AI Funding to Drive Record Year for Top-Rated Company Bond Sales

TL;DR

Companies in the US and Europe plan record high-grade bond sales in 2026, driven by AI funding, debt refinancing, and M&A. Despite strong supply forecasts, investors may demand wider spreads due to AI bubble concerns and fading high yields.

Key Takeaways

- •Record high-grade bond issuance expected in 2026, with US sales potentially reaching $2.25 trillion, fueled by AI expansion, refinancing needs, and acquisition financing.

- •AI-related debt sales alone could double to $400 billion, part of a broader $3 trillion investment boom in AI, cloud computing, and data centers by 2029.

- •Risks include potential credit spread widening as investors seek compensation for AI uncertainty and as high yields fade, with forecasts suggesting spreads could increase to 1-1.1 percentage points in the US.

- •European issuance is also set to rise, boosted by US companies selling euro-denominated bonds and higher redemptions, with total euro high-grade bonds projected to hit a record €836 billion.

- •M&A activity revival and over $1 trillion in debt refinancing will further drive bond supply, though credit quality may erode as companies take on more debt for shareholder value.

Tags

Companies across the US and Europe are preparing to sell a record amount of high-grade bonds in 2026, testing investors’ appetite as yields drift lower.

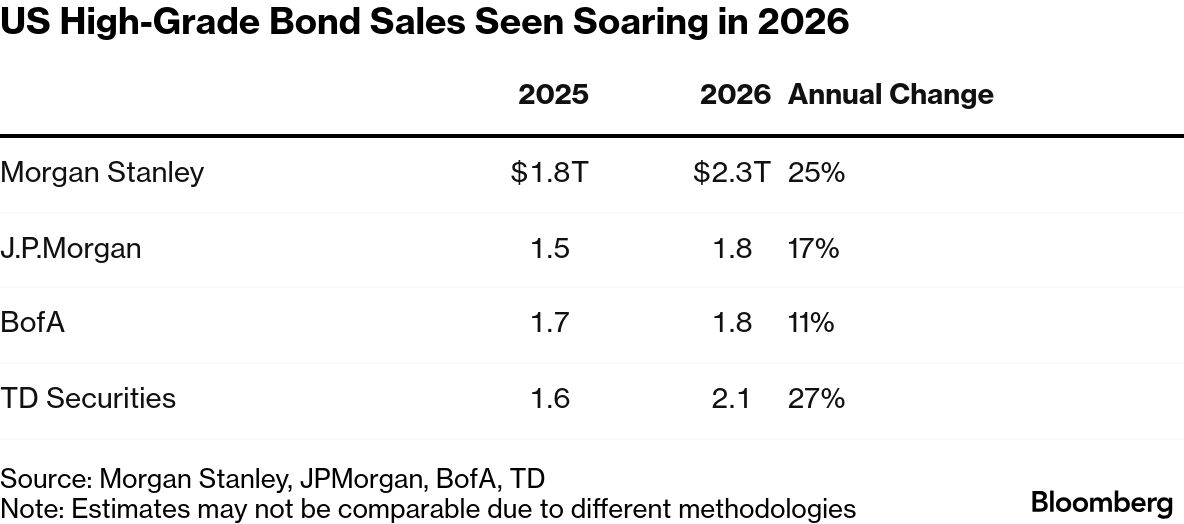

Morgan Stanley strategists predict more than $2 trillion in US investment-grade debt sales to hit the market next year, which would be the most ever. That’s expected to be driven by AI expansion projects, refinancing of looming maturities and acquisition financing.

The upbeat sales forecast comes despite questions on how much longer the current credit boom can run. Investors are expected to start demanding wider spreads to buy corporate debt as yields fall and concerns about an AI bubble become harder to ignore.

“The credit cycle should burn hotter before it burns out,” Morgan Stanley strategists including Andrew Sheets wrote in an early December note to clients, anticipating that US high-grade supply will jump 25% next year to $2.25 trillion.

Note: Estimates may not be comparable due to different methodologies

After years of caution, companies appear ready to take bigger risk. They’re encouraged by cheaper funding, looser regulation, and what the bank calls the biggest capital-spending cycle “in a generation,” the strategists wrote.

Debt sales tied to AI alone are expected to more than double to $400 billion next year, Morgan Stanley says.

That jump is part of a much bigger investment boom. Spending on AI, cloud computing, and data-center build-outs is projected to reach a combined $3 trillion by 2029, and debt is “quickly becoming the funding tool of choice,” according to Bloomberg Intelligence.

Morgan Stanley estimates that massive cloud-computing companies known as hyperscalers — a group that includes Alphabet Inc., Amazon.com Inc., Meta Platforms Inc., and Oracle Corp. — have room to issue as much as $700 billion of additional debt without triggering a single credit-rating downgrade.

While JPMorgan Chase & Co. also forecasts an all-time high for investment-grade debt issuance next year, Bank of America Corp. expects sales of such debt to jump 11% next year to $1.84 trillion — still short of 2020’s record of roughly $1.86 trillion.

Still, risks exist, especially for companies spending big on AI, with investors waiting to see how those bets play out.

“We might need to see spreads keep rising a little bit to compensate for the uncertainty behind this shifting trend in AI,” said Collin Martin, head of fixed income research and strategy at Charles Schwab & Co.

But not everyone is worried. The hyperscalers “are some of the highest-rated companies in the history of the credit market,” said Vishwas Patkar, head of US corporate credit strategy at Morgan Stanley. “There’s not necessarily credit risk being added.”

