Taiwan Lifers Cut FX Protection, Fueling Slump in Hedging Costs

TL;DR

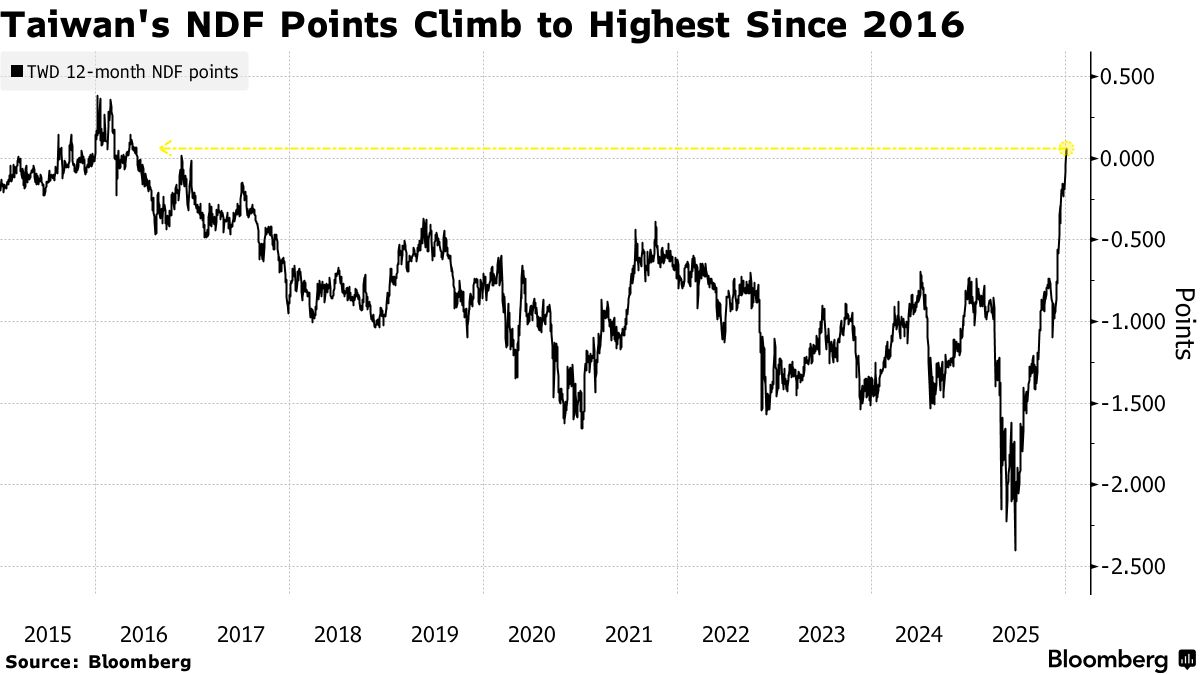

Taiwanese life insurers reduced hedging positions due to new accounting rules, causing the cost to hedge against a weaker US dollar to drop to its lowest since 2016. This shift has led to positive non-deliverable forward points for the first time in over nine years, easing hedging costs significantly.

Tags

The cost for Taiwanese investors to hedge against a weaker greenback slumped to the lowest since 2016 as local life insurers pared such wagers following an overhaul of accounting rules.

The US dollar’s 12-month non-deliverable forward points against its Taiwanese counterpart turned positive for the first time in over nine years this week, a sign that hedging costs have significantly eased. Previously, the gauge had fallen way below zero and hit the lowest level on record in June.

The latest move came as the island’s life insurers reduced their hedging positions after the authorities revised accounting rules to help ease the impact of currency swings and prevent over-hedging. A dramatic jump in the Taiwanese dollar in May had sharpened the focus on insurers that hold some $700 billion in foreign assets.

“We are likely to see the NDF points normalize in positive territory but I do not expect any overshoot, so the points are unlikely to rise too much from here,” said Khoon Goh, head of Asia research at Australia & New Zealand Banking Group in Singapore. The market was “all used to negative points due to lifer activity. Now with the big change to regulations, everyone has to get used to the new regime.”

Taiwanese insurers typically sell the US dollar-Taiwan dollar currency pair via the offshore NDF market to hedge against a weakening greenback. The 12-month NDF points stood at 0.009 on Tuesday afternoon.

The shift in hedging costs reflects the massive scale of the industry’s foreign holdings.

About NT$15.2 trillion ($483 billion) of the insurers’ assets are exposed to exchange-rate risk, based on regulatory calculations that exclude foreign currency–denominated policies. Currently, about 60% of that exposure is hedged.