What to Watch in Commodities as US Pushes Ukraine Peace Deal

TL;DR

US-led Ukraine peace talks could reshape global commodity markets, including oil, metals, and gas. A deal may lift sanctions, alter trade flows, and ease price pressures, but uncertainties remain over implementation and timing.

Key Takeaways

- •Oil markets may see shifts if sanctions on Russia are lifted, affecting prices and global supply chains.

- •Metals and gold could experience changes in trade flows and central bank buying patterns with eased restrictions.

- •Gas prices in Europe might decline further if peace reduces supply disruptions and sanctions are removed.

- •Agricultural exports from Ukraine and Russia could stabilize, but infrastructure damage may limit near-term gains.

- •Shipping and tanker markets may adjust as peace could reduce the need for shadow fleets and high freight rates.

Tags

Fresh efforts to end the war in Ukraine are putting renewed scrutiny on what will happen to the flow of multiple raw materials that have been upended by the near-four-year conflict.

Russia’s invasion sparked a reordering of oil, gas and agriculture flows. Whether commodities markets are about to reshuffle again in the next few months will be shaped by if the conflict is halted. There’s also no clarity how quickly and when sanctions against Moscow will be lifted and in what order. Russia would also need to stick to any deal.

Over the weekend, US and Ukrainian officials met in Geneva with both sides describing the talks as positive, although Russia said is yet to see a revised plan. Should the talks continue to progress — and President Trump himself said on Monday “don’t believe it until you see it” — there could be wide-reaching ramifications for the world’s raw material markets.

Oil prices dipped on Tuesday after ABC News — citing a US official — said that Ukraine had largely accepted an agreement. After the report, Ukrainian President Volodymyr Zelenskiy said talks with the US were continuing. The White House subsequently signaled optimism, while warning that additional negotiations to address remaining sticking points would be necessary.

Several traders said they doubted a durable peace deal was imminent, suggesting that commodity markets are not yet fully factoring one in.

Here’s a rundown of how key commodities have been affected by the conflict, and what to look out for if a peace pact is reached.

Oil

Swaths of Russia’s oil and fuel flows are subject to heavy sanctions — with US restrictions on Moscow’s two largest producers mostly kicking in last week.

As a result, the country’s flagship crude is available to buy at some of its deepest discounts in years. Russian supplies are also building up at sea.

Still, since the conflict began, refiners in India, China and Turkey have bolstered their purchases of Russian barrels, helping keep the country’s oil flowing and topping up the Kremlin’s coffers.

Whether the latest sanctions have meaningfully dented that will become clearer in the coming weeks, but so far international prices haven’t reacted significantly to the curbs, suggesting little panic yet. Indian refiners and banks are also again warming to handling Russian supply, provided it’s from non-blacklisted sellers.

“Though the White House is clearly working hard to build support for the deal, we would remind our readers that we have had multiple false starts to date that have failed to produce a durable agreement,” RBC Capital Markets LLC analysts including Helima Croft wrote in a note to clients.

Crude in the Black Sea is trading below $40 a barrel

In contrast, diesel markets have been soaring, fetching some of their biggest premiums to crude in years, partly as a result of Ukrainian drone attacks on Russia’s refineries. A halt to the conflict would stop those strikes, potentially lifting the supply of fuel.

Metals

The invasion initially sent prices for industrial metals including copper, nickel and aluminum soaring, as traders and manufacturers braced for a curtailment in Russian supplies.

While metals ultimately kept flowing, Russia has been sending a bigger proportion of them to China — leading to a major reordering in global trade flows.

That trend accelerated last year after the US and UK blocked sales of newly produced Russian metal on the London Metal Exchange, and the EU imposed trade restrictions on imports.

Lifting those restrictions could revive a vital sales channel for Russian producers — and a supply source for traders. At the same time it could also help to invigorate sales to western manufacturers who began self-sanctioning their Russian purchases when the war began.

