Rupee Gains as RBI Returns to Defend Currency After Slump

TL;DR

India's rupee rebounded as the RBI resumed defending it after a sharp drop, with the currency gaining 0.4% to 89.08 per dollar. The central bank's intervention helped stabilize the rupee, which faces pressure from trade deficits and US tariffs.

Tags

Follow Bloomberg India on WhatsApp for exclusive content and analysis on what billionaires, businesses and markets are doing. Sign up here.

India’s rupee rebounded after the central bank stepped back in to support it, following a sharp drop on Friday when the authority appeared to ease up on the firm defense it had maintained in recent weeks.

The rupee gained as much as 0.4% to 89.08 per dollar on Monday after hitting a record low of 89.48 on Friday, when traders were taken off-guard by the RBI’s absence as the currency bears the brunt of steep US tariffs. It closed at 89.2375.

Monday’s recovery began with sharp offshore gains just minutes before trading began at 9 am local time in Mumbai. The RBI sold dollars both overseas and onshore to boost the rupee, according to people familiar with the developments.

“Without the RBI’s presence, the rupee could have opened around 89.50, and speculative bets could have been built for the currency to head lower,” said Kunal Sodhani, head of treasury at Shinhan Bank in Mumbai. “Several market platforms are lighting up and bid-ask spreads are widening, which is a typical sign of the RBI’s presence.”

The rupee’s weakness reflects India’s inflation gap with developed economies, and an annual 3%-3.5% depreciation has been historically seen, RBI Governor Sanjay Malhotra said in an interview to Zee Business telecast Monday evening. “Our effort is to contain excess volatility.”

The rupee is Asia’s worst performer this year, and further weakness may worsen outflows from local assets while raising inflation risks, given India is a net buyer of crude oil. The country’s trade deficit widened to a record in October, with exports to the US plummeting a second straight month after the imposition of 50% tariffs.

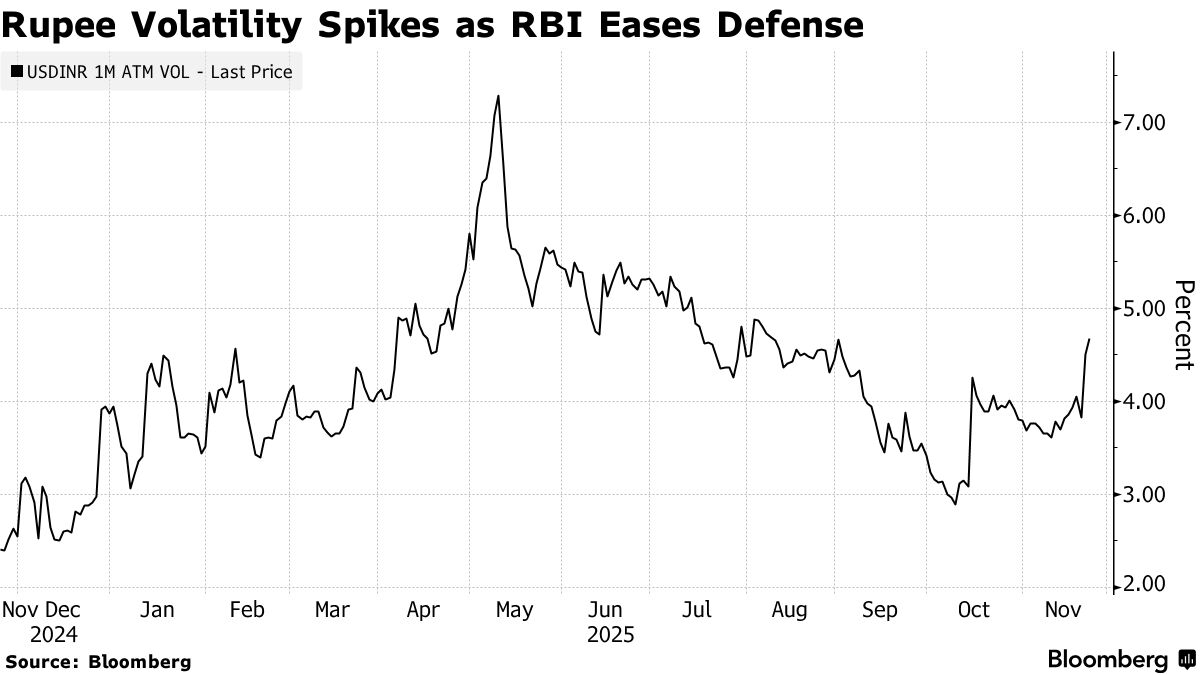

Even with Monday’s ascent in the rupee against the dollar, currency traders are pricing in greater volatility into the year-end.

