Here’s What to Watch as Very Bullish Stock Investors Enter 2026

TL;DR

Investors remain bullish heading into 2026, but face challenges from high valuations, AI sustainability concerns, and economic risks. Key issues include lofty stock prices, earnings optimism, and potential market rotation away from tech. Positioning is heavy with low cash levels, increasing vulnerability to shocks.

Key Takeaways

- •Lofty valuations, especially in tech and AI sectors, pose a hurdle for stocks, requiring strong fundamentals to justify prices.

- •Earnings growth must meet high expectations globally, with reliance on AI and economic resilience in the US and other regions.

- •Market rotation from tech to cyclicals and laggards may continue into 2026, broadening market strength and aiding stock-pickers.

- •Heavy investor positioning with record low cash levels increases downside risks, such as labor market deterioration or AI theme challenges.

Tags

It’s been a strong year for stocks and investors look set to carry that bullish mood into 2026, with the consensus view that more gains lie in store.

Positioning in equities is rising and fund managers are maintaining record low levels of cash. Their expectations of a further rally are outweighing concerns over rich valuations for stocks, doubts about heavy artificial intelligence capex and upbeat earnings expectations.

But in the background, optimism about the economy is at risk of being challenged, especially given recent weakening in the US job market. The path ahead for interest rates will likely return to the forefront of investor worries, with just two US cuts priced for next year.

“Heading into 2026, global growth remains intact, but less certain,” said Seema Shah, chief global strategist at Principal Asset Management. “While the US economy continues to benefit from AI-driven investment, solid consumer balance sheets, and targeted fiscal support, structural risks are growing. Inflation is proving sticky, labor dynamics are shifting, and the Federal Reserve faces a delicate balancing act.”

Read more: Six Charts That Show How Stock Markets Got Reshaped in 2025

Here are some of the key issues for investors to consider in 2026:

