ICICI Prudential AMC Trading Debut to Set Tone for Other Fund Houses Preparing for IPOs

TL;DR

ICICI Prudential AMC's trading debut will be closely watched as it could set the tone for other fund houses preparing IPOs. The listing comes amid India's strong IPO momentum and concerns about post-listing performance.

Key Takeaways

- •ICICI Prudential AMC's market debut could influence sentiment for upcoming fund house IPOs like SBI Funds Management

- •India's IPO market remains strong with annual proceeds nearing $21 billion, despite many recent listings trading below issue prices

- •TCS and HCL are emphasizing AI capabilities to counter growth concerns, with TCS generating $1.5 billion in annualized AI revenue

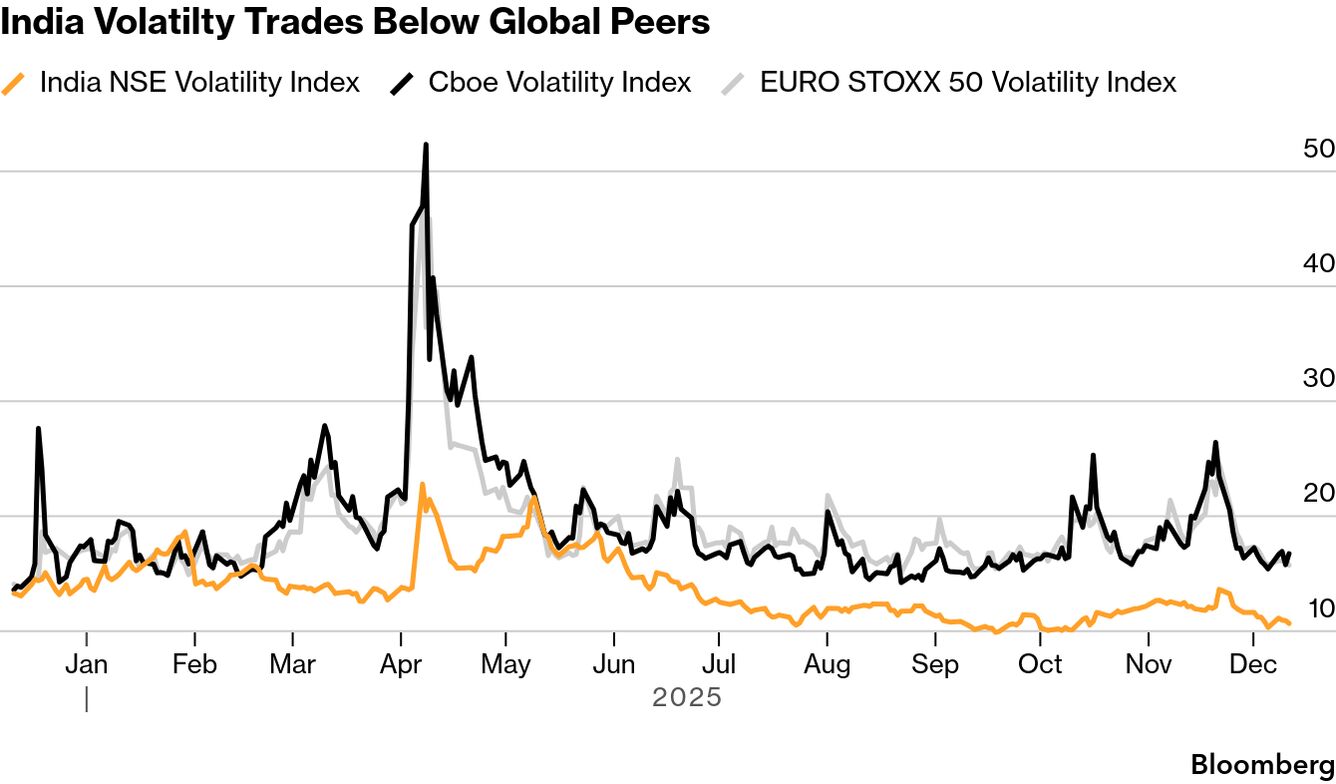

- •India's volatility index has decoupled from global trends and sits near 10, suggesting reduced equity volatility opportunities

