BlackRock’s Bitcoin ETF Investors Came Late to the Crypto Party

TL;DR

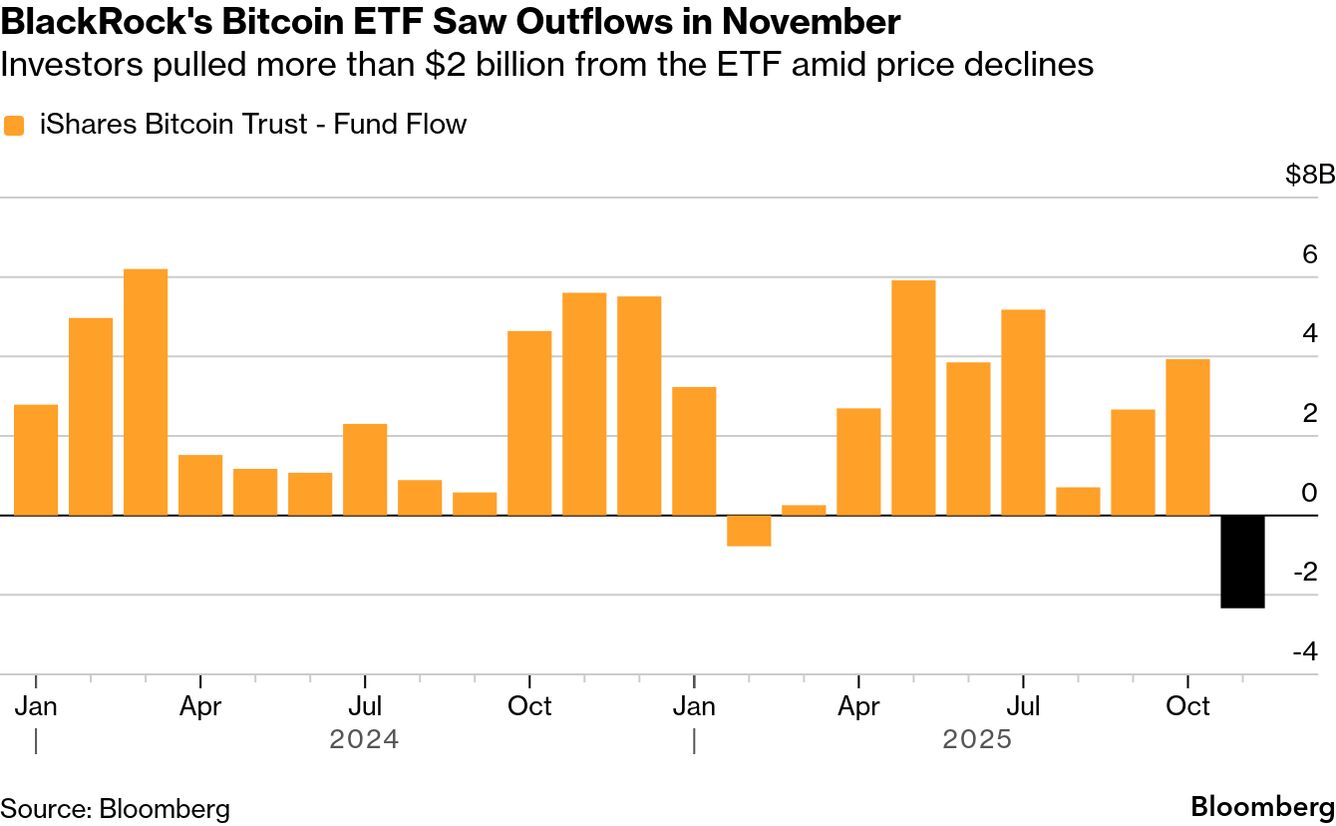

BlackRock's Bitcoin ETF (IBIT) delivered strong returns since launch, but most investors earned modest gains due to poor timing. Many piled in after the initial surge, causing a gap between fund performance and investor experience, leading to recent outflows.

Key Takeaways

- •BlackRock's IBIT Bitcoin ETF posted over 40% annualized returns since January 2024, but average investors earned only 11% due to poor market timing.