Lofty Valuations

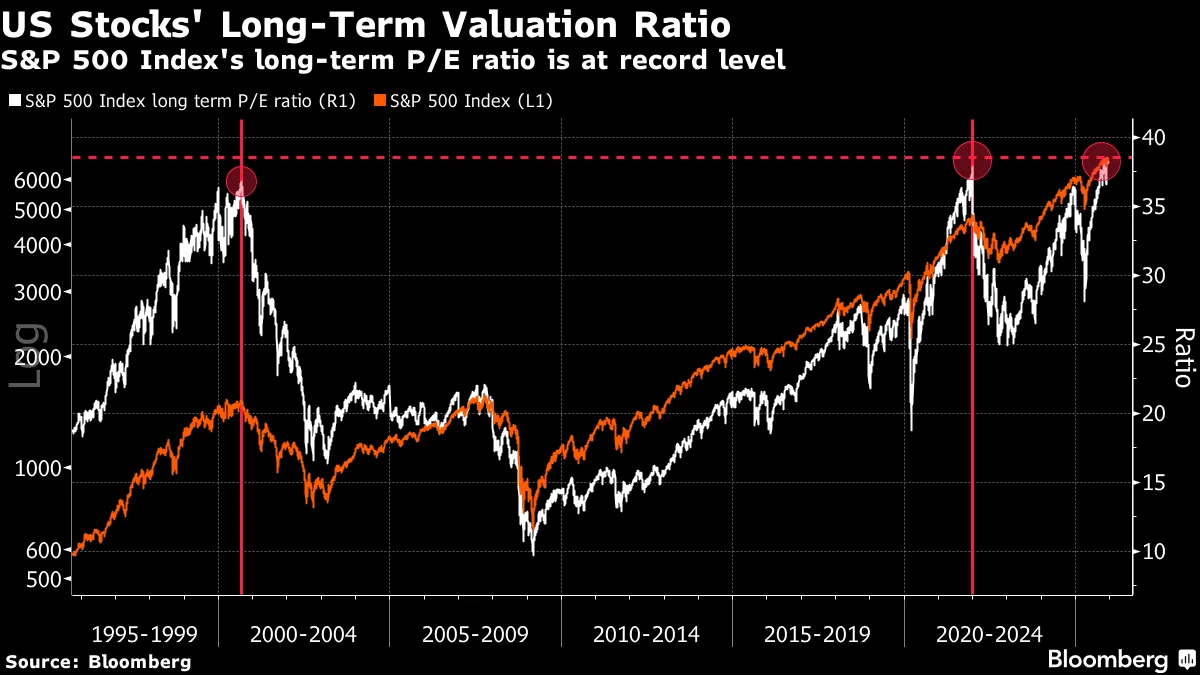

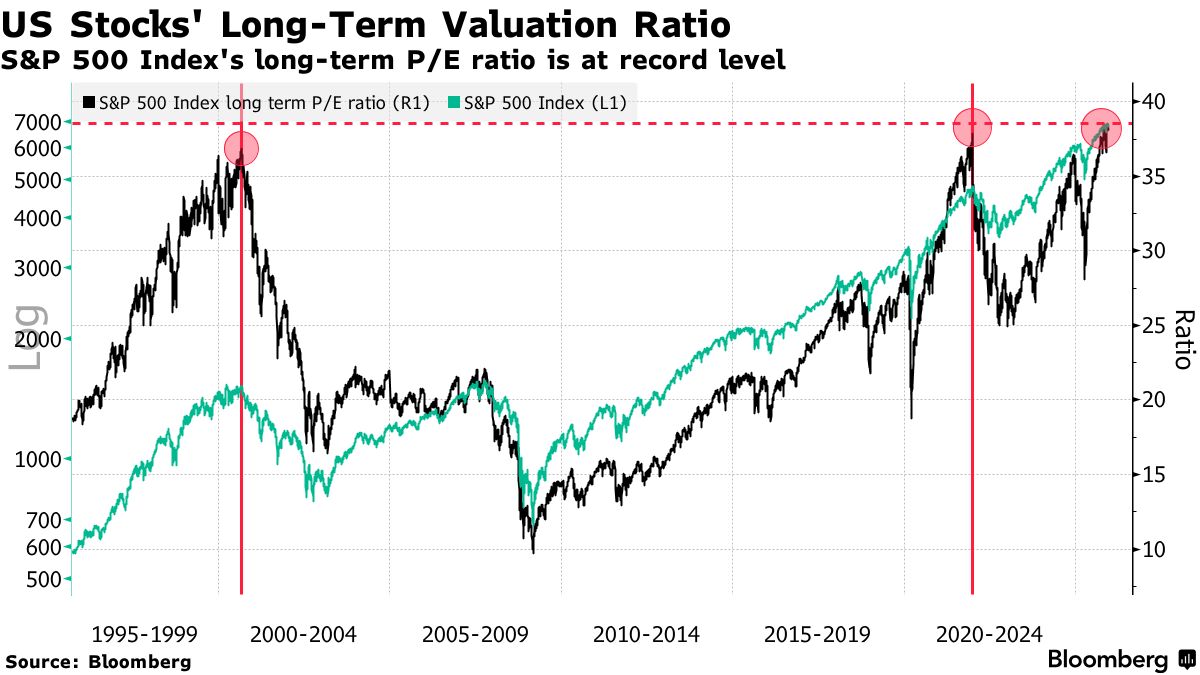

Buoyed by tech, the long-term valuation ratio of the S&P 500 is now at an all-time high. This metric has exceeded previous peaks that preceded major drawdowns, such as in the summer of 2000 before the dotcom crash, or in January 2022 when the market started to price a surge in interest rates.

“As we enter the fourth year of this current bull phase, ongoing bouts of volatility should be expected and may be more acute given implicit growth expectations,” said Citigroup Inc. strategists led by Scott Chronert. “To be clear, a high valuation starting point is a hurdle for the market, but not an insurmountable one. Rather, it puts increasing pressure on fundamentals to support the price action.”

