Franklin Templeton Sets Sights on a $500 Billion Pension System

TL;DR

Franklin Templeton aims to partner with Mexico's $500 billion pension system to invest in infrastructure, leveraging growth from reforms. The firm sees demand for ETFs and alternatives, with private investment key to boosting projects.

Key Takeaways

- •Franklin Templeton views Mexico's growing $500 billion pension funds as a strategic partner for infrastructure investments, driven by regulatory reforms.

- •The firm identifies demand from pension funds for affordable products like ETFs and alternative strategies, particularly in energy and manufacturing.

- •Private investment is crucial for Mexico's infrastructure goals, with $323 billion targeted by 2030, though execution depends on bankable structures.

- •Franklin Templeton plans creative hybrid investment structures with pension funds, focusing on local and international assets for future partnerships.

- •The firm is bullish on Mexico's economic prospects due to US manufacturing shifts and will prioritize bolt-on geographic acquisitions over large M&A deals.

Tags

Asset management behemoth Franklin Templeton sees Mexico’s $500 billion pension fund system as a potential partner in building up the country’s infrastructure.

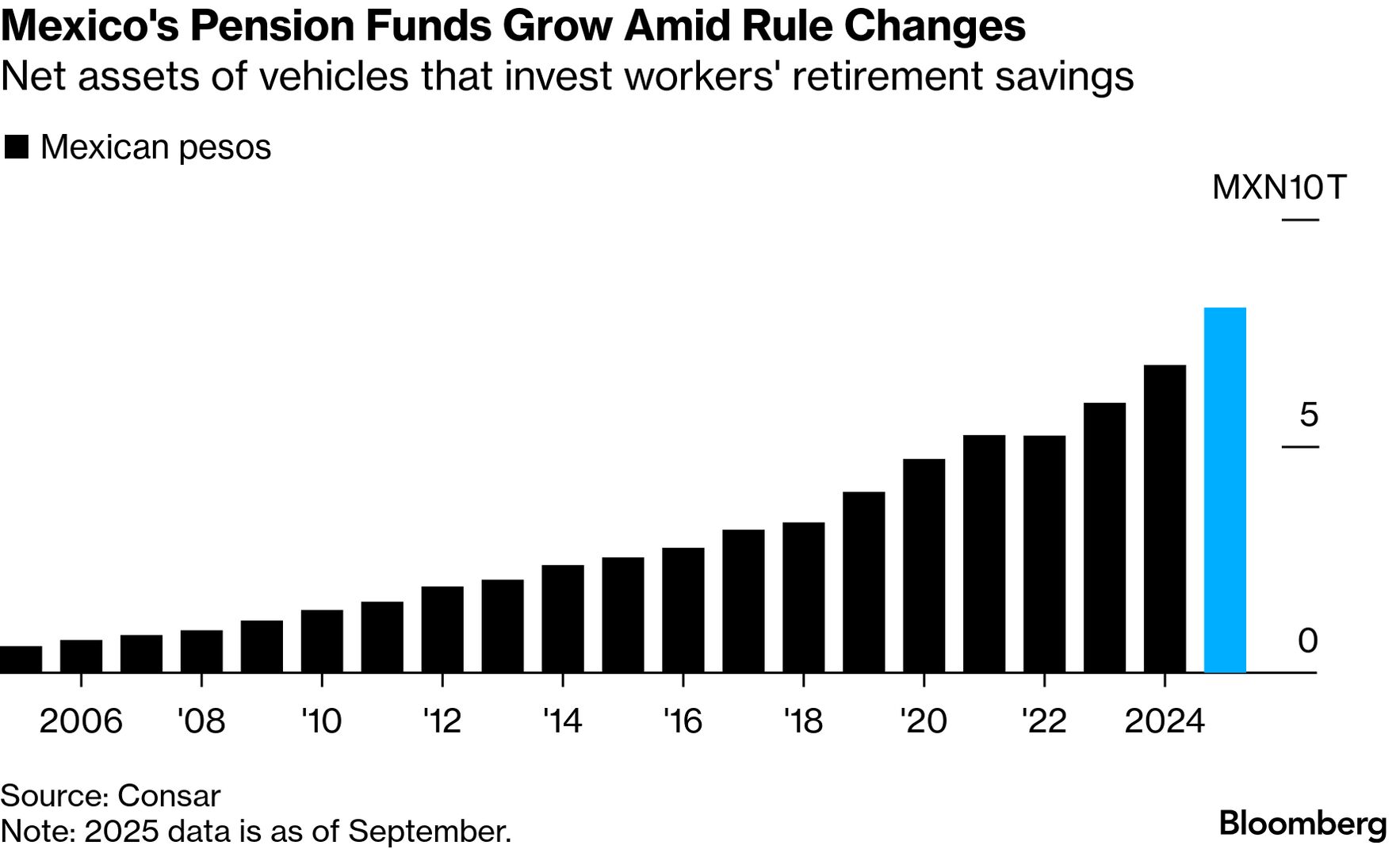

The investment firms, known as Afores, have surged in size amid reforms in the compulsory savings system that increased the number of workers that can access a pension and upped the level of contributions to retirement savings. As of January, the funds had 8.5 trillion pesos ($486.6 billion) in assets under management, with total workers’ savings in pension funds expected to climb to 12 trillion pesos in 2030, according to Consar, the regulator that oversees them.

“You look at the growth trajectory and that’s going to drive local markets, that’s going to drive investment,” said Chief Executive Officer Jenny Johnson during an interview at the firm’s Mexico City offices.

Franklin Templeton sees demand from the pension funds for affordable products like ETFs as well as alternatives strategies — with infrastructure an appealing subset.

“There’s obviously a desire to leverage that capital to be able to improve infrastructure, which is a great investment because it often has a stream of income, which is what is really attractive to people,” Johnson said.

Mexico’s government has said that private investment will be key to boosting infrastructure in the country, with a goal for $323 billion to be invested through 2030. Earlier this month, Finance Minister Edgar Amador unveiled an investment blueprint for some 1,500 energy projects and public works, which will be partially funded by private capital. Details on the specific investment vehicles have yet to be rolled out.

Credit grader Fitch Ratings said the approach could boost construction activity and create financing opportunities, but execution “will depend on whether Mexico can offer bankable structures that institutional investors and lenders can underwrite.”

