Europe’s Wounded Industries Struggle to Catch Economic Tailwinds

TL;DR

Europe's industries face deep competitiveness issues despite lower gas prices and policy tweaks. High energy costs have hollowed out manufacturing, and structural disadvantages persist compared to other regions.

Key Takeaways

- •EU policy changes and falling gas prices are insufficient to restore Europe's industrial competitiveness.

- •Years of high energy costs have led to plant closures, low capacity utilization, and record corporate insolvencies.

- •Europe's gas prices remain structurally higher than the US due to reliance on imported LNG, creating a lasting disadvantage.

- •The comparison with energy costs in other regions, not absolute price levels, is the key benchmark for industrial competitiveness.

Tags

Welcome to our guide to the commodities driving the global economy. Today, reporter Priscila Azevedo Rocha looks at how new policy initiatives and cheaper gas may not be enough to save Europe’s lagging industries.

The European Union is waking up to its competitiveness deficit, and just how much of the problem stems from high energy and carbon costs.

This week, Brussels announced several measures to mitigate some of the disadvantages faced by its major industries.

The bloc pulled back from an effective ban on internal combustion engines in a bid to shore up its ailing carmakers. It also expanded an emissions charge on imported goods that comes into effect in January, a policy aimed at protecting European industries during the green shift.

There’s reason to doubt that these policy tweaks can restore Europe’s competitiveness, especially when the bloc is struggling to take advantage of much more potent economic tailwinds.

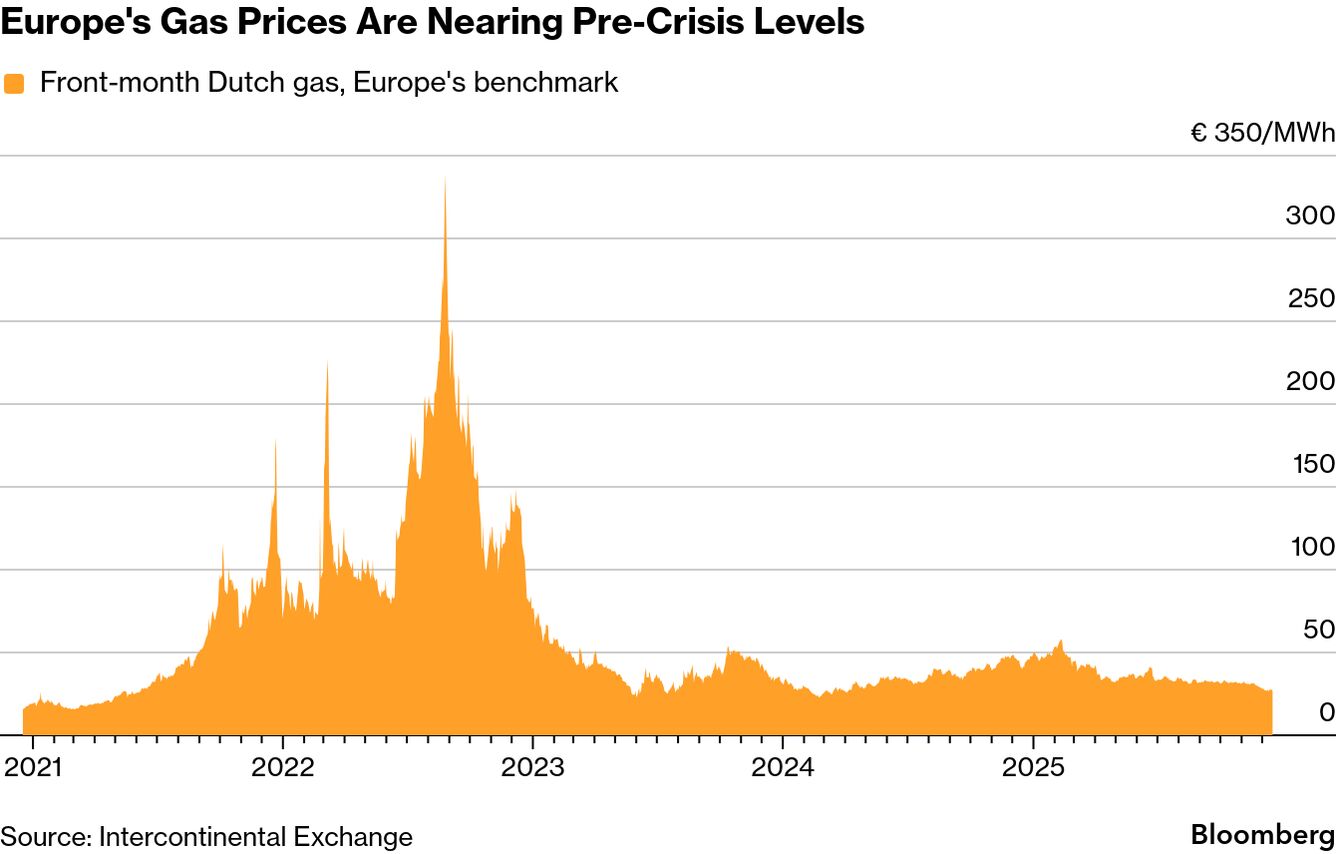

Natural gas prices in Europe have fallen close to levels not seen since Russia’s invasion of Ukraine. But even that might be too little, too late to revive the continent’s battered industry.