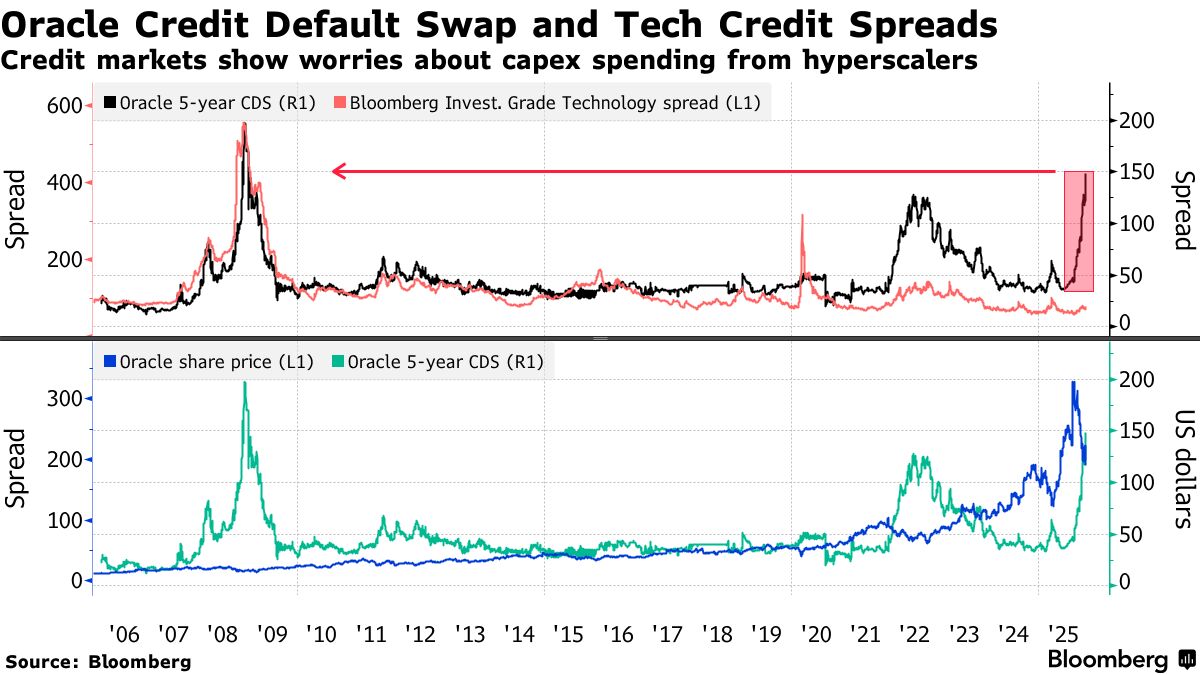

As valuations surge, talk of a bubble has been on the rise. At the forefront of worries is the technology sector and the AI trade. Hyperscalers have increased capex commitments to levels that could stretch their balance sheets. While this is not a problem for the entire market right now, bond vigilantes are ready to pounce. There was evidence of this when Oracle Corp.’s credit default swaps spiked to records as its shares plunged following disappointing results.

