Ethereum spot ETFs saw net outflows of $178 million yesterday, marking the fourth consecutive day of net outflows.

TL;DR

Ethereum spot ETFs experienced $178 million in net outflows on November 14, the fourth straight day of declines. BlackRock's ETHA led with $173 million out, while total ETF assets stand at $19.999 billion.

Tags

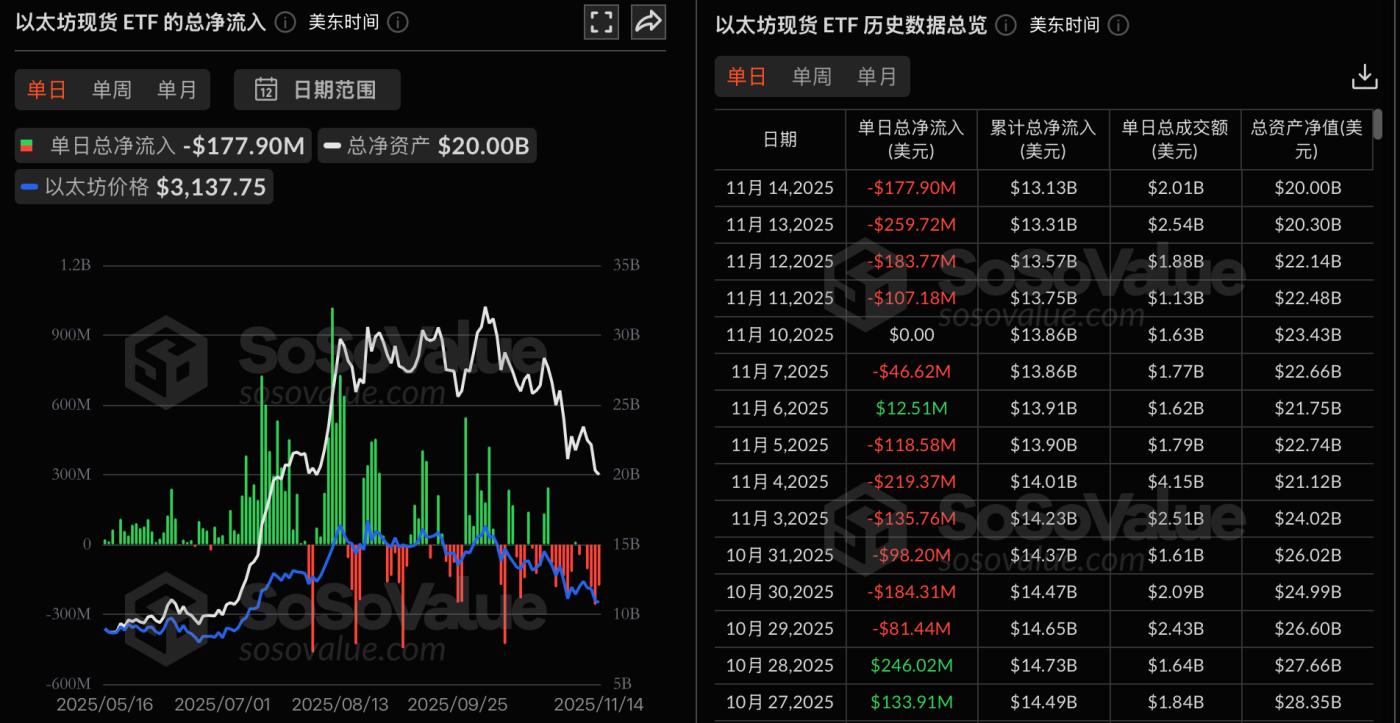

PANews reported on November 15 that, according to SoSoValue data, the Ethereum spot ETF saw a net outflow of $178 million yesterday (November 14, Eastern Time).

The Ethereum spot ETF with the largest single-day net outflow yesterday was the BlackRock ETF ETHA, with a net outflow of $173 million. The total historical net inflow for ETHA is currently $13.449 billion.

The second largest outflow was from the Grayscale Ethereum Trust ETF (ETHE), which saw a net outflow of $4.6306 million in a single day. ETHE's total historical net outflow has now reached $4.885 billion.

As of press time, the total net asset value of the Ethereum spot ETF was $19.999 billion, with an ETF net asset ratio (market capitalization as a percentage of Ethereum's total market capitalization) of 5.42%, and a cumulative net inflow of $13.133 billion.