Vanguard Equity Quant Says Bitcoin Still a ‘Digital Labubu’ Toy, For Now

TL;DR

Vanguard's quant head calls Bitcoin a 'digital Labubu' toy, not a productive asset, despite allowing ETF trades. The firm views crypto as speculative but sees blockchain's potential.

Key Takeaways

- •Vanguard's senior investment leader compares Bitcoin to a collectible toy, lacking income or cash-flow properties for long-term investment.

- •The firm allows clients to trade Bitcoin ETFs but won't provide investment advice on crypto, emphasizing investor discretion.

- •Vanguard acknowledges blockchain's utility for improving market structure but remains skeptical of Bitcoin's economic value without more history.

- •Bitcoin could gain non-speculative value in high-inflation or political instability scenarios, but evidence is currently insufficient.

Tags

Vanguard Group may now allow clients to trade spot Bitcoin exchange-traded funds, but one of the firm’s senior investment leaders says its underlying view of crypto remains unchanged.

Bitcoin is better understood as a speculative collectible — akin to a popular plush toy — than as a productive asset, according to John Ameriks, Vanguard’s global head of quantitative equity, who said the token lacks the income, compounding and cash-flow properties the firm looks for in long-term investments.

Absent clear evidence that the underlying technology delivers durable economic value, “it’s difficult for me to think about Bitcoin as anything more than a digital Labubu,” he said Thursday at Bloomberg’s ETFs in Depth conference in New York, making a reference to the viral stuffed toy collectibles.

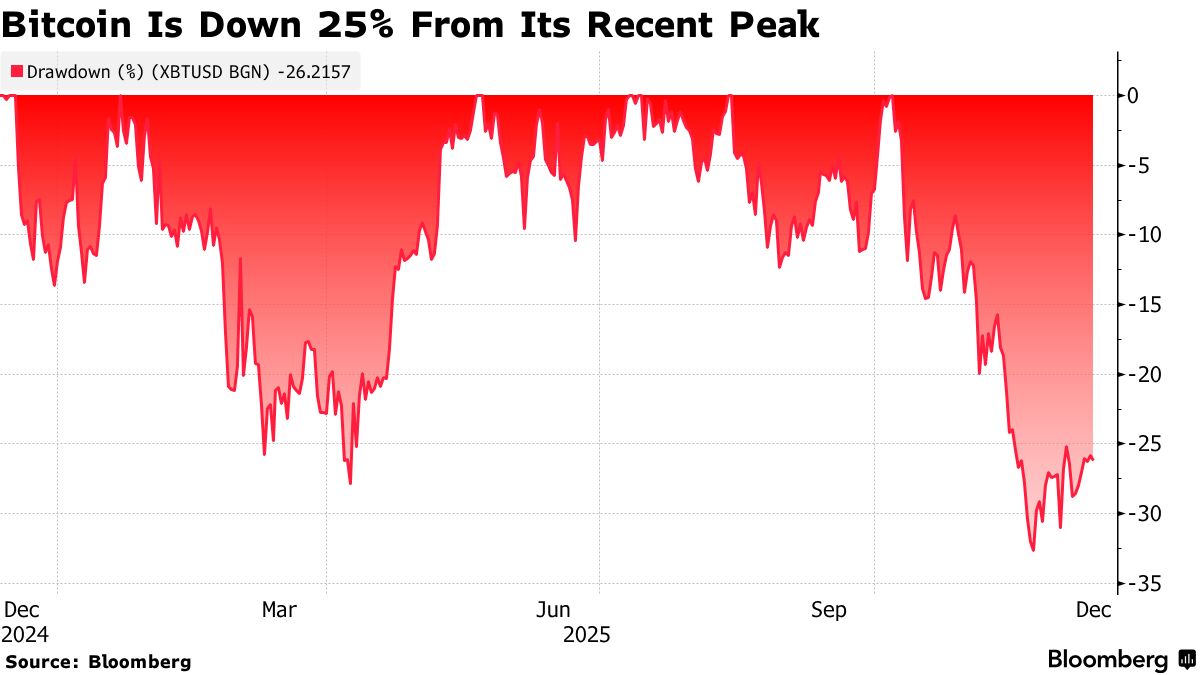

The comment comes amid a protracted drawdown for the largest digital asset, which is currently trading around $92,000 apiece, down from $126,000 mere weeks ago. Bitcoin has been known to go through volatile boom-and-bust cycles, shedding large chunks of its value only to make full-blown recoveries later on. Given this history, Vanguard executives have not been reticent in the past about what they’ve thought of cryptocurrencies as an investment, calling them speculative, among other things.

But even as the $12 trillion asset manager has shied away from offering its own crypto-focused exchange-traded funds — a point Ameriks reiterated — it still earlier this month opened its trading platform to such products, allowing its millions of investors the ability to buy and sell certain digital-asset ETFs.

That was a decision made, in part, after seeing crypto ETFs establish track records following the initial launches of Bitcoin funds in January 2024, according to Ameriks. Vanguard wanted to, among other things, make sure that the products delivered “what’s on the tin, the way that they’re described,” he said in a separate interview on the sidelines of Thursday’s conference.

“We allow people to hold and buy these ETFs on our platform if they wish to do so, but they do so with discretion,” he said. “We’re going to not give them advice as to whether buy or sell or which crypto tokens they ought to hold. That’s just not something we’re going to do at this point.”

Vanguard is optimistic about the utility of blockchain and its ability to improve market structure, a spokesperson added.

Ameriks conceded that there are certain scenarios where he sees Bitcoin potentially offering non-speculative value. It’s possible that the coin could become more valuable in high-inflation environments, or in periods of political instability, among other contexts.

“If you can see reliable movement in the price in those circumstances, we can talk more sensibly about what the investment thesis might be and what role it could play in a portfolio,” he said. “But you just don’t have that yet — you’ve still got too short of a history.”