Emerging Stocks, Currencies Hold Steady Amid Iran Conflict Risk

TL;DR

Emerging stocks and currencies remained stable amid US-Iran tensions, with oil price rises pressuring importers like India. AI demand and tech rallies, such as in South Korea, supported markets, while bond markets saw mixed performance.

Tags

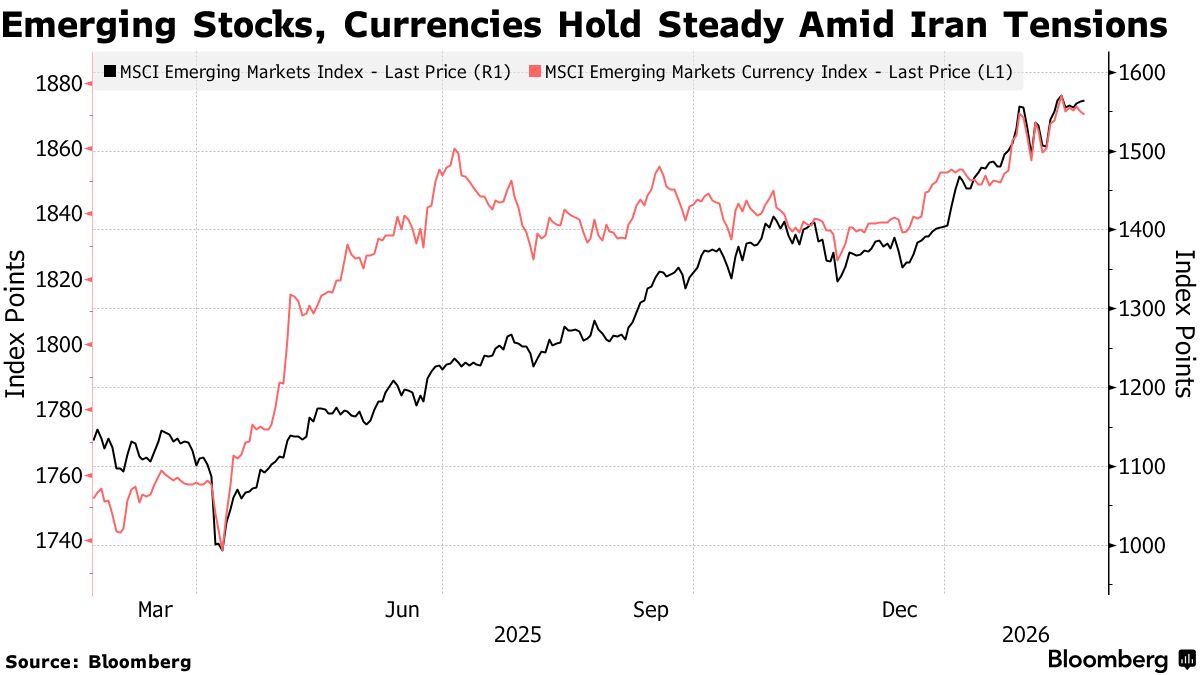

Emerging stocks and currencies traded broadly steady Friday, as mounting US-Iran tensions deterred investors from making big bets and the rise in oil prices weighed on markets in oil importing nations.

MSCI’s gauge for emerging equities traded flat as of 11:30 a.m. in London, though it was on track for a second straight week of gains.

Strategists mostly do not expect US-Iran tensions to escalate into a full-scale war that would derail emerging markets’ year-to-date rally. Demand for AI-related stocks remains in place, said Wolf von Rotberg, equity strategist at Bank J Safra Sarasin.

“The fundamental drivers of EM equities should largely remain in place,” Von Rotberg said. “Record-high US hyperscaler capex props up demand for chips in 2026 and is one driver of metals prices.”

The stocks gauge has climbed every week but one so far in 2026, thanks to hefty rallies across Asian tech names.

Earlier on Friday, the index was lifted by a fresh advance in South Korea, where SK Hynix Inc. hit a record high after BlackRock Fund Advisors said it held a 5% stake in the chipmaker.

In Hong Kong, where trade resumed after Lunar New Year holidays, traders rotated into China’s generative AI startups Zhipu and MiniMax Group Inc, at the expense of traditional internet giants Alibaba Group Holding Ltd. and Tencent Holdings Ltd. Mainland Chinese markets remained shut.

MSCI’s emerging-currency index was also steady, though the currencies of oil importers such as India and Turkey came under pressure as crude prices held above $70 a barrel. India’s rupee was the worst performer, declining 0.3%, and Indian bond yields rose. Traders said the central bank had intervened to support the currency.

South Africa’s rand firmed 0.2%, snapping a four-day drop, as prices for gold, the country’s main export, pushed above $5,000 an ounce. The currency is still set for its sharpest weekly decline against the dollar in three months. Korea’s won also outperformed thanks to continued equity-market inflows.

In bond markets, Kenya has raised $2.25 billion of securities to finance a debt buyback. However, Mozambique’s dollar bonds due 2031 were the worst-performing emerging market sovereign bonds tracked by Bloomberg after the IMF warned the nation’s debt was unsustainable.