Reliance Heads for Worst Day Since 2024 on Retail Sector Worries

TL;DR

Reliance Industries shares fell sharply due to retail sector competition concerns, impacting Indian stock indices. The decline was driven by weak performance from rival Trent and profit-taking after recent gains.

Tags

Reliance Industries Ltd.’s shares tumbled after analysts warned of rising competition in the retail sector, where the Mukesh Ambani-controlled conglomerate is a major player.

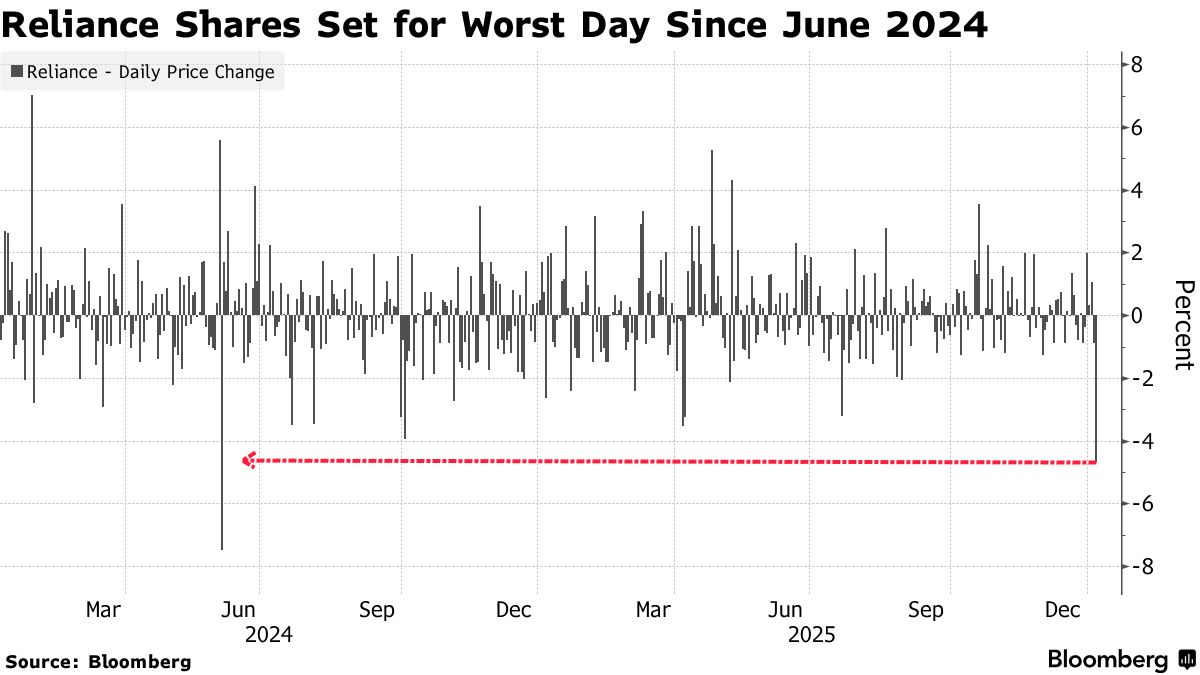

Shares of the oil-to-telecom major slid as much as 5.2% on Tuesday, heading for its worst day since June 2024. The selloff also weighed on the nation’s stock gauges, where Reliance has the second-biggest weighting, causing them to trail regional markets.

Fast-fashion rival Trent Ltd. reported a 15% decline in average revenue per square feet of store space in the December quarter from a year ago, indicating a tough environment for Indian retailers. Citigroup Inc. said Monday intense competition in the sector is eroding incumbents’ market share.

Reliance’s retail business is often seen as one of the biggest drivers of its stock price, with ICICI Securities valuing the business at more than $103 billion in October — about half of the company’s $226 billion market value. Although the retail unit is a closely held, weak commentary around Trent was viewed by investors as a sector concern that could also hurt India’s largest retailer.

Selling pressure increased as investors took profits in stocks that have rallied in recent months. Reliance shares jumped 29% in 2025, beating the benchmark NSE Nifty 50 Index’s 11% gain.

The outperformance was driven by improving prospects for the company’s energy business, supported by higher gross refining margins and potential benefits from China’s so-called anti-involution policy for the refining sector.

Morgan Stanley sees several growth catalysts for Reliance in 2026, including the initial public offering of its digital venture Jio Platforms Ltd., a likely increase in telecom rates and an upside to refining margins due to benign oil prices.

Still, uncertainties around US tariffs on India as well as the patchy recovery in consumer demand could continue to weigh on the stock. The shares also trade at more than 23 times forward earnings, more than one standard deviation above the five-year average, data compiled by Bloomberg showed.