- •Major IPOs expected in 2026 include Jio Platforms and NSE listing, potentially driving another record year for fundraising

Tags

Before the trading day starts we bring you a digest of the key news and events that are likely to move markets. Today we look at:

- TCS’s AI strength

- India’s IPO engine

- ICICI Pru AMC debut

Happy Friday readers. This is Ashutosh Joshi, an equities reporter in Mumbai. Local shares are bracing for a third straight week of losses even as key regional markets are firm this morning. A key Bank of Japan decision due Friday is worrying investors globally, with fears that a long-running global funding trade could start to unwind if the BOJ raises rates as widely expected — to the highest level in three decades. Back home, a clutch of stocks — including Swiggy, Waaree Energies, Premier Energies, and Bajaj Holdings — could be in focus ahead of their inclusion in the F&O segment starting Dec. 31. ICICI Prudential Asset Management’s market debut will also be closely watched.

TCS joins HCL in showcasing AI prowess

India’s large IT companies have been among the worst-performing names this year as doubts over their growth prospects hit shares. Against this backdrop, Tata Consultancy Services used its investor day to underline its intent to develop AI capabilities. Elara says TCS has generated $1.5 billion in annualized AI revenue, executing 5,500 AI engagements, and is moving up the value chain by helping clients anchor AI to their strategies. AI now contributes roughly 5% of the company’s top line. The update comes after HCL Technologies disclosed its revenue split, underscoring how India’s IT giants are leaning on AI to refresh their growth narrative.

India’s IPO boom poised to extend into 2026

That push to restore confidence extends to the wider capital markets. Even as about half of this year’s 350-plus IPOs this year are trading below their issue prices, fundraising momentum remains strong. Top banks, including JPMorgan and Goldman Sachs, are expecting a bumper 2026, with a deep pipeline led by potential blockbusters such as Mukesh Ambani’s Jio Platforms and the long-awaited NSE listing. Annual IPO proceeds are nearing $21 billion, marking a second straight record calendar and cementing India’s position as one of the world’s most active listing venues. Other candidates — including Manipal Hospitals, SBI Funds Management, PhonePe and Zepto — could help drive a potential record year for IPO proceeds.

ICICI Prudential MF listing to set tone

Near-term market sentiment may get an immediate test with the listing of ICICI Prudential Asset Management Co. Grey market indications suggest gains of more than 15%, which would rank the IPO among among the strongest large debuts this year, alongside LG Electronics India and Meesho. A strong showing would come at a crucial moment, as investors worry whether heavy issuance and uneven post-listing performance are cooling enthusiasm. A standout debut from the asset manager could help steady confidence in the primary market — and set the tone for other fund houses preparing to go public, including SBI Funds Management.

Analysts actions:

- Affle 3i Raised to Buy at Batlivala & Karani; PT 2,140 rupees

- Amber Enterprises Raised to Buy at Elara Secs India

- ICICI Pru AMC Rated New Buy at Equirus Securities Pvt Ltd

Three great reads from Bloomberg:

- The Landscape That Explains India’s Coal Addiction: Dispatch

- Why India Fell Off the Global Middle-Class Map: Andy Mukherjee

- Big Take: The World is Awash With Oil and Prices Are Poised to Keep Falling

And, finally...

Indian markets have faced geopolitical tensions and a stalled trade deal this year, yet the country’s fear gauge has barely moved. The India NSE Volatility Index has decoupled from global trends and sits near 10, giving up most of its risk premium over the past six months. Some traders expect volatility to pick up in 2026, especially around the federal budget on Feb. 1. The message from the options market is clear: equity volatility opportunities have dried up. For options sellers seeking yield, the focus may shift to commodity options, where structurally higher volatility offers richer potential.

One last word: The Buzz is evolving

In 2026, we’ll be bringing you the key market developments and even more insights on India (and beyond) in the Markets Daily India newsletter. Delivered to your inbox before the trading day starts, it will be a comprehensive wrap-up of the main market moves around the globe, as well as insight and analysis to set you up for the India trading day. If you haven’t already, sign up here, or if you’re reading on the Bloomberg terminal, click the subscribe button above. Thank you for joining us on the next chapter of Market Buzz!