- •Nearly 60% of IBIT's gains came in its first 66 days when few investors were in the fund, highlighting how late arrivals missed the biggest returns.

- •The ETF saw its longest outflow streak in November 2025 with over $2.3 billion withdrawn, as investor returns didn't match expectations despite the fund tracking Bitcoin well.

- •Dollar-weighted returns reveal investor behavior flaws more than fund performance, with crypto's volatility amplifying timing challenges even with ETF accessibility.

- •Average Bitcoin ETF investors underperformed traditional assets like gold and S&P 500, emphasizing the importance of disciplined, long-term holding strategies.

Tags

BlackRock Inc.’s flagship Bitcoin ETF has delivered strong returns since its launch — but for most investors, the outcome has been far more modest.

The iShares Bitcoin Trust (ticker IBIT) posted a more than-40% annualized return from its January 2024 debut through November 2025, data compiled by Bloomberg show, even after the recent crypto selloff. But the average investor earned just 11% annualized over the same period, according to new analysis by Morningstar. Much of that disconnect owes to poor timing: many investors piled in only after the fund had already surged — underscoring how market timing can blunt even the best-performing products.

That underperformance matters now because it helps explain why money is starting to flow out after a sweeping crypto downturn. IBIT just saw its sixth straight week of outflows — the longest losing streak since its inception — in a sign that the recent Bitcoin rebound has yet to restore investor conviction. In November, investors pulled more than $2.3 billion from the exchange-traded fund — the largest monthly redemption and only the second monthly withdrawal this year.

One reason: for many investors, the payoff hasn’t matched the pitch. The ETF wrapper may have solved the Bitcoin access problem — but not the timing problem.

“The ETF has done its job — it has tracked Bitcoin almost perfectly and thus notched excellent total returns since inception,” Jeffrey Ptak, a managing director at Morningstar, wrote. “The problem is investors appear to have arrived late to the party.”

Investors pulled more than $2 billion from the ETF amid price declines

BlackRock declined to comment.

The gap stems from the difference between what the fund earned and what investors actually experienced. Morningstar’s Ptak compared IBIT’s total return and dollar-weighted return. The result is a more realistic picture of how the average dollar fared.

In IBIT’s case, most inflows came after the ETF had already surged. By the time the fund’s asset base swelled, the pace of gains had slowed. That pattern — enthusiasm peaking after performance — is common in high-volatility investments, but the magnitude here was notable. Nearly 60% of IBIT’s total dollar gains came in its first 66 days, wrote Ptak, when few investors were actually in the fund.

“The large gap between the ETF’s dollar-weighted and total return underscores the importance of staying the course,” he said. “If current investors do so, their average dollar’s return should gradually converge toward the ETF’s total return. If not, it will likely continue to lag.”

All told, the average Bitcoin-ETF investor underperformed gold, the S&P 500 and even a plain-vanilla 60/40 stock-and-bond portfolio, which returned more than 15% annualized over the stretch Ptak looked at.

To be sure, Ptak, in his conversations with BlackRock, highlighted factors that help explain the chasm, such as limited access to the Bitcoin funds early on, institutional derivatives-driven outflows — since big money funds like hedge funds use a popular trading strategy called the basis trade — and in-kind Bitcoin transfers, a recent development.

Many crypto enthusiasts also argue that the token is a long-term hold, given its ability to rally back forcefully following major drawdowns.

| Read more: |

|---|

| Bitcoin Is Set for First Yearly Split From Stocks in Decade |

| Bitcoin Funds Head for Worst Month as $3.5 Billion Pulled |

| Crypto’s Retail Traders Hit Hard as Strategy ETFs Plunge 80% |

And regardless of one’s view, there’s no denying that demand has been strong. IBIT, for one, has received positive net flows on 80% of trading days since inception, according to Morningstar. Assets across US spot-Bitcoin ETFs total some $117 billion.

In the eyes of James Seyffart of Bloomberg Intelligence, the analysis is fair. But dollar-weighted returns are just one window into a fund’s performance.

“Dollar-weighted returns are more a critique of the investor than the fund adviser,” Seyffart said. “We know on average investor behavior is not great, particularly in high-momentum funds like this.”