Canada Budget Watchdog Doubts Carney Can Fulfill Deficit Promise

TL;DR

Canada's budget watchdog doubts the government can meet its deficit reduction pledge, with only a 7.5% chance of success. The fiscal plan is criticized as unsustainable, despite market and IMF support.

Key Takeaways

- •The parliamentary budget officer is skeptical about reducing the deficit-to-GDP ratio to 1.5% by 2029-30, citing a low probability of 7.5%.

- •Debt levels as a share of the economy are unlikely to decline long-term, limiting fiscal flexibility for future spending or revenue cuts.

- •Despite warnings, markets and groups like the IMF have shown support, with bonds rallying and praise for tax incentives.

- •The government defends its budget as addressing growth challenges and claims long-term sustainability, while the watchdog suggests creating an independent body to classify capital spending.

Tags

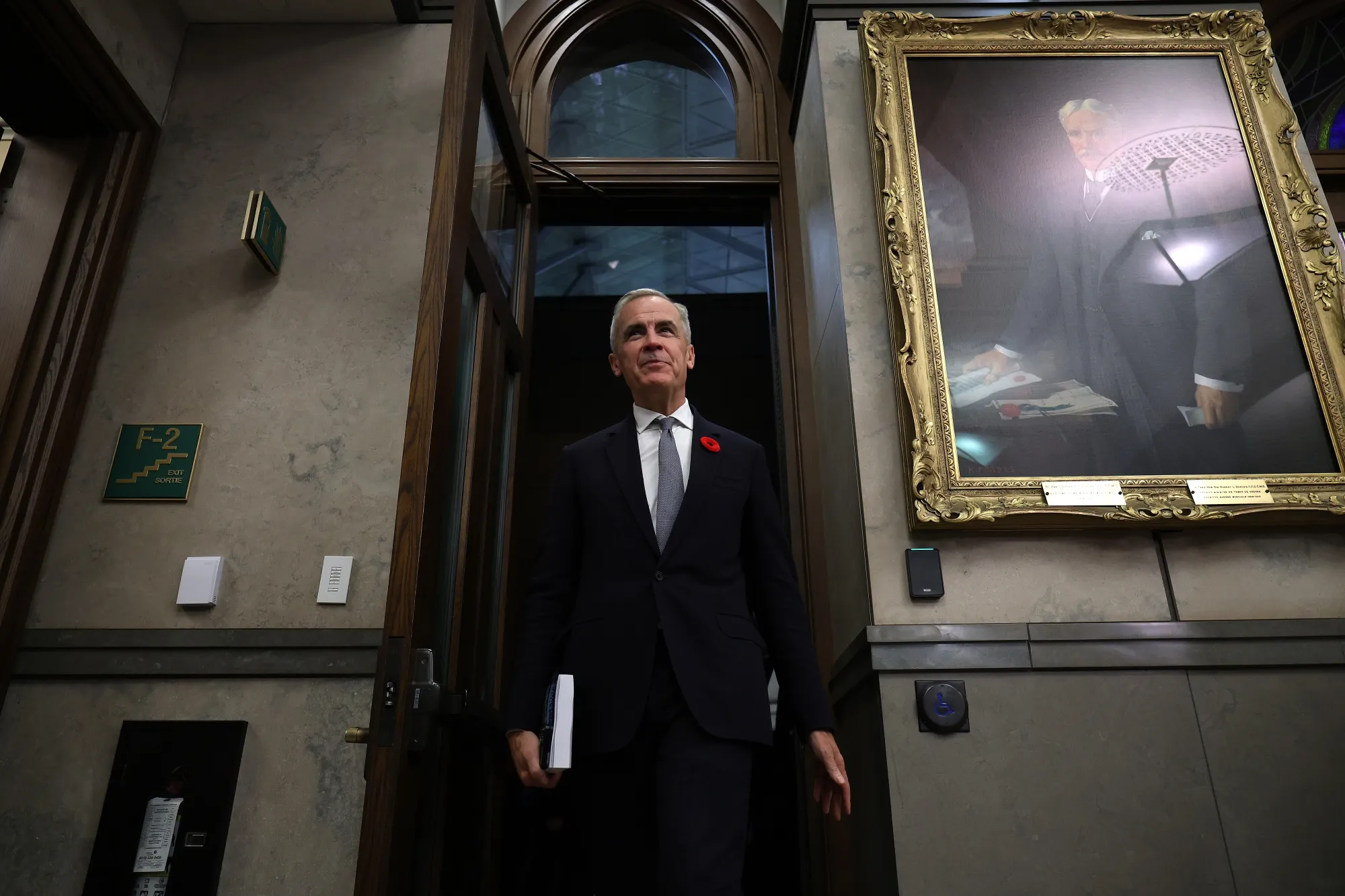

Canada’s budget watchdog is skeptical Prime Minister Mark Carney’s government will fulfill one of its key fiscal pledges.

The parliamentary budget officer says it’s unlikely deficits will fall as a share of the economy in coming years, suggesting the federal government won’t meet one of the fiscal anchors it outlined in its budget last week.

