Bitcoin and Almost Everything Else Looks Risky

TL;DR

Wall Street's risk appetite fades amid AI valuation concerns and Bitcoin selloffs, with potential Fed hawkishness adding to market jitters. Losses ease slightly, but investor nerves remain high as key stocks and crypto face pressure.

Key Takeaways

- •JPMorgan warns of a possible correction in AI valuations, which could impact the broader stock market.

- •Bitcoin's price drop raises fears of a selling spiral affecting other assets, though losses have pared recently.

- •The Federal Reserve's potential shift to a more hawkish stance is driving selloffs in multiple assets, with rate cut probabilities declining.

- •Specific stocks like Amazon and Microsoft are downgraded, while others like Roche and Barrick Mining see gains on positive news.

- •Investor sentiment is dampened by fading bullish factors like AI enthusiasm and dovish central bank expectations.

Tags

Wall Street’s risk appetite has disappeared before Nvidia earnings.

Five things you need to know

- US stock futures and Bitcoin pared losses as the global markets selloff showed signs of easing. Losses were deeper in Asia and Europe, with equity benchmarks sliding more than 1%. Japanese stocks and bonds were hit hard amid a diplomatic spat with China.

- JPMorgan Chase Vice Chairman Daniel Pinto warned of a possible “correction” in artificial intelligence and said any decline would reverberate across the stock market.

- President Donald Trump argued his administration was making progress on lowering prices as he faces new political headwinds, pushing back on criticism from Democrats who blame his tariffs for high costs.

- Trump said the US would sell F-35 fighter jets to Saudi Arabia, offering Mohammed bin Salman a prize he’s long cherished. The crown prince is due to visit the White House today.

- Dutch paint maker Akzo Nobel agreed to buy smaller US rival Axalta in a $9.2 billion deal that will create a US-listed leader. Axalta is jumping 11% in premarket trading while Akzo Nobel is down 4.4% in Amsterdam.

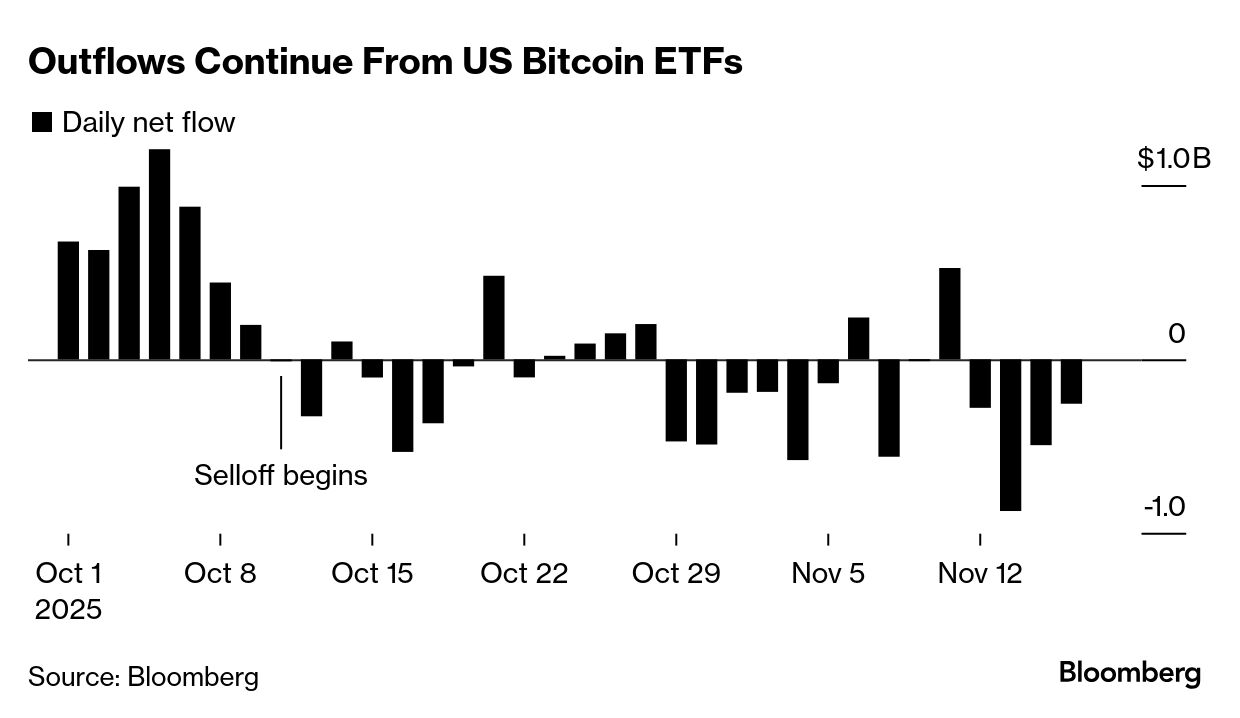

Bitcoin’s feedback loop

The freefall in crypto token prices is sparking some concern about a spiral of selling pressure hitting other markets.

