outperformance could return only once the market is convinced that the volume slowdown has bottomed out,” the analysts wrote in a note.