London Watchdog Seeks Tougher Data Center Rules to Help Housing

TL;DR

A London watchdog proposes stricter rules for data centers, warning their high power use could hinder new housing construction. This conflicts with government plans to boost data centers for economic growth, as both compete for limited grid capacity.

Tags

A London government watchdog wants tougher rules on building data centers, warning that their power demands may impinge on the construction of new homes in the crowded capital.

The London Assembly, which scrutinizes the work of Mayor Sadiq Khan, wants data center developers to face more stringent requirements amid concerns about the pace of residential construction, according to a report published Monday.

Prime Minister Keir Starmer has promised to fast-track planning approval for data centers and ease access to the power grid to encourage investment and boost the UK economy. But balancing that priority with another key pledge, new housing developments that need to tap the same grid connections, is challenging in power-hungry London.

One of the proposals from the Assembly’s planning and regeneration committee would put data centers into a new category, as currently they are zoned as warehouses. This means a developer can convert an empty warehouse into a data center, despite the widely different energy usage. An average data center can use the same power as 100,000 homes, far more than a warehouse.

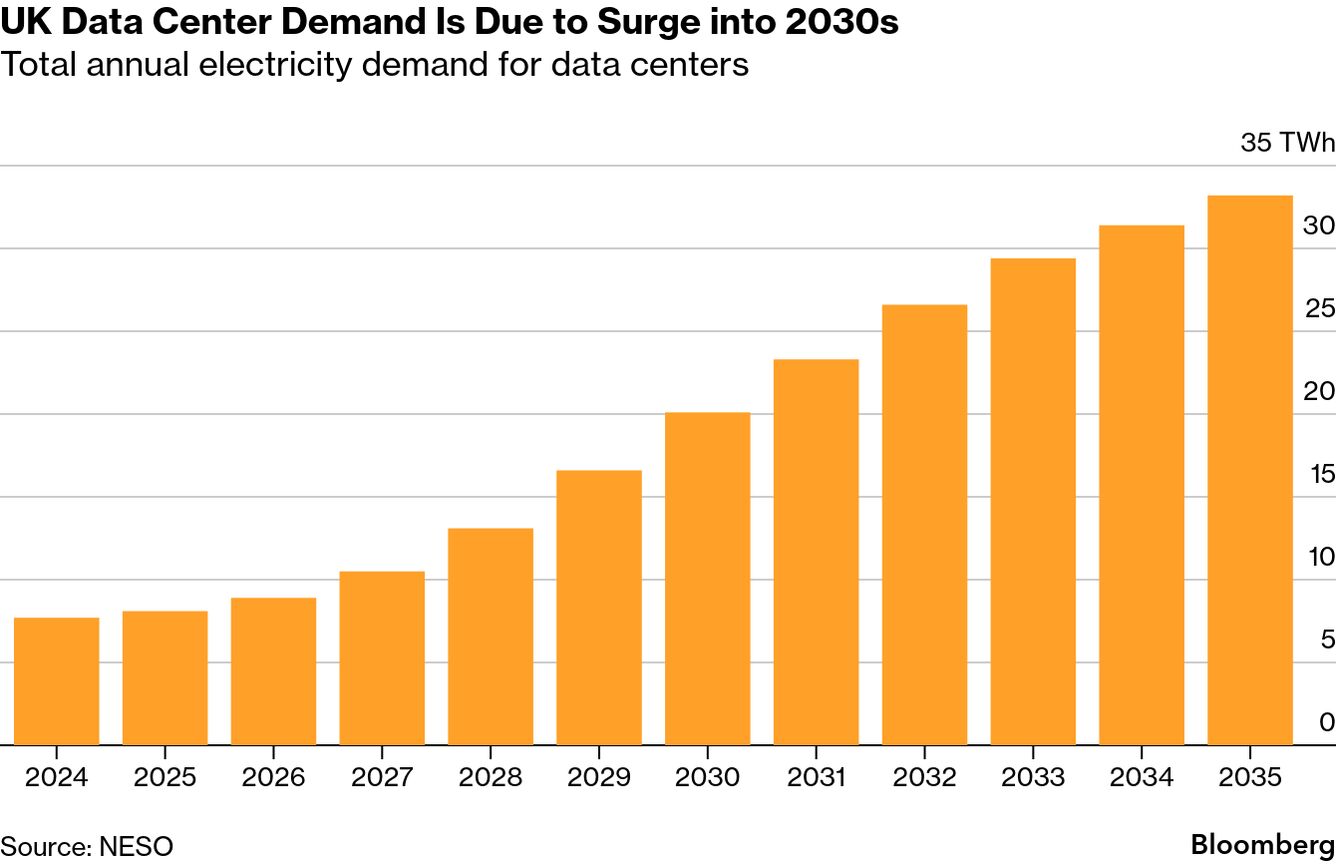

Total annual electricity demand for data centers

Around the world, data centers have become one of the fastest-growing sources of electricity demand. UK regulator Ofgem has warned that a wave of speculative data-center proposals is clogging the grid connection queue. A report from Aurora Energy Research suggested that higher demand from data centers could contribute to pushing up UK power prices 9% by 2040.

The number of homes being built in the UK capital has slumped as soaring costs and stretched affordability have made development financially unviable. Grid-connection delays pose another challenge, with some developers informed they may have to wait until 2037.

Still, west London has long been the UK’s data center hub, and developers still see its proximity to major customers and tech infrastructure as a key pull. In September, BlackRock Inc. outlined plans to increase its footprint in the UK data center market including buying a site in west London.