Earnings Optimism

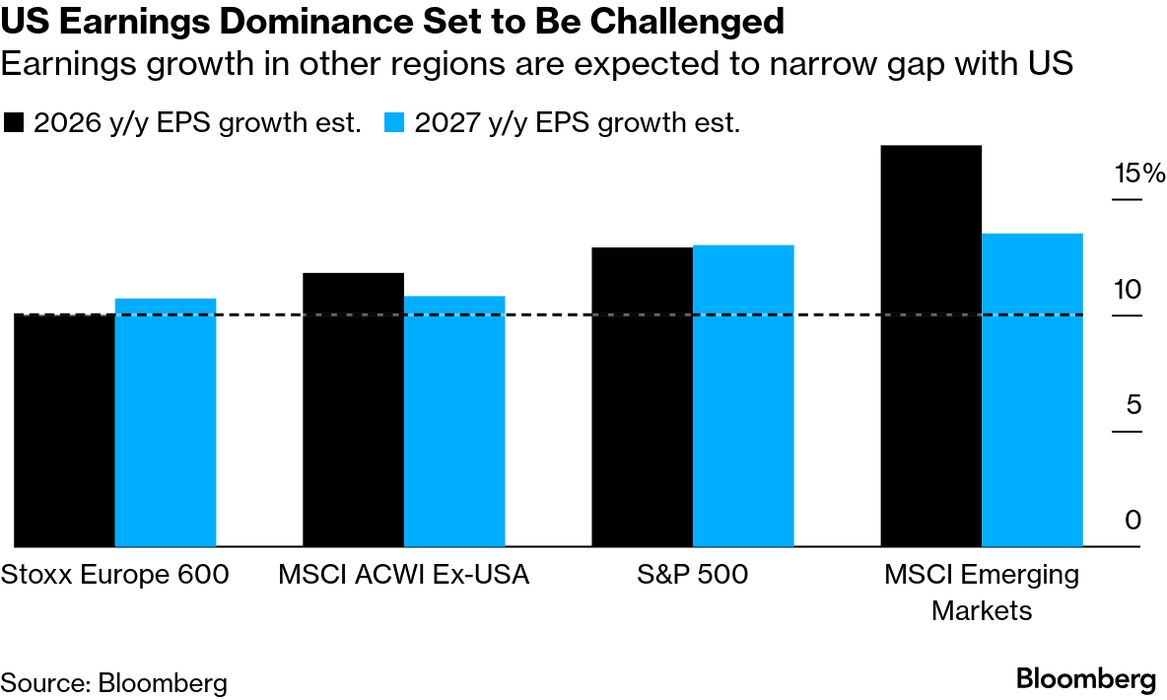

Corporates will have to deliver on earnings to sustain positive market sentiment — and this time the bar is high. Consensus expectations are for double-digit growth in all regions, with emerging markets in the driving seat. That view may be too optimistic. Asia will need to meet economic growth projections, Europe’s fiscal stimulus will have to feed into corporate bottom lines, while in the US, growth is dependent on the AI revolution rolling on and on a resilient job market.

