Spanish Stocks Notch Best Year Since 1993 as Banks Drive Rally

TL;DR

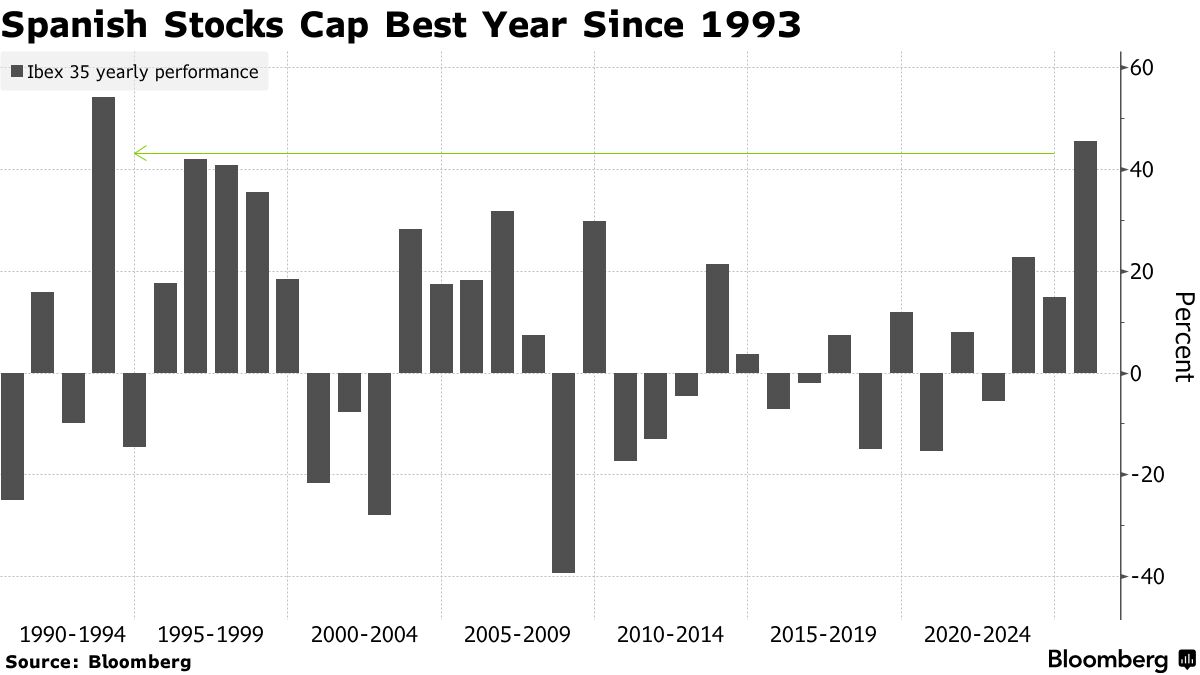

Spanish stocks are set for their best year since 1993, driven by strong bank performance and a brightening earnings outlook. The Ibex 35 Index has gained 50%, with banks like Santander and BBVA leading the rally, while fundamentals remain favorable for continued growth.

Tags

Spanish stocks are poised for their best showing since the early 1990s and strategists predict more gains to come thanks to a brightening earnings outlook.