— Ven Ram, cross-asset strategist. For full analysis, click here

“On the back of a higher-than-expected trade deficit, net financial flows have been on the weaker side, thereby pressuring the rupee to depreciate while RBI had been containing the volatility,” Yes Bank economists including Indranil Pan wrote in a note.

Delays in finalizing a trade deal are dampening sentiment, even after India recently suggested an accord was close. The US currently levies 50% tariffs on Indian exports, the harshest in Asia.

“It may be only a matter of time before USDINR pushes higher through 90, though we would expect the RBI to resume interventions to smooth any move lower in the rupee,” Barclays Plc strategists, including Mitul Kotecha, wrote in a note.

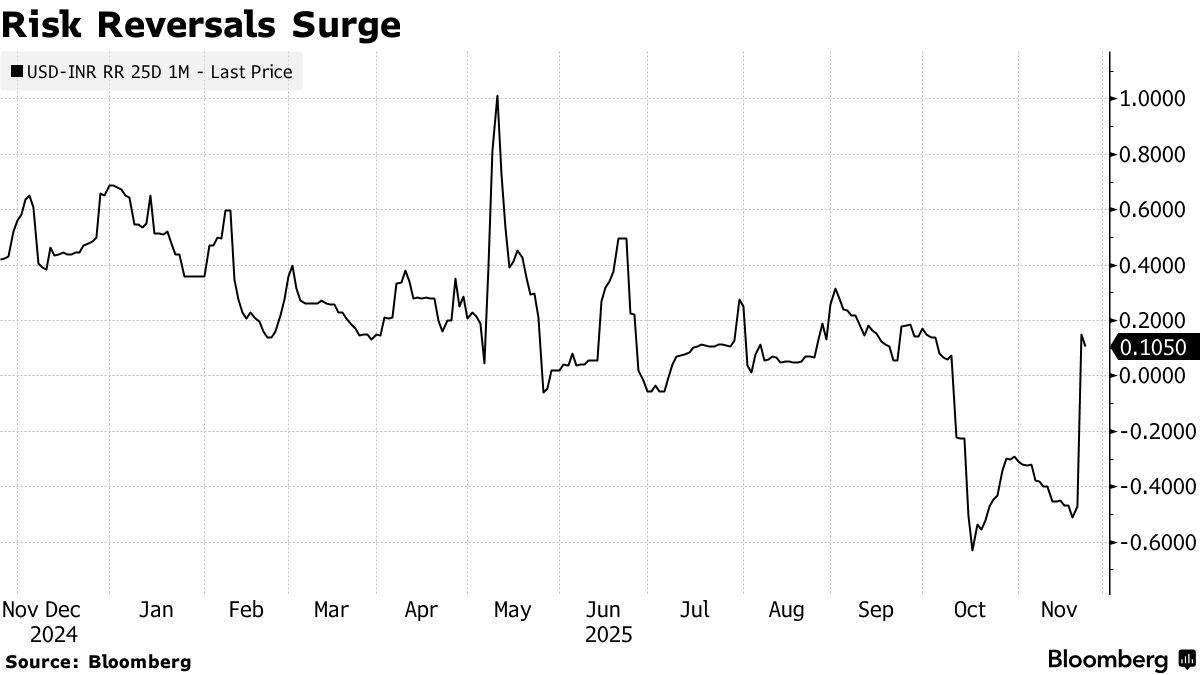

The 25-delta one-month risk reversal — which shows the demand for dollar/rupee calls relative to puts — jumped about 62 basis points on Friday as the rupee dropped past 89 to the dollar. That was the biggest single-day surge since March 2022.

Following its recent currency market interventions, the RBI’s foreign-exchange reserves have dropped around $10 billion since mid-September, data released after trading hours on Friday showed.