Earnings growth in other regions are expected to narrow gap with US

Stock Rotation

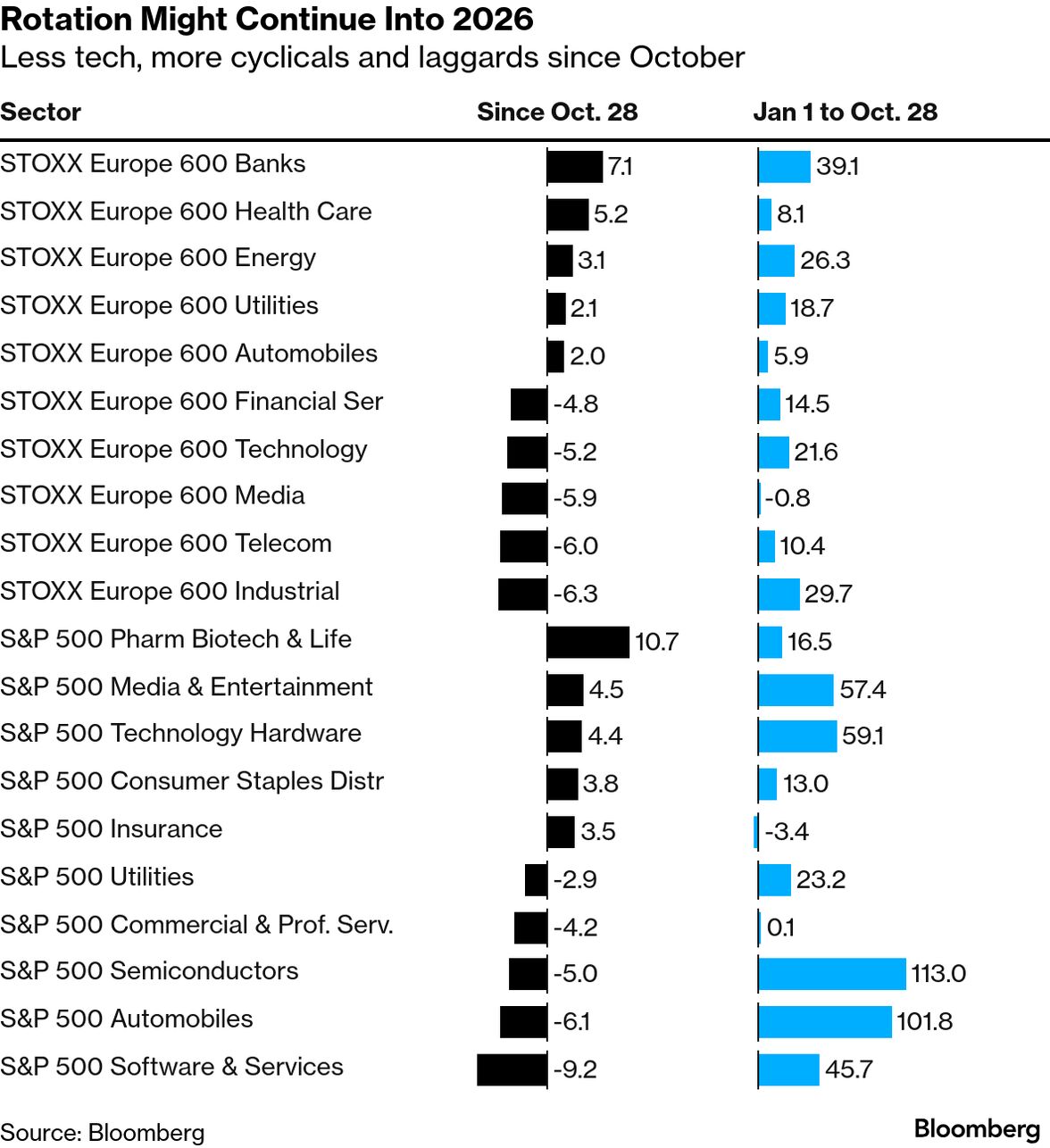

Investors have been rotating their allocations for the past two months as the AI and semiconductor trade stalls and more attractive options arise elsewhere. It’s a pattern on display in both the US and Europe, although the details differ between the regions. Rotation helps to broaden strength within the market as it sees investors pursuing a mix of stocks exposed to the economy, defensive positioning and wagers on laggard sectors.

As AI keeps facing questions over returns and sustainability, chances are that investors might extend rotation in portfolio themes into next year. It’s likely that the next two or three earnings seasons might prompt further switching as investors gain insights into the health of various industries.

