The Man Who Got Eric Trump Into American Bitcoin Before 70% Rout

TL;DR

Eric Trump celebrated American Bitcoin Corp.'s Nasdaq debut in September 2025, but shares plunged 70% within months. CEO Michael Ho, who connected with Trump through Florida contacts, now leads the struggling crypto mining venture amid a broader market downturn.

Key Takeaways

- •American Bitcoin Corp.'s shares crashed 70% after its Nasdaq debut, despite Eric Trump's initial $500+ million windfall celebration.

- •CEO Michael Ho rose from obscurity through Trumpworld connections, leveraging access for rapid corporate growth during the crypto boom.

- •The company's decline reflects broader struggles of Trump-affiliated crypto ventures in the volatile digital currency market.

- •Ho and Trump blame the sell-off on early investors cashing out, maintaining confidence in the company's fundamentals and mining capabilities.

- •Ho's background includes early Bitcoin mining, luxury car sales, and previous legal disputes with crypto firms like MARA Holdings.

Tags

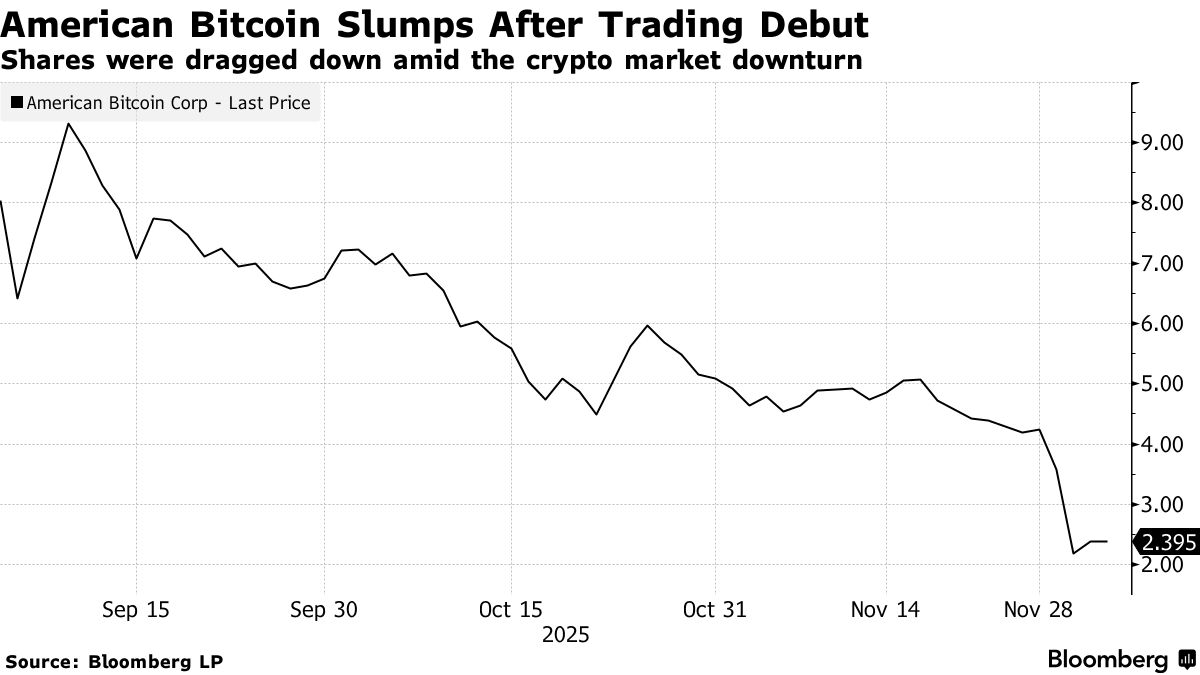

Eric Trump rang the Nasdaq bell in September to celebrate a more than $500 million windfall from American Bitcoin Corp.’s trading debut. Three months later, the shares have cratered 70%.

Standing beside him that day was a little-known Canadian now at the center of the meltdown: Michael Ho, who helped sell Trump on the venture over dinner at the US president’s Florida golf club and now serves as the company’s CEO.

