Jim Ratcliffe’s Big Push Into China Is Backfiring on Ineos

TL;DR

Jim Ratcliffe's Ineos is struggling with its major investments in China, including a potential exit from a joint petrochemical project and underperformance at its SECCO venture, exacerbating financial pressures from cheap Chinese imports and high debt.

Key Takeaways

- •Ineos is considering a full or partial exit from a joint ethylene cracker project with Sinopec in Tianjin due to poor market conditions and a focus on cash preservation.

- •The company's investment in SECCO (Shanghai Petrochemical Co.) has underperformed, leading to debt covenant breaches and requiring $300 million in injections to avoid default.

- •Ineos faces broader financial strain, including a Moody's downgrade, distressed debt, and cost-cutting measures, amid challenges from cheap Chinese exports and weak European demand.

Tags

The saying goes that if you can’t beat them, join them. But for billionaire Jim Ratcliffe and his bet on China’s chemicals sector, that hasn’t been working out.

While he’s blamed cheap Chinese imports for some of the troubles facing his Ineos group and other European chemicals producers, his bid to profit from the Asian market’s expansion faces deeper issues and is adding to his woes.

The group is now mulling a “full or partial exit” from a project with China’s Sinopec to jointly build and run an ethylene cracker plant in Tianjin, Ineos said in an emailed statement to Bloomberg News.

“Given current market conditions and our strong focus on preserving cash, we are having to make difficult investment choices,” the firm said, adding that it remains committed to SECCO, its main partnership with Sinopec, and its other interests in China.

Ineos pushed into the Chinese market in late 2022, buying 50% of SECCO, or Shanghai Petrochemical Co., from Sinopec. The transaction was part of a wider deal with a combined value of $7 billion, which included the partnership on the planned petrochemical project in Tianjin.

Ratcliffe’s group, known for its stake in football club Manchester United and the Grenadier offroader, is under pressure on a number of fronts. Cheap exports from China have added to strains on the flagship firm of an industry already struggling with high energy costs and weak demand.

Just this week, Moody’s Ratings downgraded Ineos Group and Ineos Quattro — a unit focused on petrochemicals — citing “very weak credit metrics.” The ratings company forecasts limited improvement in earnings at the unit over the next two years resulting in a “potentially unsustainable capital structure.” Ineos Quattro bonds saw a record drop following the downgrade.

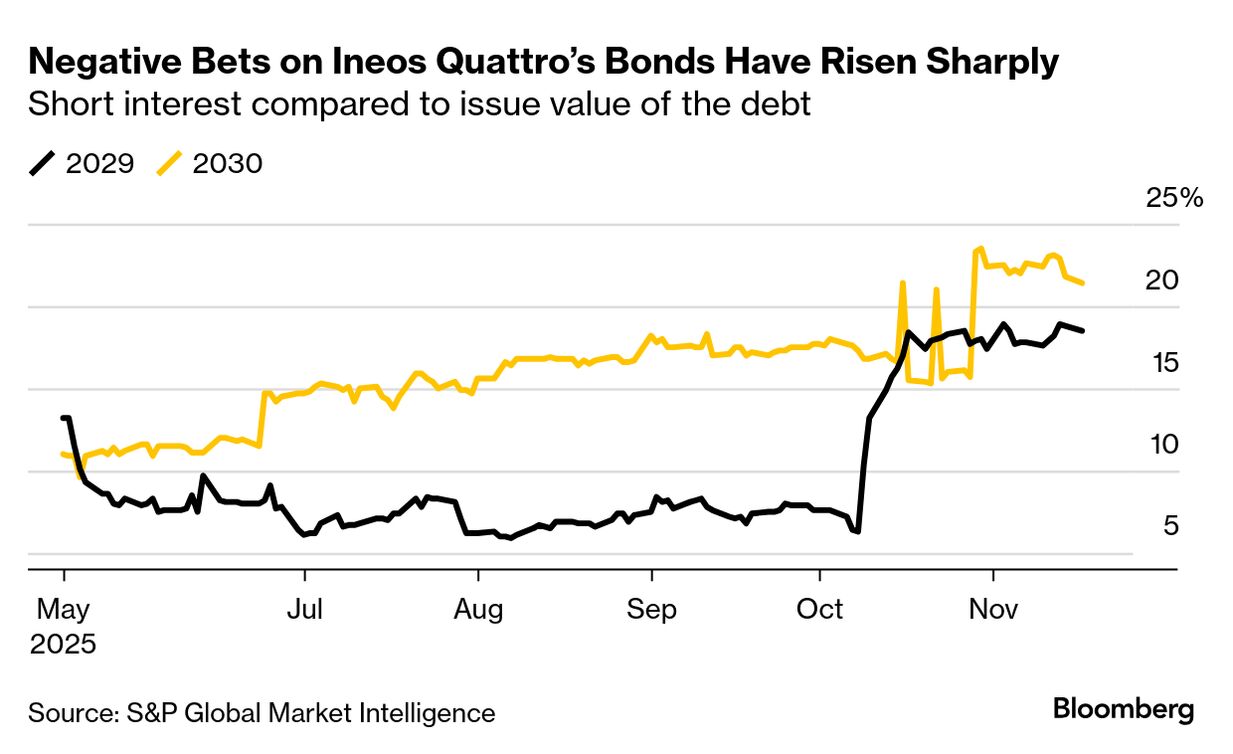

The turmoil has sent $5.8 billion of the conglomerate’s debt into distressed territory. Short-sellers have placed sizable wagers against bonds issued by the group. To improve its liquidity, Ineos has responded by cutting costs, laying off workers and closing an Ohio plastics facility.

Read More: Short Sellers Ramp Up Bond Wagers Against Jim Ratcliffe’s Ineos

Ineos is a focal point because the amount of its debt means traders see it as a proxy for the European chemicals sector. The industry’s outlook remains glum. Some plants are closing, contributing to deindustrialization in the Europe Union, according to the industry’s trade association.

Short interest compared to issue value of the debt

Diversifying into China offered the prospect of insulating Ineos from headwinds in Europe. At the time of the deals with Sinopec, Ratcliffe said that they provided “growth opportunities for both companies” and that the two parties were exploring the potential for further collaboration.

The SECCO stake purchase was funded with floating-rate debt. Ineos borrowed the equivalent of around $930 million at its peak from a group of ten lenders, filings show. China Construction Bank Corp., Industrial & Commercial Bank of China Ltd., Mizuho Bank and Credit Agricole SA were among the financiers, data compiled by Bloomberg show. Mizuho declined to comment, while other banks didn’t immediately respond to requests for comment.

SECCO “didn’t perform in line with expectations,” Ineos China Holdings Ltd., the entity through which the group bought the stake, said in accounts filed earlier this year.

The weak results at the venture with Sinopec led to several breaches of debt terms, raising the possibility that banks could demand immediate repayment. Ineos injected about $300 million into the venture over the last two years to cure the breach, with the most recent payment made in August.

Ineos China Holdings isn’t covered by the credit agreements in place with Ineos bondholders and term-loan lenders. That leaves it free to incur debt, sell assets or pay dividends without needing approval from the other creditors. Still, the loan is due for repayment in June 2026 and there was about $640 million still to be repaid at the end of September.

As for the Tianjin ethylene project, Ineos hasn’t yet committed material funding, according to an August filing.

The company was due to contribute about $750 million to finance its portion of the cracker plant at completion, but consultations with Sinopec included a potential deferment or restructuring of its financial obligations. While it negotiates its exit, Ineos doesn’t have significant influence over the project, according to separate filings.