Less tech, more cyclicals and laggards since October

New Year Seasonality

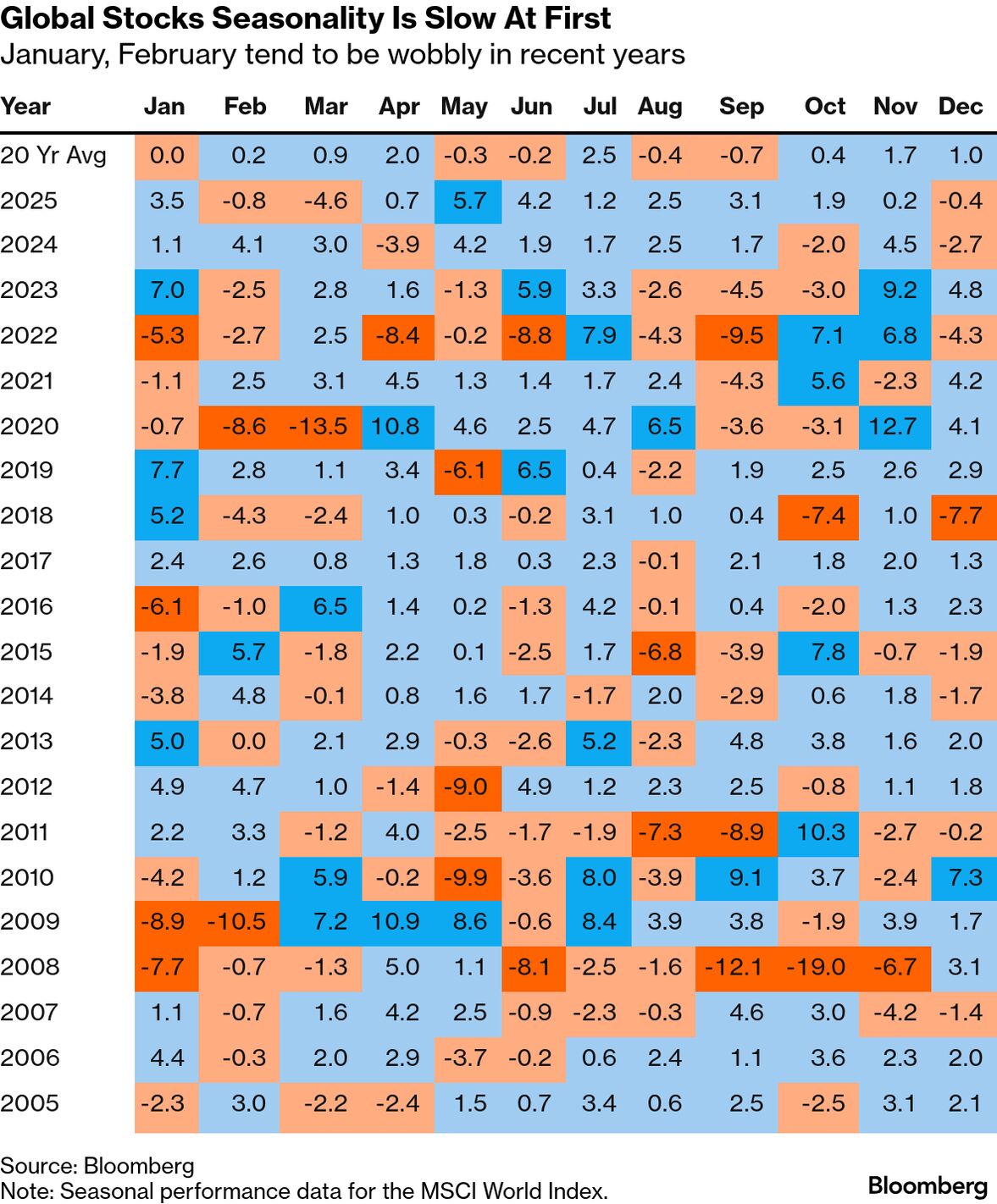

Seasonal appetite for risk taking as a new year begins is usually considered a tailwind for stocks. Fresh risk budgets, a reset of performance measures and inflows into pensions are some of the factors that typically provide a boost.

While the outlook for stocks screens as positive overall in the first quarter and into April, January and February aren’t traditionally months of blockbuster performance. Recent years have proved mixed, with both strong gains and big drawdowns.

January, February tend to be wobbly in recent years

Note: Seasonal performance data for the MSCI World Index.