The worrying scenario is that investors, facing steep losses on their Bitcoin holdings, may sell other assets to shore up cash, adding momentum to the broad markets downdraft. That could potentially heap pressure on stock prices at a time when Wall Street seems to be saying AI valuations are detached from reality.

“We could see further downside risk for crypto as portfolio adjustments are made either by choice or to cover losses in equities,” said Nick Twidale at AT Global Markets.

For the moment, however, it’s more akin to a bear case than what’s actually happening in markets. Bitcoin pared losses this morning after its sudden slide below $90,000, and US futures are only slightly lower.

Still, it’s fair to say trader nerves are running high. Add the crypto selloff to the prospect that the Federal Reserve may not be so accommodating with monetary policy in coming months (see below), and you have a good excuse to take money off the table.

If the S&P 500 drops today, it would notch a four-day losing streak, its longest since late August. The benchmark closed below its 50-day moving average yesterday for the first time in 139 sessions.

Another downbeat crypto stat that’s getting a lot of attention: more Bitcoin ETF holders are sitting on losses. The average cost basis across all ETF inflows sits at approximately $89,600, according to Sean Rose at Glassnode. The token is trading around $91,000 now.

“The bad news is that some of the more bullish vibes — AI enthusiasm, massive government stimulus, dovish central-bank expectations — are starting to fade,” said Ipek Ozkardeskaya at Swissquote. —Ruth Carson, Winnie Hsu, Vildana Hajric, Geoffrey Morgan, Jess Menton, Sagarika Jaisinghani and Kurt Schussler

On the move

- Amazon falls 1.4% in premarket trading and Microsoft is down 0.6%. Rothschild & Co Redburn cut both stocks to neutral from buy, with the analyst saying it’s time to take a more cautious stance on AI hyperscalers.

- Barrick Mining rises 2%. The Financial Times reported Elliott Management has built a “large” stake in gold miner.

- Roche surges 7% in Zurich. The Swiss drugmaker’s experimental cancer pill fared well in a late-stage trial for a second time this year, boosting optimism about its potential to treat breast cancer.

- Rheinmetall rises 3% in Frankfurt after the German tank-maker said it’s aiming for annual sales of about €50 billion by 2030.

- Temu owner PDD Holdings, Medtronic, Home Depot and Klarna are slated to report before the opening bell. —Subrat Patnaik