Years of elevated energy costs have hollowed out the region’s industrial core. Chemical plants are closing down and the shutters are falling on steel foundries. The lowest seasonal gas prices since 2020 haven’t been enough to reverse these trends.

Corporate insolvencies in western Europe in 2025 hit the highest in over a decade. In Germany, the region’s biggest economy, chemical plants operated at just 70% of capacity, the weakest level in 20 years.

The loss of so many industrial consumers means the region’s underlying demand remains weak even with current gas prices of about €28 a megawatt-hour, down from a peak of €345 in 2022.

The energy crisis has accelerated the rise of renewables in Europe, an important source of clean, low-cost power. But there will always be days when the sun doesn’t shine or the wind doesn’t blow, keeping the region reliant on supplies of liquefied natural gas from overseas.

The fuel’s share of Europe’s gas imports ballooned to 45% at the start of this year from 20% before the war. Much of this is American supply, meaning European gas prices always have to be higher than in the US to maintain the flow of cargoes, said Anthony Yuen, head of energy strategy at Citigroup Inc.

“It’s not the price trend over time that matters, but rather the comparison with other regions,” said Tilo Rosenberger-Süß, a spokesman for InfraServ Gendorf, which operates an industrial site for the manufacture of chemicals east of Munich. “That’s precisely the benchmark for competitiveness.”

It’s an in-built disadvantage that will hurt Europe’s economy for years to come.

—Priscila Azevedo Rocha, Bloomberg News

Chart of the day

Virtually all of the world’s biggest traders see the oil market in a state of oversupply early next year — the only question is by how much. OPEC+ has been steadily lifting output since early this year. Brazil pumped a new high of 4 million barrels a day in October. A shale boom in Argentina has helped buoy South American output and China now pumps roughly as many barrels as OPEC giant Iraq.

Top stories

Gold and silver hovered near record highs, after slower-than-expected inflation in the US supported bets for more interest-rate cuts. Platinum was close to a 17-year peak.

Oil headed for a second weekly decline as concerns over a growing glut outweighed potential supply disruptions. Brent crude edged lower to stay below $60 a barrel and was down more than 2% for the week.

India has seen major growth in renewable energy, adding more solar capacity over the past decade than any country except China and the US. But fossil fuels, namely coal, still underpin its economic rise and the wealth of its most prominent tycoons.

Woodside Energy Group Ltd.’s Chief Executive Officer Meg O’Neill’s surprise exit for BP Plc leaves her successor with a dilemma: Should the Australian company continue down the path she set of promoting massive LNG projects when forecasts point to a glut?

Vestas Wind Systems A/S is ending 2025 among Europe’s biggest winners, with a 74% share-price gain. The remarkable turnaround from a slump the prior year comes amid huge demand for all kinds of energy from the new boom in artificial intelligence.

BNEF today

LNG exports by country

Note: 2025 value is actuals plus BNEF forecast for December, 2026 value is BNEF forecast as of Nov. 21, 2025.

The global LNG market is heading into oversupply as 29 million metric tons a year of new export capacity will be added in 2026 from the US, Qatar, Australia, Mexico and Africa, according to BloombergNEF. The influx of supply will put further downward pressure on European gas and Asian spot LNG prices.

Coming up

Bloomberg Invest: Join the world’s most influential investors and financial leaders in New York on March 3-4 to examine how artificial intelligence, geopolitical uncertainty, shifting central-bank policy and the convergence of public and private markets are reshaping global finance. Learn more here.

More from Bloomberg

- Economics Daily for what the changing landscape means for policymakers, investors and you

- Business of Food for a weekly look at how the world feeds itself in a changing economy and climate, from farming to supply chains to consumer trends

- Green Daily for the latest in climate news, zero-emission tech and green finance

- Hyperdrive for expert insight into the future of cars

- Supply Lines for daily insights into supply chains and global trade

You have exclusive access to other subscriber-only newsletters. Explore all newsletters here to get most out of your Bloomberg subscription.