Japan’s Stock Market Has Strongest Start to the Year Since 1990

TL;DR

Japanese stocks have their best start to a year since 1990, driven by strong buying from foreign and domestic investors, with the Nikkei 225 hitting a record high. Factors include lower valuations compared to the US, improved earnings expectations, and pro-stimulus policies, though sustainability concerns and geopolitical risks persist.

Tags

Japanese stocks made their strongest start in several decades, buoyed by robust buying from overseas investors and individuals.

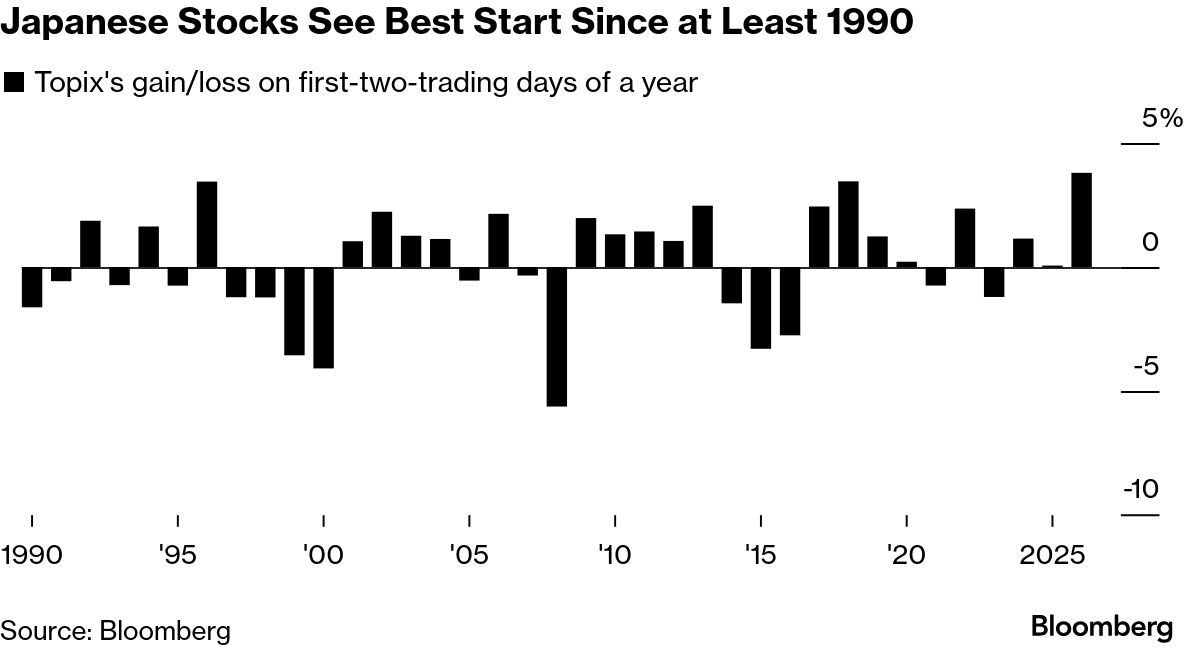

The Topix index and the Nikkei 225 climbed further on Tuesday, bringing their two-day gains to 3.8% and 4.3% respectively. That rally was the strongest for the first two trading days of a new year since at least 1990, Bloomberg-compiled data showed.

One noticeable factor was buying of major large-cap equities. “Japanese stocks still have lower price-to-earnings ratios compared to US stocks, and it seems foreign investors have strong appetite” for core stocks, said Hideyuki Ishiguro, chief strategist at Nomura Asset Management Co.

Some analysts said Japan’s equity rally is being further fueled by a surge in buying among domestic retail investors topping up their tax-free NISA accounts for the new year.

“Following yesterday’s sharp stock surge, some individuals may be buying today out of fear of missing out,” said Tsutomu Yamada, market analyst at Mitsubishi UFJ eSmart Securities Co.

The strength of Japanese stocks stems not only from the resilience of the US market amid hopes of interest-rate cuts there, but also from expectations for improved company earnings, enhanced corporate governance and Prime Minister Sanae Takaichi’s pro-stimulus policies.

Stock prices have mostly priced in a recovery in upcoming corporate earnings, according to Masayuki Doshida, senior market analyst at Rakuten Securities. “If earnings turn out to be better than the market expects, the Nikkei 225 could reach 55,000 and potentially go even higher,” he said. The index closed at an all-time high of 52,518.08 Tuesday.

However, concerns remain regarding the sustainability of the AI rally and geopolitical risks. Regarding the situation in Venezuela, the focus will now shift to the actions of China, Russia and India, Doshida said. “Depending on how things unfold, it wouldn’t be surprising if this becomes a geopolitical risk that draws attention,” he said.