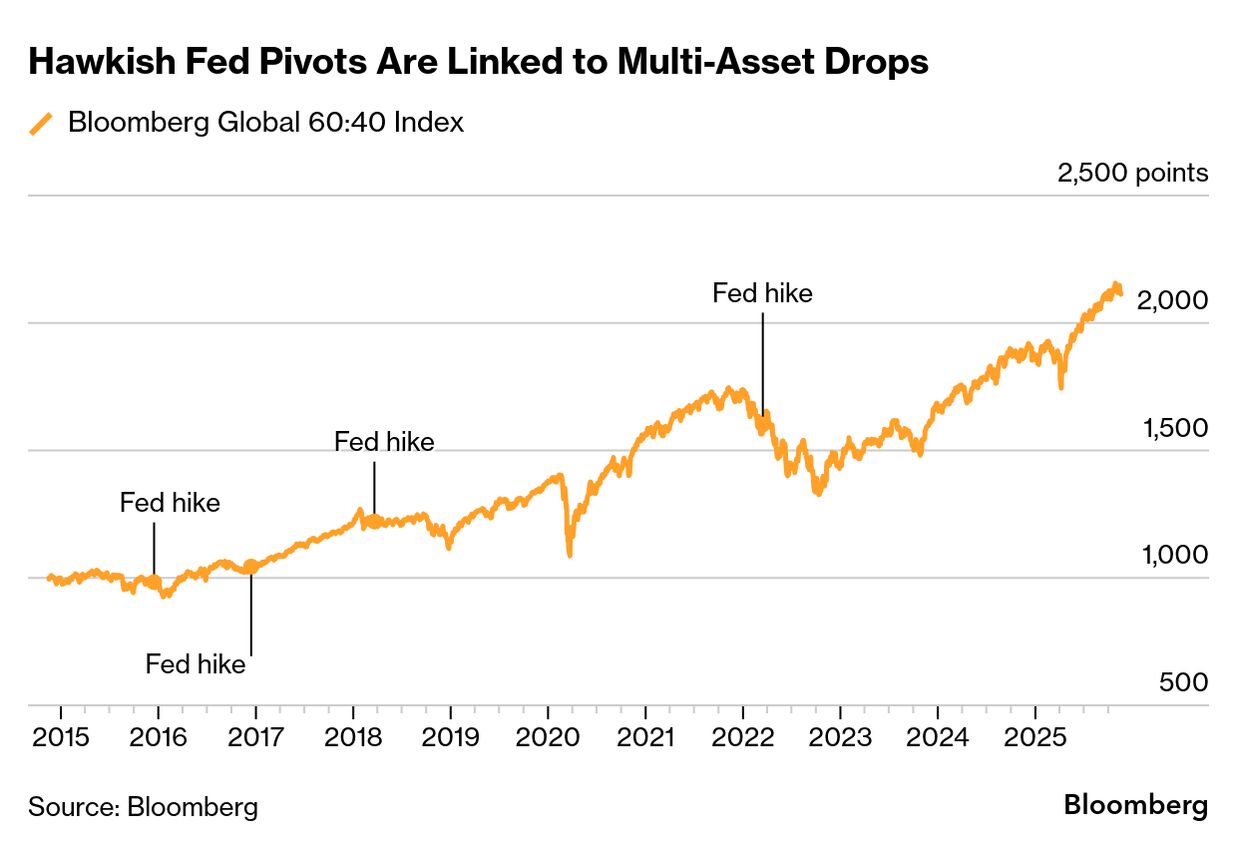

Fed hawks take their toll

When it comes to animal spirits, the Federal Reserve may be emerging as public enemy No. 1.

While Governor Christopher Waller repeated yesterday that the central bank should again lower rates next month, some of his colleagues are warning persistent inflation may stay their hand.

Bloomberg's World Interest Rate Probability measure now puts the probability of a reduction at less than 50%, although interest-rate strategists at Goldman Sachs and Bank of America say economic data delayed by the US government shutdown will revive the case for action.

As Henry Allen of Deutsche Bank told clients this week, the mounting reluctance among policymakers to act again in December is the most important driver behind the selloff in multiple assets.

Market expectations for a dovish Fed began to shift Oct. 29, when the central bank cut rates but Chair Jerome Powell cautioned investors against assuming another reduction would follow in December. Since then, the S&P 500 has dropped 3.2% and the yield on US 2-year notes has ticked up to 3.57% from 3.49%.

It's obviously not the first time a pivot from the Fed has ignited selloffs. Using Bloomberg's global 60-40 index of stocks and bonds, Allen notes a more hawkish posture was behind declines in 2015-2016, 2018 and 2022.

The shift in sentiment isn't just the Fed's fault. Allen noted that the rally in stocks has been relentless and thus likely unsustainable, while investors are also becoming increasingly concerned about the fiscal positions of governments.

But don't give up just yet. Allen reckons the “backdrop is still fundamentally robust” in that the S&P 500 isn’t far from a record high, the Fed has cut rates by the most outside of a recession since the 1980s and the US and China have found some common ground in their trade war.

Central bankers might give further clues to the rate outlook today, when Fed Governor Michael Barr and Richmond Fed President Tom Barkin speak at separate events. —Simon Kennedy and Felice Maranz

Word from Wall Street

divPlay Alphadots!

Our daily word puzzle with a plot twist.

Today’s clue is: Credit card number?

One number to start your day

byTheNumbersWhat else we’re reading

-

Stocks ‘Running Out of Time’ For a Year-End Rally Without Tech

-

Hong Kong Property Concerns Deepen Among Bankers, Regulators

-

Distressed Firms’ Earnings Are Falling Too Fast for Quick Fixes

-

Trump Hails McDonald’s Extra Value Meals in Affordability Pitch

Please share your thoughts on how we’re doing and what we’re missing. Contact us at [email protected].

Enjoying Markets Daily? You might also like:

- Breaking News Alerts for the biggest stories from around the world, delivered to your inbox as they happen

- Odd Lots for Joe Weisenthal and Tracy Alloway’s daily newsletter on the newest market crazes

- Supply Lines for daily insights into supply chains and global trade

- Money Stuff for Bloomberg Opinion’s Matt Levine’s newsletter on all things Wall Street and finance

- Points of Return for Bloomberg Opinion’s John Authers’ daily dive into markets

Bloomberg.com subscribers have exclusive access to all of our premium newsletters.