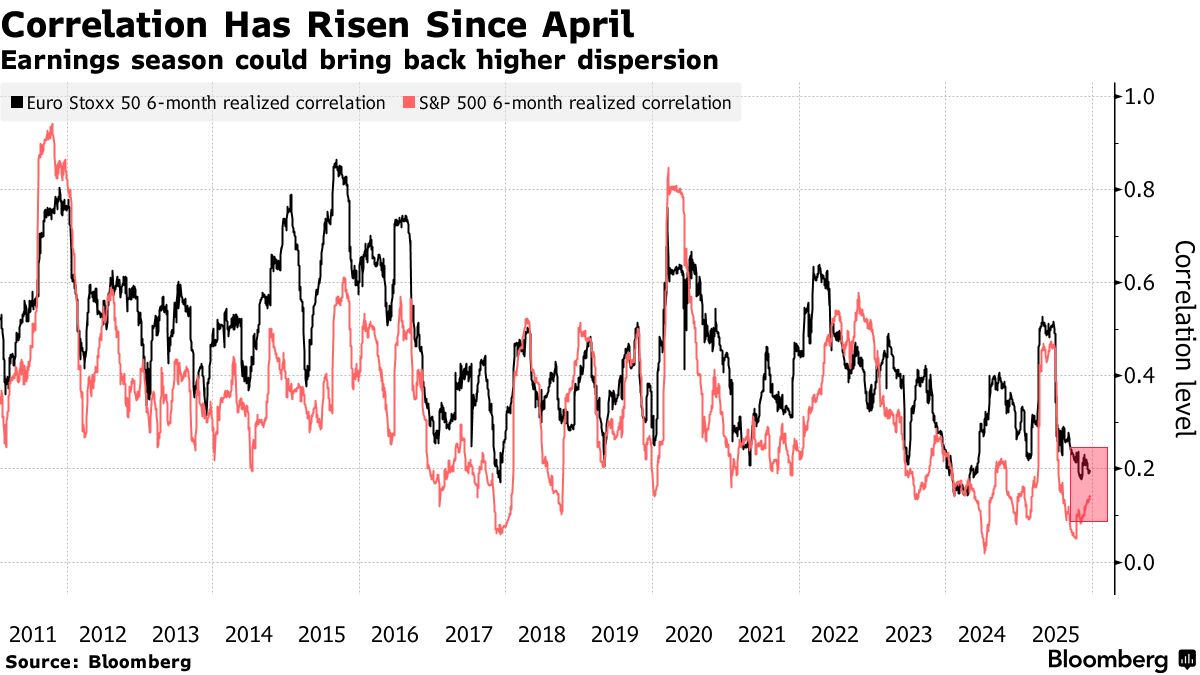

Stock Picking

With a pronounced concentration of returns in 2025 caused by the heavy weighting of megacaps in major markets, correlations between individual index members have collapsed, creating a paradise for stock-pickers. While 2026 could shape up differently, a broadening out of winners and a potential change in leadership among sectors are likely to help discretionary fund managers outperform their benchmarks.

“We remain pro-risk and see the AI theme still the main driver of US equities,” wrote BlackRock Inc. investment strategists led by Jean Boivin. “Yet this environment is ripe for active investing – picking winners and losers from among the builders now and later as AI gains start to spread, in our view.”

Heavy Positioning

Finally, positioning is looking rather full. According to the Bank of America Corp. fund manager survey, investors are heading into the new year filled with confidence about everything from economic growth to equities and commodities.

Combined exposure to these two asset classes, which typically perform well when the economy is expanding, has hit the highest since February 2022. Cash levels have plunged to just 3.3% of assets under management, a record low.

“The key downside risk is still the prospect that the US labor market deteriorates in a way that brings recession risk back onto the table,” wrote Goldman Sachs Group Inc. strategists led by Kamakshya Trivedi.

Markets are pricing a low risk of recession, while the biggest micro threat to US equities is a challenge to the AI theme, according to the Goldman team. They recommend diversifying equity exposure both internationally and across sectors, to include some more classically cyclical shares or cheaper defensive areas such as health care.