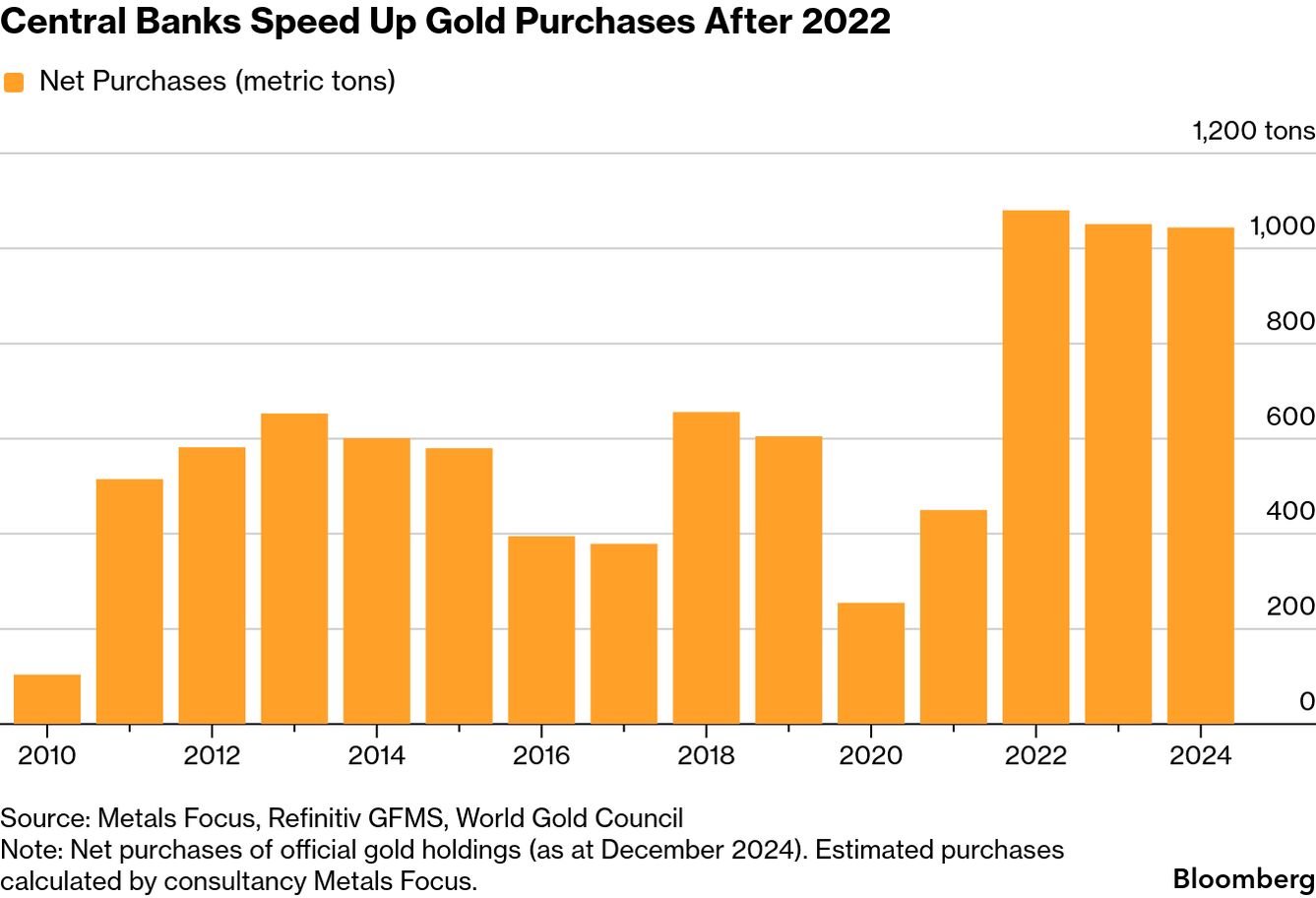

In the gold market, a key question will be whether any peace deal affects the pace of central-bank buying.

Led by China, huge volumes were purchased after Washington took steps to limit Russia’s access to the world’s dollar-based financial system. The bullish case for gold is built in part on a belief that the buying spree will continue, meaning sentiment could deteriorate if they slow. Still, many in the industry view it as part of a longer-running effort to break away from the US currency.

Note: Net purchases of official gold holdings (as at December 2024). Estimated purchases calculated by consultancy Metals Focus.

The treatment of frozen Russian assets could have implications for how developing economy central banks view the attractiveness of gold, which can’t be seized when stored domestically.

Gas

Europe’s reliance on Russian gas has declined sharply since the war began.

Until early 2022, Russia was by far the continent’s top gas supplier, accounting for 45% of its imports. That figure fell to 19% in 2024 — still ranking second — and is unlikely to rebound any time soon.

On Tuesday, an energy spokesperson for the European Commission said the bloc was still aiming to fully ban imports of Russian fossil fuels from 2027.

That doesn’t mean there will be no impact on the region’s gas prices from any peace pact. The negotiations have already helped push Europe’s benchmark futures below €30 ($34.70) a megawatt-hour for the first time in over a year, aided by a combination of high imports and forecasts for milder winter weather. That price is higher than before the invasion but a fraction of the peaks seen in 2022.

