Bitcoin’s Silent Exodus Hits Crypto as Long-Time Buyers Cash Out

TL;DR

Bitcoin's long-term holders are selling at record rates, creating sustained downward pressure as ETF demand fades. This 'silent exodus' has reactivated over $140 billion in dormant coins since 2023, contributing to Bitcoin's 30% decline from its peak.

Key Takeaways

- •Long-term Bitcoin holders are selling at some of the fastest rates in over five years, with $140 billion worth of dormant coins reactivated since early 2023.

- •The market's ability to absorb this selling has weakened as ETF flows turned negative, derivatives volumes dropped, and retail participation thinned.

- •This sustained selling differs from previous cycles as it's driven by profit-taking at high prices enabled by institutional liquidity, not altcoin trading or protocol incentives.

- •Analysts suggest the selling pressure may be nearing saturation, with expectations that long-term holder distributions will subside in 2026 as institutional integration deepens.

Tags

Bitcoin’s most entrenched investors are still cashing out — and the pressure is starting to show.

More than two months after the token hit a record high above $126,000, Bitcoin has fallen nearly 30% and is struggling to find support. One reason: long-time holders haven’t stopped selling. New blockchain data shows that coins held for years are being divested at some of the fastest rates in recent memory, just as the market’s ability to absorb them is fading.

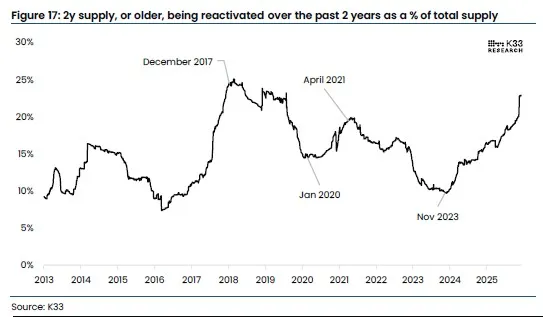

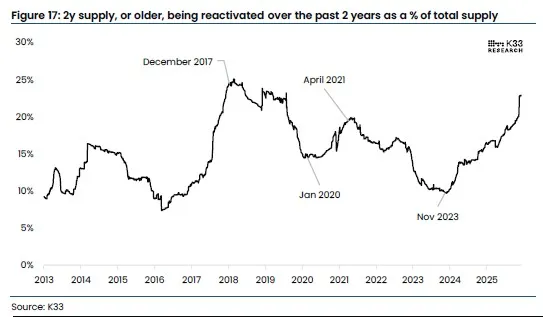

According to a report from K33 Research, the amount of Bitcoin that had remained unmoved for at least two years has declined by 1.6 million coins since early 2023, roughly $140 billion worth. That signals sustained selling by long-term holders.

In 2025 alone, nearly $300 billion worth of Bitcoin that had been dormant for over a year has re-entered circulation. CryptoQuant, a blockchain analytics firm, reported that the past 30 days saw one of the heaviest long-term holder distributions in more than five years.

“The market is experiencing a slow bleed characterized by steady spot selling into thin bid liquidity, creating a grinding decline that’s harder to reverse than leverage-driven capitulation events,” said Chris Newhouse, director of research at Ergonia, a firm specializing in decentralized finance.

For much of the past year, that selling was absorbed by a surge of demand from newly launched exchange-traded funds and crypto investment firms. But that demand has faded. ETF flows have turned negative. Derivatives volumes have dropped. And retail participation has thinned. The same supply is now landing on a weaker market with fewer active buyers.

The pressure has been most acute since Oct. 10, when $19 billion in liquidations were registered following unexpected comments on punitive tariffs by US President Donald Trump. That was the biggest single-day leverage washout ever in crypto’s history. Traders have retreated from derivatives markets since the crash with few signs of a rebound in sight.

Some executives view the selling by long-term holders as normal, given that many are sitting on large gains even after the recent selloff.

“When you’re up 1,000x to 10,000x, it is natural to see some of that distribution take root,” Hassan Ahmed, head of Coinbase Global Inc.’s Singapore operations, told Bloomberg TV.

After a brief jump on Wednesday to $90,000, which traders attributed to a raft of liquidations of short positions, Bitcoin quickly resumed its decline. The original cryptocurrency fell back toward the lower end of the trading range seen since the October crash, dropping as much as 2.8% to $85,278. It was trading just below $87,000 at 9:30 a.m. in London on Thursday.

embed“Unlike prior cycles, these reactivations are not driven by altcoin trading or protocol incentives, but by deep liquidity from US ETFs and treasury demand, enabling OG holders to realize profits at six-digit prices and materially reducing ownership concentration,” K33 Senior Analyst Vetle Lunde said, referencing the abbreviation for “original gangster,” the slang term used by crypto enthusiasts to describe early adopters and investors. The amount seen this year and last “represent the second and third-largest long-term held supply reactivations in Bitcoin’s history, surpassed only by 2017.”

Open interest, the number of outstanding contracts, for both Bitcoin options and perpetual futures, remains well below the levels seen before the October crash, according to data from Coinglass. The decline points to most traders still on the sidelines given such markets make up the majority of trading volumes in crypto. At the same time, the so-called basis trade — a way to profit from pricing discrepancies between spot and futures markets — has turned unprofitable for hedge funds.

However, Lunde said selling from Bitcoin long-time holders may be drawing to a close as the reactivation nears a threshold based on observations of historical onchain flows.

“Looking ahead, the sell-side pressure from long-term holders appears closer to saturation, with around 20% of BTC supply reactivated over the past two years,” Lunde wrote. “The expectation is for OG selling to subside in 2026, allowing two-year supply to rise as BTC transitions toward net buy-side demand amid deeper institutional integration.”