Issuance in Europe

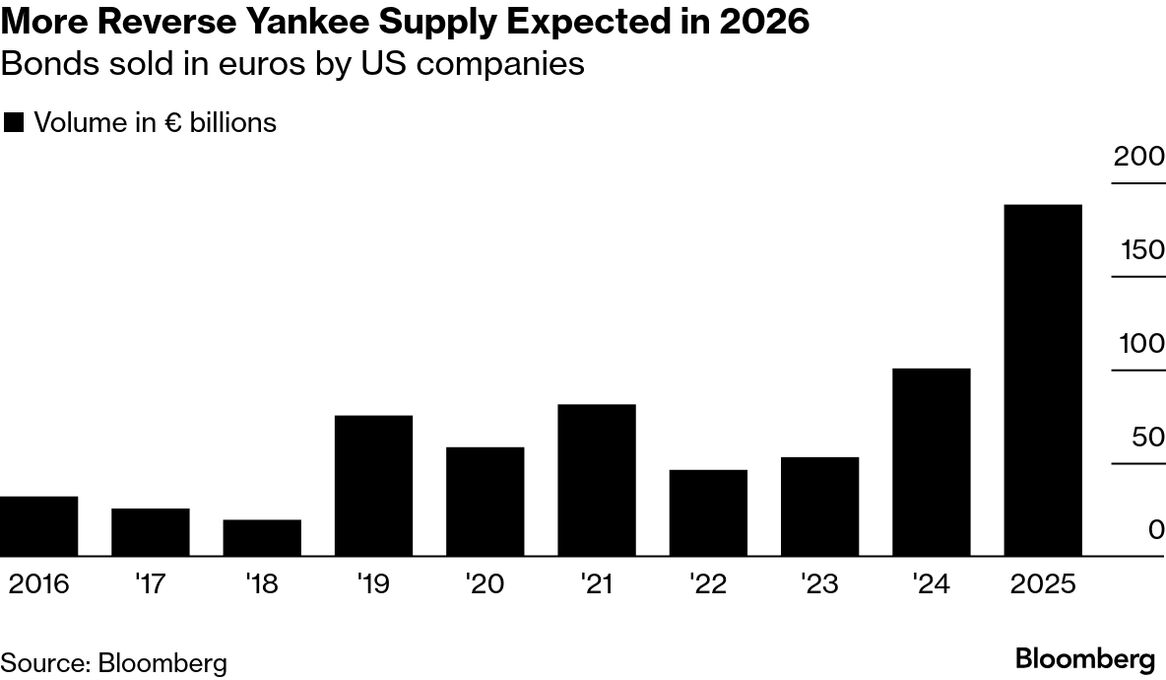

US companies selling euro-denominated bonds are also set to help drive record issuance in Europe. So-called reverse-Yankee supply climbed to a record €188.1 billion in 2025, including financial and non-financial debt, according to data compiled by Bloomberg. Most forecasters expect a further increase in 2026.

Bonds sold in euros by US companies

“Our research expects that 2026 could be a further record for euro corporate primary issuance”, said Xavier Beurtheret, global head of corporate DCM at Credit Agricole, during a December virtual presentation. “US issuers should be very active next year just to take advantage of the cross-currency, which currently remains attractive for them, and to diversify their investors’ base.”

Total issuance of high-grade corporate bonds denominated in euros is seen rising more than 6% to a record €836 billion, also boosted by higher redemptions, according to Barclays Plc.

Other Reasons to Borrow

Apart from funding the AI boom, companies will also need to refinance more than $1 trillion in debt in 2026 as their existing obligations near maturity, JPMorgan estimates. The bank projects an increase of 17% in US investment-grade bond sales in 2026 to an all-time high of $1.81 trillion by its estimates. Forecasts by different banks often aren’t perfectly comparable because they may use different methodologies.

A revival in M&A activity after years of restraint is also set to boost bond supply. Deals expected to be at least partly funded with bonds next year include Kraft Heinz Co.’s planned spinoff of North American Grocery, and AT&T Inc.’s acquisition of Lumen Technologies Inc.’s consumer fiber operations, the bank says. Investment-grade bonds will also be issued regardless of whether Paramount Skydance Corp. or Netflix Inc. win the takeover battle for Warner Bros. Discovery Inc.

M&A-related issuance should reach $182 billion in 2026, a 21% increase year-over-year, according to JPMorgan.

Read More: Larry Ellison Pledges $40 Billion to Bolster Warner Bros. Bid

But with debt supply set to grow, it’s far less certain that demand will keep pace. Some of the forces that fueled investor appetite in recent years — including unusually high yields — are now fading. The Federal Reserve has already cut interest rates three times this year, and more reductions are expected in 2026.

Read More: US Credit Spreads to Widen on High Supply in 2026: Deutsche Bank

What’s more, credit quality — which has strengthened in the past few years after companies slashed leverage on recession fears — is now poised to start eroding, according to BofA. That’s as companies pursue heavy-debt financed deals to support shareholder value.

“We expect weaker fundamentals and technicals in 2026,” BofA’s Yuri Seliger and Sohyun Marie Lee wrote in a note to clients. “That means spreads should trade a bit wider.”

Spreads should widen to a range of 1 to 1.1 percentage point in 2026 from 0.75 to 0.85 percentage point, as the “period of excess demand ends,” Hans Mikkelsen, US credit strategist at TD Securities Inc., wrote in a note.

“The last couple of years have seen long periods of favorable technicals — basically excess demand due to attractive high yields, which led to extended periods of artificially tight credit spreads”, Mikkelsen said.

Spreads are also expected to widen moderately in Europe with fewer rate cuts expected for the next year. Deutsche Bank predicts a jump to 1.03 percentage point by the end of 2026 from 0.86 percentage point this year.