Bitcoin Recovery From Worst of Selloff Holds, Buoying Traders

TL;DR

Bitcoin selling pressure is easing as the token stabilizes around $88,000, with indicators like reduced options stress and oversold RSI suggesting a potential bottom. Traders remain cautious amid record ETF outflows, awaiting the Fed's rate decision.

Key Takeaways

- •Bitcoin's selling pressure is easing, with the token recovering to around $88,000 from a seven-month low, indicating a possible end to the recent slide.

- •Key metrics show reduced stress: the options put-call premium fell to 4.5%, and the RSI is at 32, signaling an oversold market that may have bottomed out.

- •Despite record outflows from crypto ETFs in November, long-term holders are holding positions, viewing current prices as too low to sell, while short interest in funds like IBIT has dropped.

- •Traders are positioning for a breakout, with implied volatility returning to April levels, but the market remains fragile and dependent on the Federal Reserve's upcoming rate decision.

Tags

The intense selling pressure that has weighed on Bitcoin in recent weeks looks to be easing, raising hopes that the token’s brutal slide is nearing an end.

The original cryptocurrency slipped as much as 2.4% to $86,666 on Tuesday, while remaining well above last week’s slump that consigned it to a seven-month low, triggering massive liquidations and erasing more than $1 trillion in value from the broader digital-asset market. Bitcoin recovered slightly and was trading at around $87,500 at 6:39 a.m. in New York.

The mood among traders remains cautious, highlighting the market’s fragile state. Bitcoin remains on track for its worst month since 2022, and exchange-traded funds investing in the token look likely to record their heaviest monthly outflows since launching. But after Bitcoin’s modest rebound, some see cause for optimism.

In the Bitcoin options market, the cost of purchasing downside protection has fallen sharply, with the premium for one-week puts over calls sliding to around 4.5% from a 2025 high of 11% reached on Friday, according to Caroline Mauron, co-founder of Orbit Markets.

“This indicates the level of stress has come down significantly, and investors expect we’ve seen the bottom for now,” she said.