His rise from a precocious Vancouver car dealer to the head of a Nasdaq-listed company underscores how access to Trumpworld became a fast route to riches during the 2025 crypto boom — and how quickly the music is stopping as the industry grapples with another downturn.

The slide in American Bitcoin’s shares was stunning even in the highly volatile world of digital currencies and thrust the company among the Trump-affiliated ventures that have been hammered since the crypto markets started sinking two months ago. On Tuesday, when some early investors were freed up to sell their shares, the price tumbled 51% during the first half hour of trading and has since recouped only a fraction of the loss.

“Basically anything related to Trump has done quite poorly — and that’s not surprising because their operations are all on the highly speculative end of crypto,” said Todd Baker, a senior fellow at Columbia University’s Richman Center. “This particular venture, which combines the Trump brand and Bitcoin mining itself, suffered when there was a flood of potential sellers.”

As the share price swooned, Ho’s longtime partner Asher Genoot — now chairman of American Bitcoin and CEO of Hut 8 Corp. — and Eric Trump, the firm’s chief strategy officer, blamed the drop on temporary selling pressure and voiced confidence in the business.

“Our fundamentals are virtually unmatched,” Trump said on X, while noting he was holding on to all of his shares. He told Bloomberg News that American Bitcoin is “growing one of the best companies in the crypto space.”

Ho also attributed the slide to early investors taking profits on positions “that were significantly in the money.” He said the opening price on Tuesday was dragged down by sales during pre-market hours, when liquidity was thinner, and that he hasn’t sold any of his shares. “None of this changes our focus or our conviction,” Ho said in a written response to questions.

As CEO, it’s largely up to Ho to build out the less-than-one-year-old Bitcoin mining business, marking the most prominent stage of a career that until recently left him largely unknown.

Ho said his start during the primitive, do-it-yourself days of crypto mining has prepared him by making him “battle scarred,” as he put it during an interview in Singapore in October.

Born in Shanghai and raised in Canada, Ho ran his own luxury-car business while still a student at Simon Fraser University, according to a 2014 profile in the Vancouver Sun. A 2023 investor presentation said the import-export company he founded when he was 17 generated over $100 million in revenue.

He began mining Bitcoin in 2014 by using rigs made from milk cartons and gaming GPUs and went on to work as a middleman for companies like Riot Platforms Inc. and MARA Holdings Inc., helping them with energy infrastructure and mining equipment. Later, he sued MARA for $138 million, claiming the company had failed to compensate him for work on the acquisition of an energy supplier. A court ruled in Ho’s favor in July 2024. MARA is appealing the decision.

After the pandemic struck, Ho and Genoot were part of a push to sell stock in a hand-sanitizer business, SEC filings show. In 2020, the two started US Bitcoin Corp., a mining company, with financial backing from men who in 2018 settled SEC allegations of illegal promotion and manipulative trading of microcap stocks, according to a complaint by Massachusetts regulators. US Bitcoin agreed to pay $1 million to settle the state’s claims faulting it for failing to register the stock offering, without admitting any wrongdoing. US Bitcoin merged with Hut 8 in 2023.

Ho’s breakout came in late 2024, when he and Genoot were introduced to the Trump family through Palm Beach, Florida, contacts. “We first started having conversations toward the end of last year just through a lot of mutual friends who were in similar circles in Florida,” Ho said.

American Bitcoin launched in March through a deal with Hut 8, which gave the new company control of its mining fleet in exchange for a majority stake.

The new company’s stock initially took off once it started publicly trading, closing as high as $9.31 on Sept. 9. Even after it slid, Ho struck an upbeat tone during November’s earnings call, when the company reported a quarterly profit of $3.5 million on revenue of $64.2 million.

“Nasdaq told us during our bell ringing we’re probably one of the fastest public companies to have gone public from inception to bell ringing,” Ho said on the earnings call. “We’ve become one of the largest miners in the world — essentially overnight.”

But as the crypto selloff continued, the stock kept losing ground. Then, on Tuesday, as the lockup period expired, the price was swiftly cut in half before ending the day at $2.19.

On X, Trump expressed faith in the company’s competitive edge, saying it was able to mine Bitcoin at roughly half its spot trading price, has strong profit margins and is “climbing the BTC ranks daily.”

“I’m 100% committed to leading the industry,” he said.