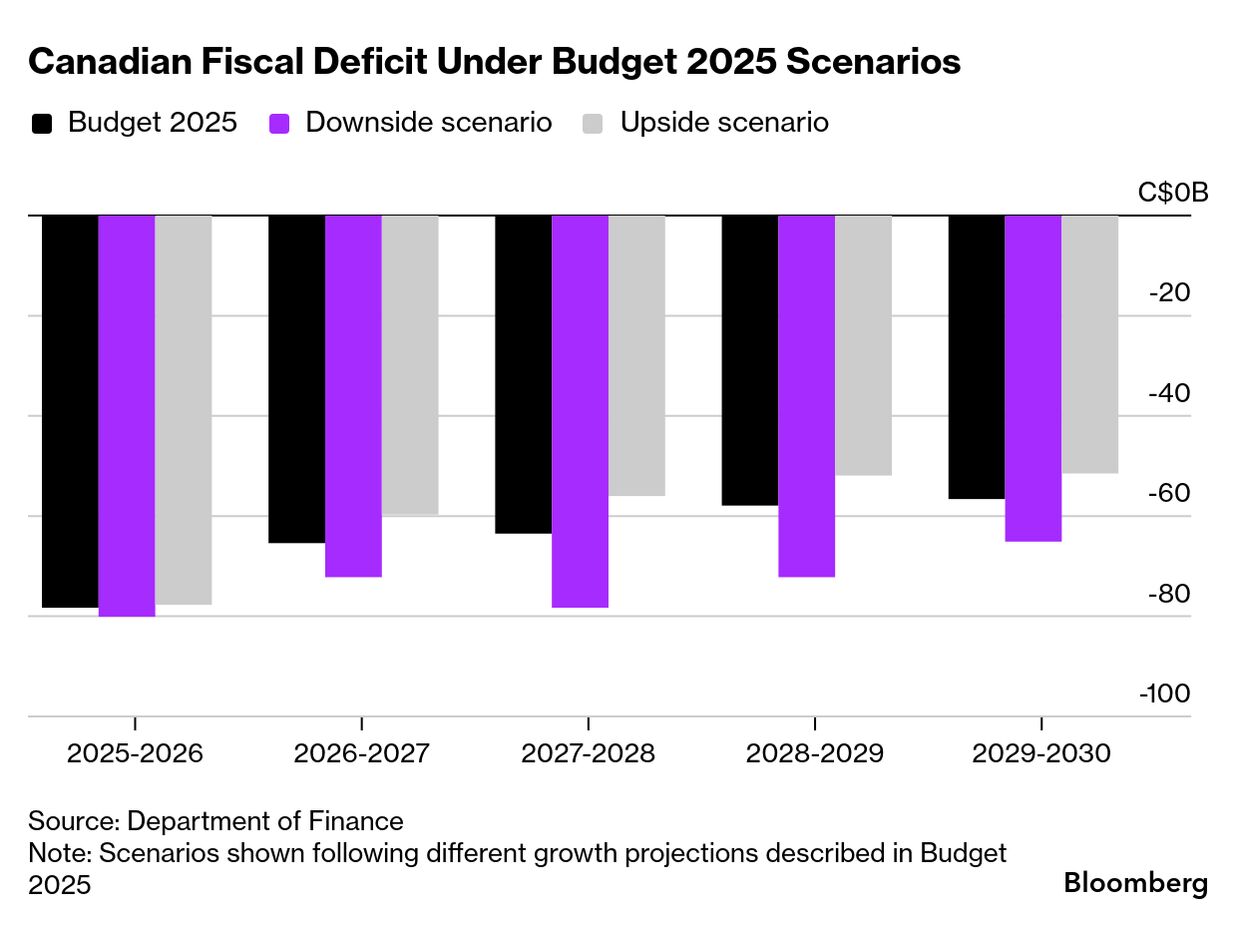

On Nov. 4, Finance Minister Francois-Philippe Champagne projected a C$78.3 billion ($55.8 billion) deficit for the 2025-26 fiscal year, representing 2.5% of the country’s gross domestic product and driven by major increases in spending on infrastructure, military and housing.

The government said the ratio would fall to 1.5% by 2029-30 “to ensure disciplined fiscal management for future generations.”

In the report Friday, the watchdog said stress-testing suggested there’s only a 7.5% chance of that taking place.

Note: Scenarios shown following different growth projections described in Budget 2025

Jason Jacques, the country’s interim parliamentary budget officer, has previously called the fiscal picture “stupefying” and “not sustainable.” In the report, he said it’s also unlikely that the country’s debt levels as a share of the economy would decline over the long run.

“There is limited fiscal room for the government to reduce revenues or increase program spending while ensuring the federal debt-to-GDP ratio in 2055-56 is at or below its initial (2024-25) level,” he said. The fiscal situation contrasts with that of the previous three years, which “would have provided more fiscal room to address future challenges and risks,” he added.

Despite the warnings, there’s little evidence of concerns from markets about the added debt. Government of Canada bonds rallied after the budget was released last week, and business groups and economists have generally praised changes to investment tax write-offs.

The International Monetary Fund has also said that relative to other Group of Seven countries, Canada has fiscal room to spend to boost the country’s lagging investment and productivity.

Read More: Bank of Canada Mulled Delaying Cut Until After Carney’s Budget

A spokesperson for Champagne said the budget addresses the broader growth and productivity challenges Canada has long faced.

“While we respect the PBO and the work they do to provide timely reports to parliamentarians, the report in question takes a narrow outlook of Canada’s fiscal and economic policy trajectory, looking at Canada’s budget in isolation — absent longer-term considerations and knock-on effects,” John Fragos said in a statement.

“Notably, the PBO itself has noted that the fiscal plan presented in Budget 2025 is sustainable over the long term.”

Carney has also pledged to balance operating expenditures with revenues by 2028-29, which requires a distinction between capital spending and the day-to-day costs of the government. In the report, the watchdog suggested the government “establish an independent expert body to determine which federal spending categories and measures qualify as capital investment.”

The government is searching for a permanent replacement for Jacques and has listed an ad on the job posting site Indeed.