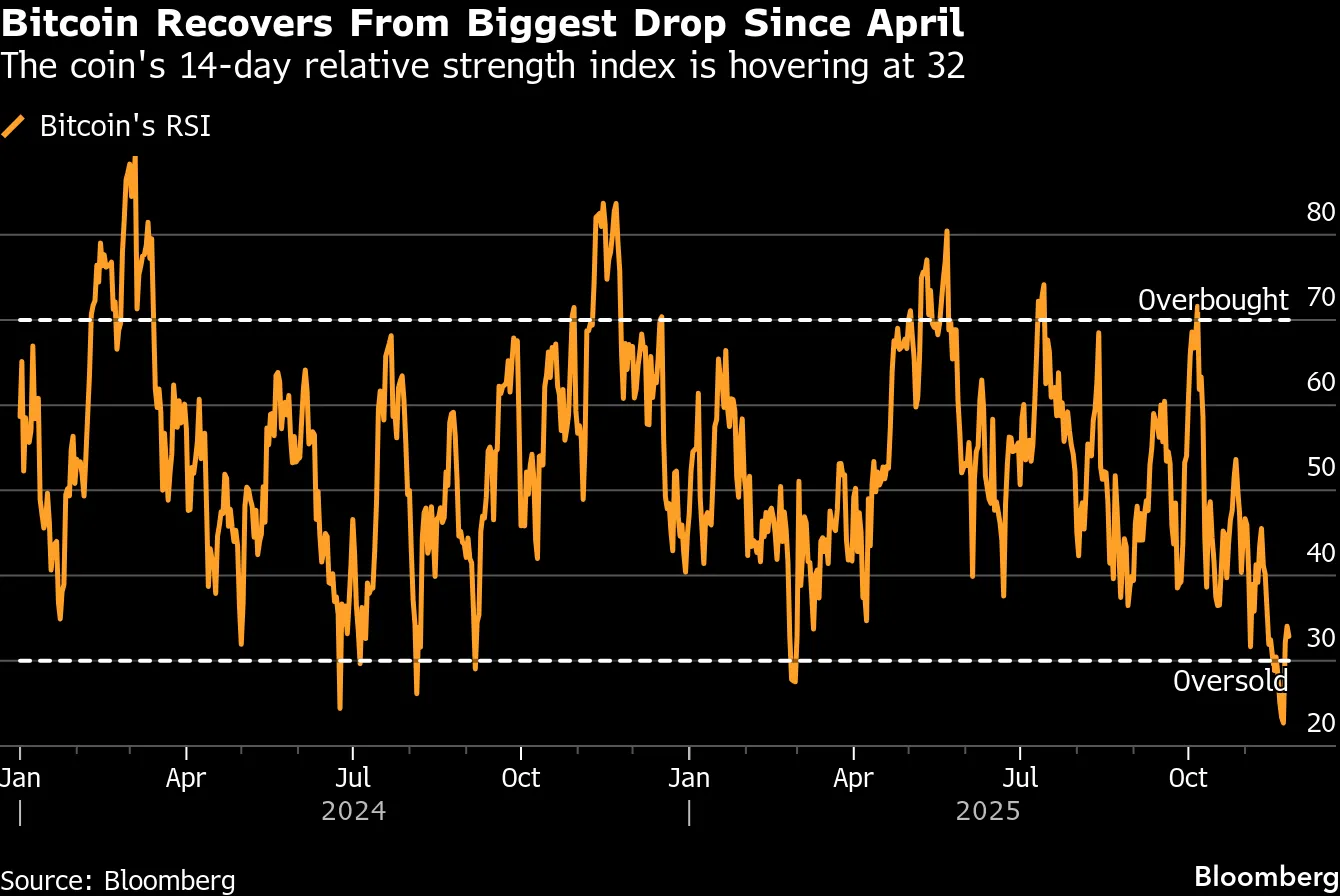

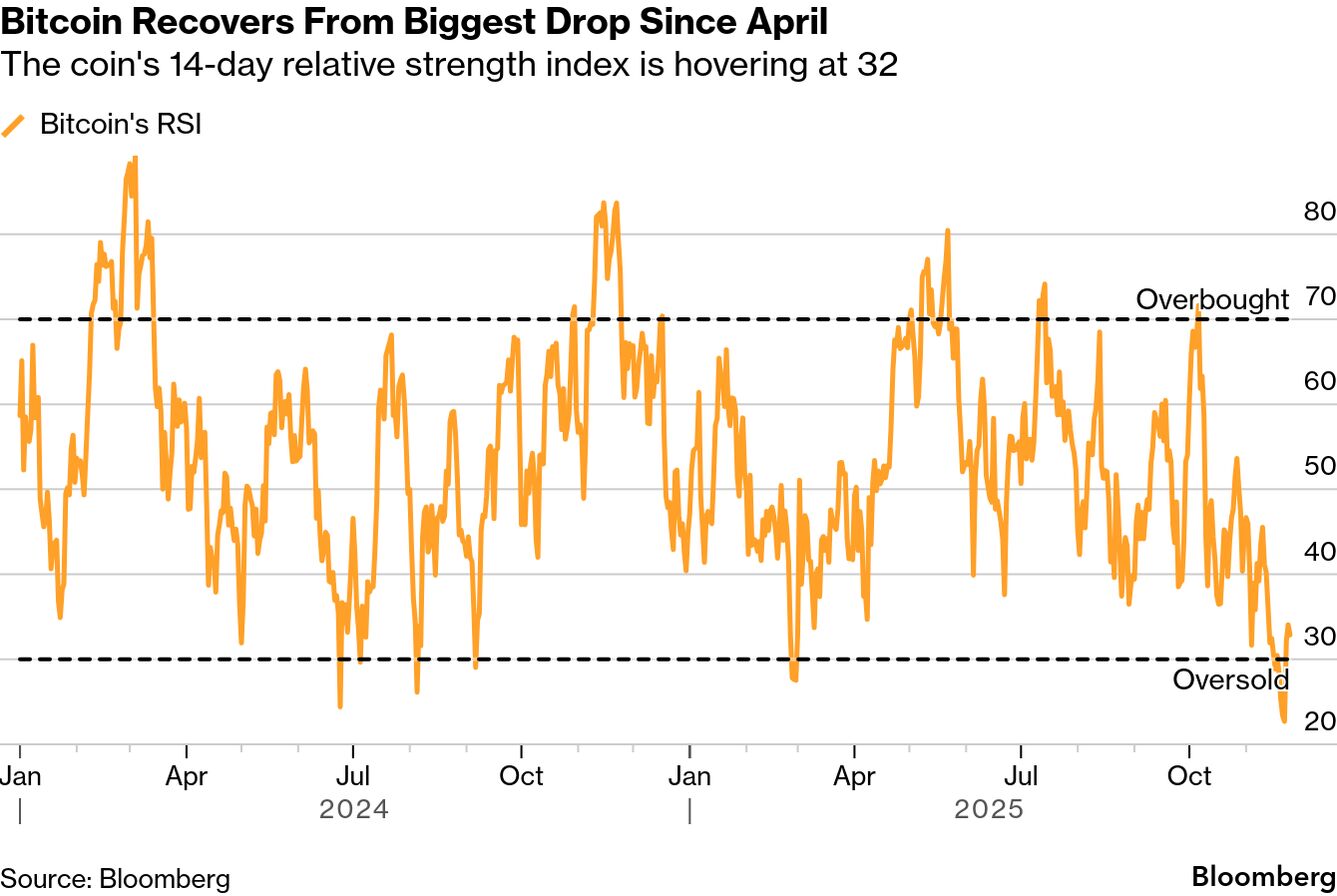

Another metric drawing attention is Bitcoin’s 14-day relative strength index, now at 32 after a steep decline from early October. A reading of 30 or below typically signals an oversold asset while 70 or above indicates the opposite. Meanwhile, implied volatility on Bitcoin options — a gauge of expected future price movement — has returned to April levels, when tariff news induced a wave of selling.

The coin's 14-day relative strength index is hovering at 32

“This suggests traders are positioning for a breakout, which could of course be in either direction,” said Noelle Acheson, author of the Crypto is Macro Now newsletter. “But options skew shows that the bets on further drops are softening relative to those on a price increase from here.”

