McDonald’s Rival Jollibee Soars on Plan to List Global Unit

TL;DR

Jollibee Foods Corp. plans to spin off and list its international business on a US stock exchange, driving its shares to their largest single-day surge since 2008. This move aims to sharpen strategic focus and provide investors with clearer exposure to its global expansion efforts.

Key Takeaways

- •Jollibee's announcement of spinning off its international unit for a US listing led to a 14.5% stock surge, the largest since 2008.

- •The spinoff separates the stable Philippine operations from higher-growth international businesses, enhancing strategic clarity for investors.

- •International revenue has grown significantly, accounting for 43% of total revenue in 2023, up from 21% in 2017.

- •Jollibee owns multiple brands globally, including Smashburger and Compose Coffee, with over 6,800 stores overseas across 30+ countries.

- •Shareholders will receive equivalent shares in the international business, maintaining their investment exposure post-listing.

Tags

Jollibee Foods Corp. will spin off its international business and list it on a US stock exchange as the Philippine fast-food group plots its global expansion, an announcement that fueled its shares’ largest single-day surge since 2008.

Jollibee, which increasingly is taking aim at global fast-food giants such as McDonald’s and Yum! Brands Inc. from Los Angeles to Ho Chi Minh City, said Tuesday said it has hired international and local advisers to work on the spinoff and potential US listing. Jollibee Foods Corporation International would include all of the company’s businesses outside its home market, the company said in a statement filed to the Philippine Stock Exchange, where its Philippine operations will remain listed.

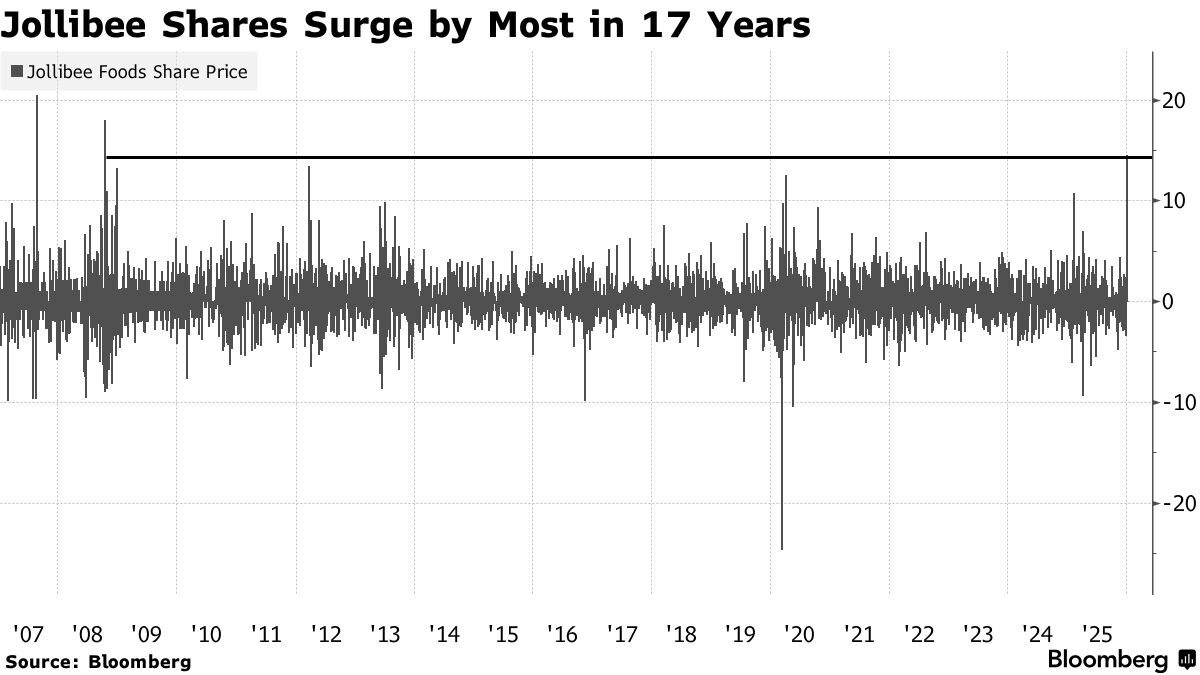

Jollibee shares — after a one-hour trading halt — closed 14.5% higher, the most since October 2008. It was the top gainer among 30 firms that make up the Philippines’ broader stock index, which rose 2.49%, and the best performer in Asia on Tuesday.

Establishing two listed businesses is designed to sharpen the strategic focus of each company and enhance the “clarity of each equity story,” Jollibee said.

The spinoff would allow investors to value the “stable, cash-generative Philippine business separately from the higher-growth but more volatile international operations,” COL Financial Group analyst Rachelle Biacora said in a note. However, the company’s domestic unit may have a lower market value, which could affect its weighting in some stock indexes, she added.

“This clearer separation sharpens strategic focus and gives investors more targeted exposure,” said Jasper Timoteo Ondap, Regina Capital Development in Manila.

Read More: Jollibee Is on a Quest to Conquer American Palates

Jollibee shareholders would receive a number of shares in the international business equal to their company holdings at the time of the listing, the company said.

The food giant owns several brands, including its iconic Jollibee chain known for its sweet-style spaghetti and crispy fried chicken.

Jollibee is building its international profile, striking 27 cross-border deals worth around $1.1 billion since 2000, according to data compiled by Bloomberg. That includes US brands such as Smashburger and Coffee Bean and Tea Leaf, which Jollibee struggled to turn around, and recently, South Korea’s Compose Coffee.

Read More: Philippine Food Empire Jollibee Sees Coffee as Next Big Thing

The group had 10,304 stores as of September, of which 6,859 were located overseas across over 30 countries, including China, Canada and Vietnam. International business generated around 43% of Jollibee’s 224.2 billion pesos ($3.8 billion) revenue from January to September, up from its 28% share in 2019 and 21% portion in 2017, company data show.