Investing in infrastructure hand-in-hand with the country’s pension funds, particularly in energy and manufacturing, could be a future step, according to Chief Commercial Officer Daniel Gamba.

“That’s an area where we can be creative with the pension plans and working in hybrid structures” that invest both in Mexican and international assets, Gamba said. “I think that’s a big area of future partnership with the Afores.”

Net assets of vehicles that invest workers' retirement savings

Note: 2025 data is as of September.

A regulatory framework that allows capital to be deployed quickly and attractive returns will be key for the plan’s success, Johnson added.

Franklin Templeton, which has had offices in Mexico for 20 years, is bullish on the future of the country, predicting it will benefit from its proximity to the US amid the northern neighbor’s desire to shift away from China.

“We are actually very positive about the prospect of Mexico going forward,” Gamba said. “It’s not just because of the Afores, but when you look at the world and you see the US needing to actually rebuild some parts of their manufacturing, they’re going to come to Mexico.”

| Read More: |

|---|

| Mexico’s Pension Giants Eye Private Equity, Alternative Markets |

| AMLO Gets $852 Million Pension-Fund Backing for Iberdrola Deal |

M&A, Private Credit

The firm, which has been on an M&A spree during Johnson’s time in the top seat, will likely slow its pace of acquisitions going forward. Just after she became CEO, Franklin Templeton announced it was buying Legg Mason Inc. in a deal that more than doubled the fund giant’s assets under management, and the firm has made other sizeable acquisitions since then.

“When we look going forward, the bar is much higher,” Johnson said, adding that recent acquisitions were either about adding capabilities the firm didn’t already have, or about secular trends it wanted to participate in.

“The types of acquisitions we would do would be bolt-on geographic acquisitions,” she said, pointing to a recent deal to acquire private credit firm Apera Asset Management, which brought the firm’s alternative credit assets under management to $90 billion. “We would look for more local asset management.”

Investments in private credit — which has been critiqued for the risks that lie within — should be analyzed by the subsets, not the broader category, Johnson said. She highlights real estate debt, asset-backed and structured credit as appealing opportunities, while investment grade private credit may not necessarily pay enough for the lack of liquidity that’s baked in.

“The key is don’t look at it broad brush,” she said. “You never look at your fixed income portfolio that way. Do your work as you would in credit.”

Watch More: Johnson Speaks on Leading a $1.6 Trillion Company Amid Credit Risk and AI