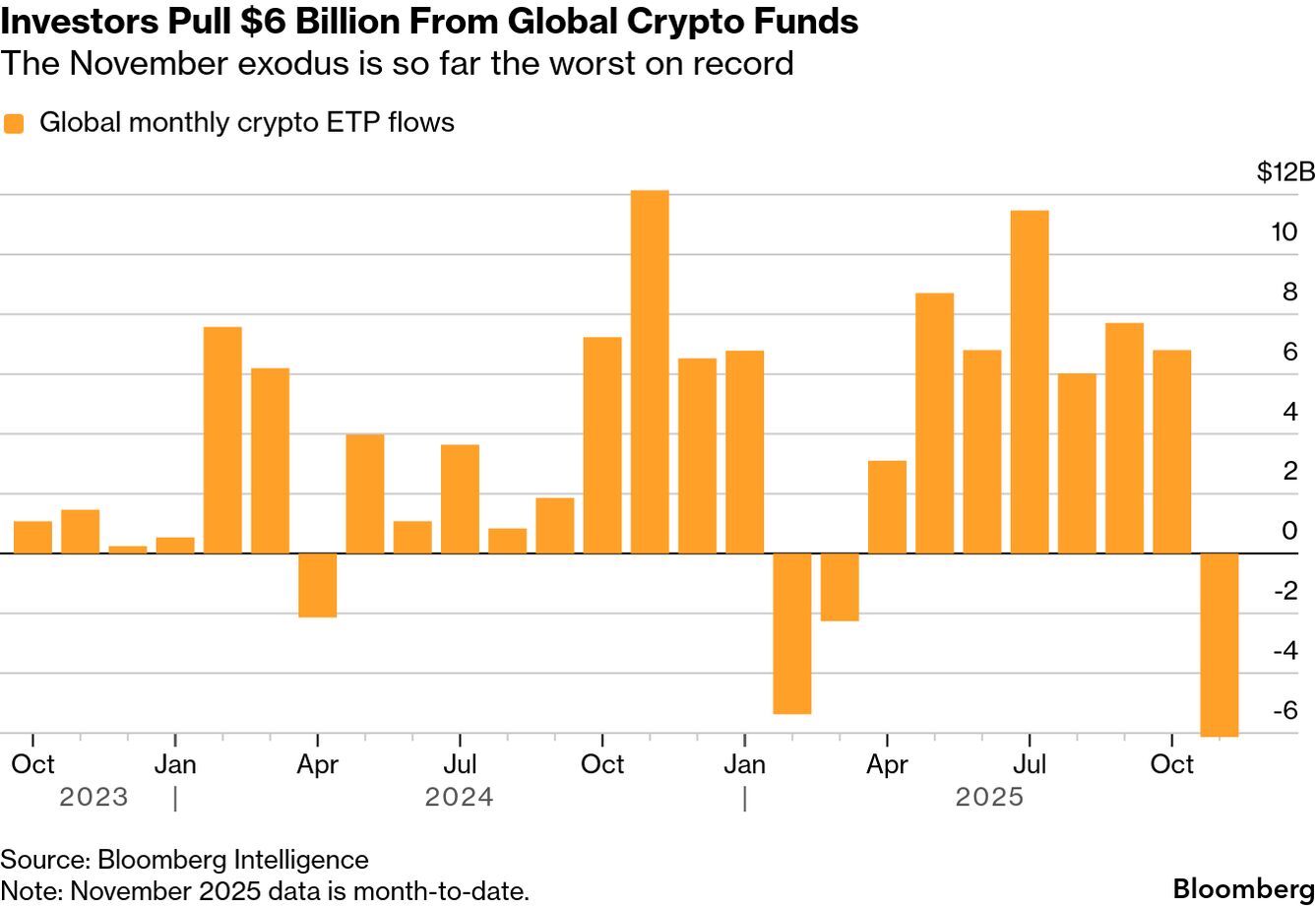

Global crypto exchange-traded products have seen more than $6 billion in outflows so far in November, the largest monthly withdrawal on record going back to 2018, according to data compiled by Bloomberg Intelligence. Even so, investors are largely staying put. The US Bitcoin ETFs’ combined redemptions of $3.7 billion in November represent about 3% of their $110 billion in assets.

Read more: Bitcoin Funds Head for Worst Month as $3.5 Billion Pulled

For BlackRock Inc.’s Bitcoin fund (IBIT), short interest — measured by the dollar value of shares sold short — has plummeted, according to a report published by S3 Partners LLC.

The November exodus is so far the worst on record

Note: November 2025 data is month-to-date.

BTC Markets Analyst Rachael Lucas noted that Bitcoin’s muted trading on Monday could also indicate that selling pressure is subsiding. She sees $80,000 as the near-term floor, with $90,000 to $95,000 forming the resistance band to any meaningful rebound.

Technology stocks drove an advance in global equities on Monday as traders kicked off a data-packed week. Investors have put the chances of a rate cut at the upcoming December meeting of the Federal Reserve at about 80%, up from 42% a week ago, according to futures contracts. Fed officials appear deeply divided over whether another reduction would be appropriate, following cuts in September and October.

“The market is going to be in wait-and-see mode until the Fed’s decision,” Orbit’s Mauron said. “Long-term holders who were exiting their position over $100,000 are seeing current levels as too low to sell and are back in holding mode, while those looking to accumulate new positions may try to wait for another dip below $85,000.”

| Read more: |

|---|

| Bitcoin Tracks Stocks Higher With Crypto Traders Staying on Edge |

| Crypto Crash Erodes Wealth for Trump’s Family and Followers |

| Crypto’s Brutal Month Triggers a Stress Test for Wall Street |

As investors contend with a mix of concerns from a cooling US labor market to surging artificial-intelligence capital spending by major corporations, a risk appetite gauge maintained by Goldman Sachs Group Inc. has fallen to zero. The reading signals mounting pressure on speculative assets, including Bitcoin. A drop of this magnitude reflects fading risk enthusiasm and, at extreme levels, may even suggest that markets have overshot to the downside.

“Elevated equity valuations and bullish positioning increased vulnerability to shocks, especially within more retail-driven segments such as Unprofitable Tech,” wrote strategists at the bank including Christian Mueller-Glissmann.