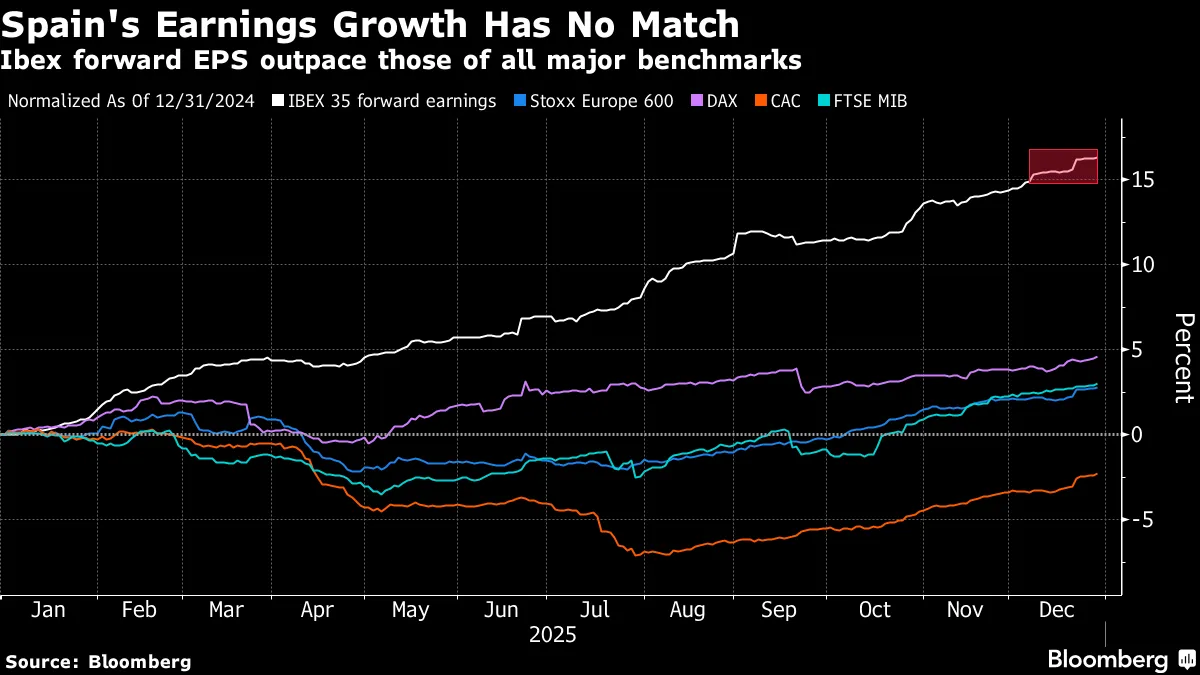

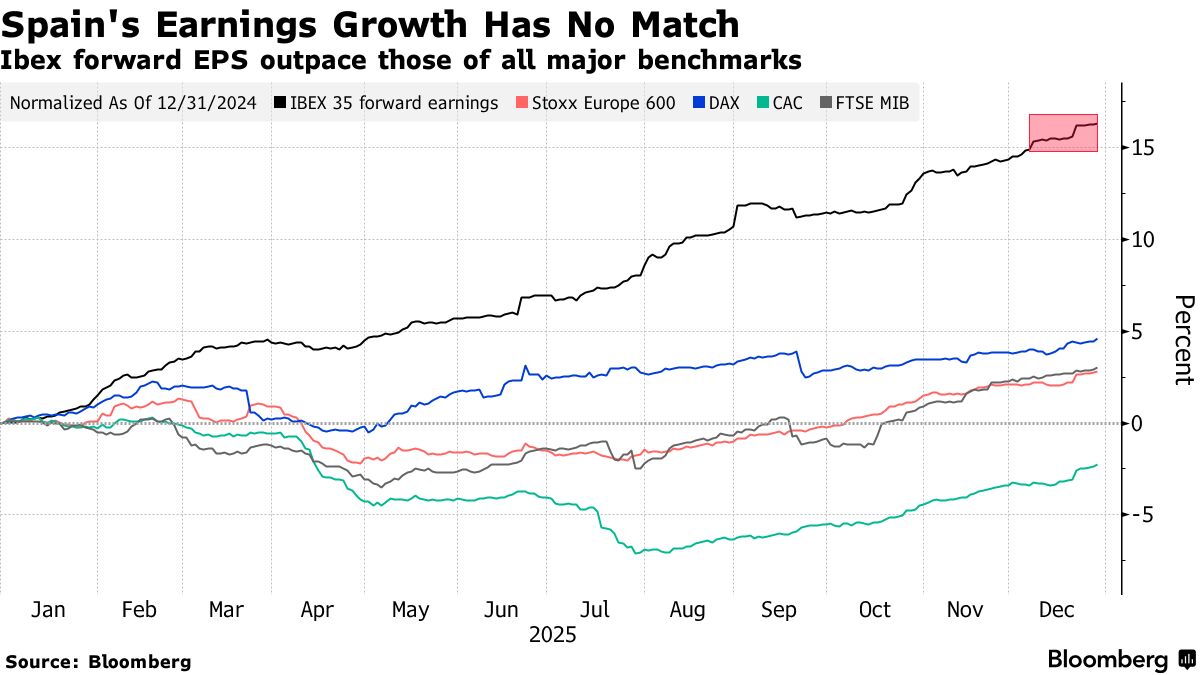

The country’s benchmark Ibex 35 Index had gained 50% this year through Tuesday’s close, which would be the most in 32 years and make it the best-performing major market in Europe. Estimates for Spanish companies’ earnings growth have risen more than 15% this year, outpacing European peers.

With comparatively little exposure to US markets and President Donald Trump’s trade tariffs, Spanish stocks are trading at a record high. Low unemployment and benign inflation helped the country win credit-rating promotions from the three main agencies this year.

The earnings outlook makes Spain’s stock market “completely different,” said Mabrouk Chetouane, global head of market strategies at Natixis IM Solutions, at a presentation in Madrid on Dec. 11. “It is driven by something which is fundamental and solid.”

Read more: In Spain and Italy, Banks Drive a Long-Awaited Stocks Recovery

Banks contributed the majority of the gains. Six of the top 10 performers were lenders, led by Banco Santander SA, Unicaja Banco SA and BBVA SA, whose share prices have more than doubled in the year. Santander and BBVA are now the two biggest banks by market capitalization in the European Union.

The Ibex’s top performer, meanwhile, owes its gains to investors’ voracious appetite for defense firms as Europe races to rearm amid Russia’s ongoing invasion of Ukraine. Indra Sistemas SA, which supplies sensors, radars and other electronic systems for airplanes, boats and armed vehicles, has jumped 185% in 2025.

The rally has left Spanish stocks looking less cheap and the benchmark now trades at about 14 times expected earnings — above its average long-term valuation level. That’s still a nearly 8% discount compared with the broader Stoxx 600 gauge.

Strong demand for credit from companies and households suggests the Ibex’s gains have room to run in 2026, Natixis’s Chetouane said.

“Fundamentals remain favorable,” he said.