“While peace in Ukraine does not equal Europe resuming Russian gas flows, overall European gas prices would still feel downside if Russian energy sanctions are lifted, and other global buyers can access Russian gas/LNG,” said Florence Schmit, an energy strategist at Rabobank.

Progress toward peace could affect global gas balances before new projects, mainly in the US, start from late 2026. If sanctions on Moscow are eased, countries outside Europe might feel more comfortable buying from Russia. That, in turn, could ease competition for buyers in Europe in other markets.

Prices remain higher than where they were before the war in Ukraine

Agriculture

In the initial aftermath of the conflict, Ukraine’s grain flows slumped as ships were blocked from lifting cargoes from its Black Sea ports.

But after the initial dip, Kyiv managed to restore some supply to global markets. Russian crop exports, which not subject to sanctions, were unimpeded and the country continued to ship out its surplus.

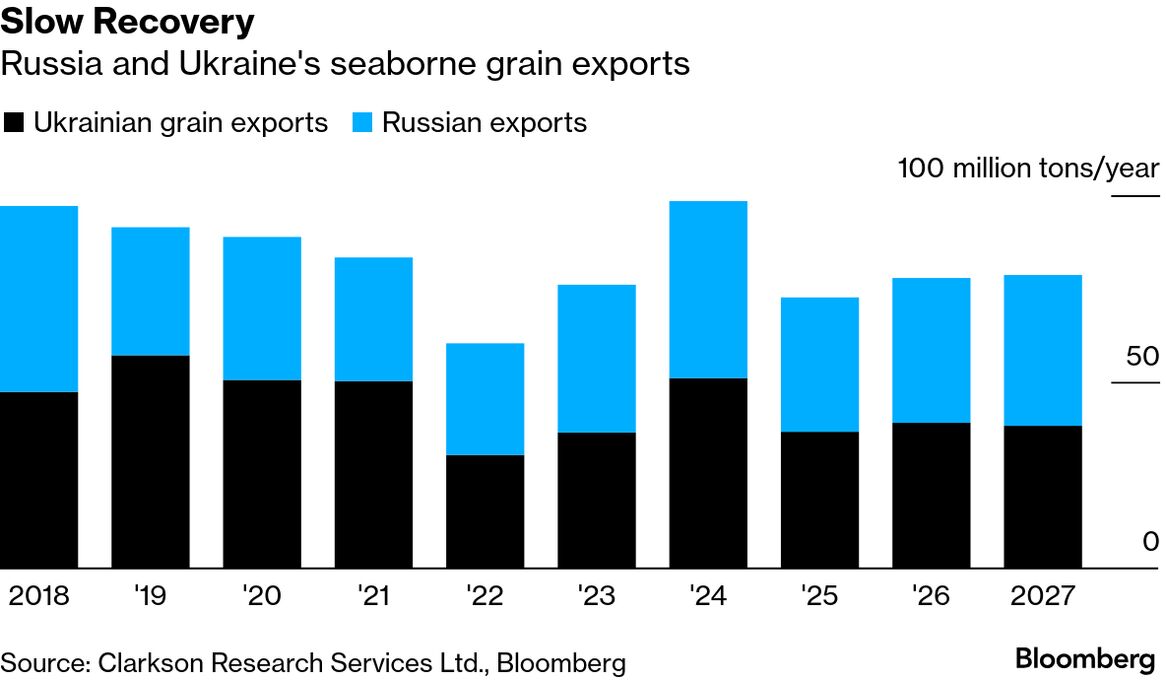

For agricultural prices, a potential peace deal might soothe markets but would probably bring limited near-term change. The two nations still account for about 14% of the seaborne grains market, according to data from Clarkson Research Services Ltd., a unit of the world’s largest shipbroker.

Russia and Ukraine's seaborne grain exports

Alexander Karavaytsev of the International Grains Council says peace would offer “immediate operational benefits,” while longer-term gains hinge on easing structural constraints.

Russia has largely maintained its exports and while Ukraine has also continued to export, it has suffered attacks on its railway network that could take time to repair, according to Andrey Sizov, head of consultancy SovEcon.

Shipping

There could also be implications for global tanker markets.

Earnings for the biggest vessels have soared close to $140,000 a day, the highest in more than five years, as Russian barrels get stuck at sea and some refiners seek alternative supplies.

Earnings hit highest since 2020 after sanctions on Lukoil, Rosneft

A deal would also raise questions about the fate of the shadow fleet of vessels that has been amassed to keep Moscow’s barrels moving.

Many of the blacklisted tankers have been forced to idle, or are restricted in the trades they can serve, tightening wider vessel supply.